How to Make a Customer Loyalty Survey (+ Questions to Include)

Published: March 05, 2021

Customer loyalty is a customer's willingness to make repeat purchases from your business regardless of how many competitors offer the same products or services. Customers usually become loyal after delightful experiences with your brand, whether that means exceptional customer service or products that go above and beyond in meeting their needs.

Your loyal customers also drive revenue and attract new customers through word-of-mouth marketing . When they’re satisfied, they won’t hesitate to tell everyone they know — from friends and family to strangers online — about your brand.

As nice as it is to have loyal followers, it’s important to prioritize different levels of customer loyalty. Some may need more nurturing to make repeat purchases, while others are already committed to being lifetime supporters. Therefore, it’s also important to understand where your customers fall on the loyalty ladder .

One of the ways to figure out where your customers stand is through customer loyalty surveys. This post will explain what a customer loyalty survey is, outline how to create your own, and suggest questions to include in your survey.

What is a customer loyalty survey?

A customer loyalty survey is a questionnaire that’s sent to customers to measure their commitment to your brand. It measures their trust levels, the likelihood of recommending your brand to others, and whether they’d make repeat purchases.

Although they’re similar, loyalty surveys shouldn’t be confused with customer satisfaction surveys . Satisfaction surveys focus on the past (experiences with products or customer support), and loyalty surveys focus on the future (if they’ll ever do business with you again).

For example, a business would send out a satisfaction survey after a support call. It would contain questions about how well a representative solved their issue or if they still need help. The same business could send out a loyalty survey after a product is purchased and ask if they would recommend it to a friend.

Next, we’ll go over key considerations for creating a customer loyalty survey for your business.

How To Make a Customer Loyalty Survey

A critical step in creating your survey is understanding the information you’re hoping to collect. There are three areas that customer loyalty questions can address:

- Customer Retention : retention questions tell you whether a customer would ever consider a competitor or if they’re completely loyal to your business. Retention can also be called lifetime value.

- Advocacy: these questions let you know how likely a customer is to recommend you to friends, family, or other consumers. Advocacy is also referred to as Net Promoter Score® .

- Purchasing power: sometimes called repeat purchase ratio, answers to these questions explain the extent to which a customer will make repeat purchases or increase their purchasing behavior.

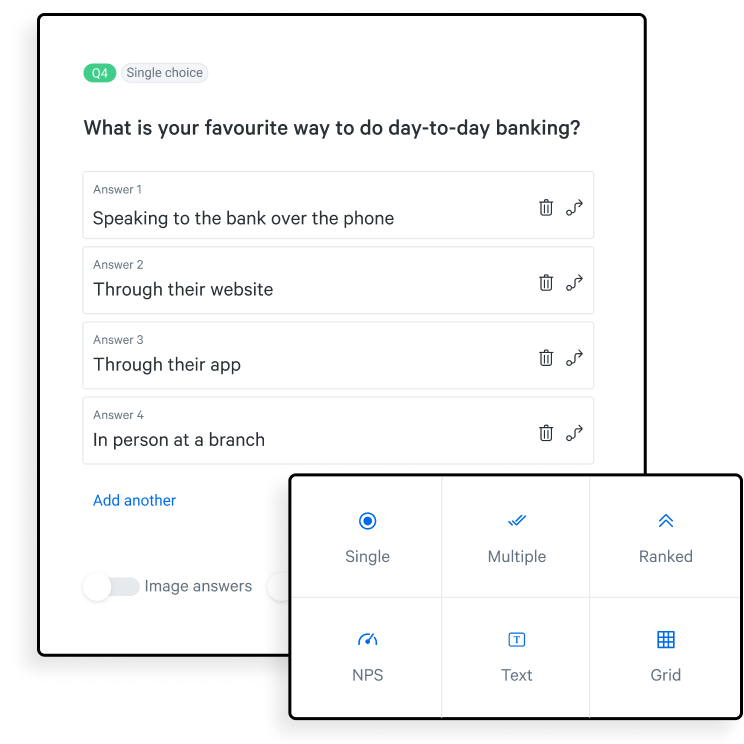

Your survey questions can address a single aspect of customer loyalty or a combination of the three. It’s also essential to decide on a measurement scale . There are a variety of options available, and here are some examples:

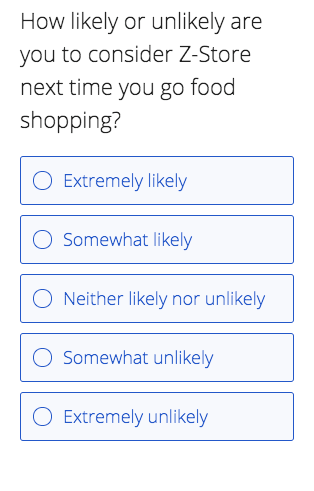

- Likert scale : this unit of measurement is a five to seven-point scale of numbers that align with phrases like “not at all likely,” or “highly likely.” The image below is an example of a Likert scale.

Image Source

- Dichotomous scale: this scale typically offers two straightforward responses, like “yes,” or “no.” They’re quick and easy to answer and don’t leave much room for interpretation. The image below is an example of a dichotomous scale.

- Open-ended: these questions require customers to input responses in an empty text field. It produces qualitative feedback from customers that’s more in-depth and personalized than the other scale items. The image below is an example of an open-ended question.

Lastly, the survey should require minimal customer effort. Asking questions that require a significant amount of thought or asking for too much information at once may cause incomplete responses.

Given these factors, let’s go over some sample questions you can include in your loyalty survey.

Customer Loyalty Survey Questions

You can include all of the questions below in a customer loyalty survey. Many of them address various aspects of loyalty and can be used interchangeably.

1. How likely are you to recommend [product, service, business name, brand] to others?

This question addresses advocacy, and responses will give you a sense of your customers’ promotional value. There can be different iterations of this question depending on the scale you use. For example, a dichotomous scale question could be “Would you recommend [product, service, business name, brand] to others?”

2. How long have you been involved with our business?

This question explains retention and lifetime value. You can use a Likert scale for this question or accept open-ended responses.

3. How likely are you to switch to a competitor?

Responses to this question will address customer retention as well as loyalty. With a Likert scale, lower numbers will indicate loyal customers while higher numbers will indicate that customers are lower on the customer loyalty ladder and may still be considering competitors.

If you’re using a dichotomous scale, you could write this question as “Would you ever buy [product name, service name, etc.] from another company?”

4. Would you be willing to try our other [products, services, etc.]?

This question addresses purchasing power, and a dichotomous scale would provide you with straightforward answers. But, if you’d like to use a Likert scale instead, you can word this question as, “How likely are you to try our [product name, service name]?”

5. Would you purchase [product name, service name, etc.] again?

Like question four, responses to this question explain both purchasing power and lifetime value. You’ll understand if customers would repurchase a product or move on to a competitor. If you’re using a Likert scale, the question could be “How likely are you to purchase [product name, service name, etc.] again?”

6. Would you be interested in a loyalty program?

This question also addresses retention and purchasing power, as loyalty programs typically offer rewards after a certain number of purchases. A customer would need to continue making purchases to receive rewards, inspiring both loyalty and driving revenue.

If you’re using a Likert scale, the question could be, “How likely are you to enroll in our loyalty program?”

7. How satisfied are you with our business?

Although this question mentions satisfaction, it can also explain advocacy and retention. Customers reporting higher satisfaction levels are probably more loyal, more likely to make repeat purchases, and more likely to recommend you to others.

8. Would you continue to do business with [company name] if prices increased?

This question addresses retention because responses let you know that your customers are loyal to your products not because of the cost but because they’re valuable. Essentially, they would make repeat purchases despite higher costs. The question can be reworded to “How likely are you to purchase [product or service name] again if the price increased?” for a Likert scale.

9. Would you consider yourself a loyal customer of [business name]?

A straightforward question for a straightforward answer; it’s a different way of asking questions one and three. You can write this question as “On a scale of [metric numbers] how loyal do you consider yourself to be to [business name]?” for a Likert scale.

10. I purchase products from [business name] because I want to, not because there isn’t an alternative.

You can pose this question on a Likert scale, and responses will provide insight into customer retention.

Don't Assume Loyalty, Ask About It

Although it would be nice, you can’t assume that customers are loyal just because they seem loyal.

A customer may like your product because it’s affordable, but a price increase would prompt them to switch to a competitor. Also, since brand commitment to social issues is increasingly important, a long-time customer may drop your company and never look back after your business makes a PR mistake — like making an inappropriate comment online.

In sum, directly asking your customers how they feel is the best way to understand their commitment to your company, and a customer loyalty survey will give you the information you need to retain their business.

Once you’ve created your survey and collected data, learn how to analyze the results .

Net Promoter, Net Promoter System, Net Promoter Score®, NPS®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.

Don't forget to share this post!

Related articles.

Customer Stickiness: What It Is and How You Can Build It

Customer Loyalty: The Ultimate Guide

The Beginner's Guide to Building a Customer Loyalty Program

14 Customer Loyalty Trends to Follow in 2022

7 Tips to Reduce Customer Effort and Increase Customer Loyalty

![brand loyalty research survey How & Why Loyalty Punch Cards Attract Customers to Your Brand [+ Examples]](https://www.hubspot.com/hubfs/customer-loyalty-punch-card_6.webp)

How & Why Loyalty Punch Cards Attract Customers to Your Brand [+ Examples]

How a POS System Can Drive Your Customer Loyalty Program

16 of the Best Customer Loyalty Software for 2023

Customer Loyalty Analytics: 6 Ways to Help Grow Your Business

What Is the Customer Loyalty Ladder?

An actionable guide on building customer loyalty and retention

Service Hub provides everything you need to delight and retain customers while supporting the success of your whole front office

17 Brand preference survey questions that measure customer loyalty

Looking for example brand preference survey questions? These samples will help measure brand preference & more.

Why are brand preference surveys important?

Brand perception survey questions, how to write a brand preference survey, who to send your brand preference survey to, before you go: here’s what will make your brand preference survey even better, faqs about brand perception survey.

You should always have this voice in your head when crafting a new marketing strategy, and it shouldn’t (just) be your inner critic: it should be your customer.

What would your brand and products look like if your customers were the CEO? It might sound like a ridiculous fantasy, but having their needs and wishes at the forefront of your strategy will be what make you their go-to brand. Every. Single. Time.

Brand preference is a complex concept, because you can often not predict whether trends or friends are more important when choosing who to shop with. But how do you learn about your customers’ preferences? Most importantly, how do you develop your brand to match them?

Time to launch a brand preference survey and find out what makes them tick and what would make them stick. In this article, we’ll specifically focus on brand preference questions that revolve around customer loyalty. Ready to launch a kick-ass brand perception survey for your market research?

If you know why customers choose your brand—or any brand—you can use that knowledge, get one step ahead and become their first choice.

It’s crucial that you know their motives for choosing a brand: it’s rarely random. A brand preference survey reveals what could bind consumers to your brand.

Brand preference and customer loyalty are obviously closely knit: knowing what people prefer, will help you create a brand they want to be loyal to.

But can you even measure customer loyalty through a brand perception survey?

Of course you can, with the right questions—and by combining the answers with the right metrics.

With a brand preference survey, you can measure the non-quantifiable part of customer loyalty—their motives, their thoughts, their wishes. If you combine this with the metrics below, you get a full picture of customer loyalty around your brand.

The Experts’ Guide to Brand Tracking

How to look at the impact of things like audience reach, panel diversity, and survey design to help you decide whether your current brand tracker is up to scratch.

Customer Lifetime Value (CLV)

One of the most widely known customer loyalty metrics is the CVL. It’s the sum of how much value a customer will bring to your brand in the entire time they shop with you. In other words: how much money they’ll spend on you.

Consider how important this is for car brands, for instance. If someone can be converted into a hyper-loyal Mercedes-Benz driver, it will guarantee the business a big CVL, with a very high ROI.

Net Promoter Score (NPS)

How likely are you to recommend us to friends, family, colleagues? It’s one of the most-asked questions by businesses, and it’s an important one.

Your NPS goes beyond loyalty and lets you find out whether people are willing to be brand ambassadors, recommending you to others. Who wouldn’t want some free salespeople?

On the other side of the scale, however, you find out if there are people who could harm your brand by badmouthing you to their nearest and dearest. It’s essential to find out the motives of both.

Repeat Purchase Rate

How many people buy from you more than once? This is an important one, especially for goods that people are meant to buy more often.

If you get a lot of new business, but rarely anyone sticks around for a second purchase, it could mean that your product or service, or your marketing messaging or overall customer experience aren’t a match and people are disappointed.

Upsell ratio

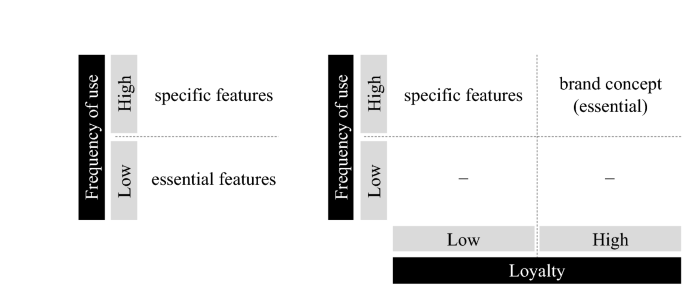

Let’s close the list with an important metric in advanced customer loyalty, the upsell ratio.

Picture Apple users for a second. If you have an iPhone, it’s likely that you have AirPods, and not some other brands of headphones. You might work from a MacBook, because well, it simply works better with your phone, right? That Apple TV is just the next logical step.

And so, the list goes on. The upsell ratio is all about selling customers not more of the same product, but additional products or services.

When combining these metrics with data on reasons people buy from you, you get a goldmine of information that will help you improve marketing, products, customer service and so on.

How do you get that other data? With a survey. Let’s move on to the survey questions that you could be asking to identify what loyal customers are really thinking about your brand image and product features.

The brand perception survey questions below will give you valuable insights into how consumers perceive your brand and how well consumers connect to it, but it’s not a matter of copying and pasting this list in a survey.

It’s important that you choose and add questions that are specific to your market research goals, that match the place in the customer journey your target audience is in, and that you use your own words to stay on brand—because a survey is just another opportunity to show off your brand qualities.

Now that we’ve got that out the way, here are some brand perception survey questions for your next brand preference or brand perception survey.

1. For how long have you been aware of X Brand?

Let’s start at the beginning. If your brand has been around for a long time, and someone has only recently learned about you—what has changed in your branding? Or was it simply that they didn’t fit in your target group before? What is at the core of that vital brand awareness ?

Give your respondents options here, and make clear it’s an approximate. You could even remind them of specific campaigns or product launches from the past.

Asking this question can be interesting if your brand has a longer track record, and you want to investigate how any changes in either your marketing or products have influenced your customers’ loyalty. But for that, you need to know if they knew about the changes, about the ‘old’ you.

2. When was the first time you bought from X Brand?

This question is connected to the first one and a useful follow up. If someone knew about your brand for a long time but it took them a while to buy from you, it can be interesting to dive into that period between first locking eyes and sealing the deal. Were they simply not convinced by your brand? Did their needs change? Did your brand change?

3. Why did you decide to buy from X Brand?

If you’ve finally convinced someone to buy from your brand, it’s good to know what gave them the last push.

Note that their first reason might not be the same as the reason they are still buying from you, so you could follow up with a question about that.

4. Thinking about X Brand, name all the types of products it sells.

With an open-text question like this you’ll find out what people think your brand actually sells when they aren’t prompted with cues. You’ll learn about certain products or product categories that are valuable to your brand, and you’ll also find out whether that big specific product campaign you’ve published has had any effect.

5. What would make you switch to a competitor?

Is someone’s loyalty simply based on price? You can give respondents multiple options here, such as proximity, or certain features, to gauge what makes them loyal to a brand, and find out what you should be competing on.

6. Which of the following statements do you associate with X Brand?

How does your brand make people feel ? By offering a list of emotive responses here you’ll get an understanding of the vibe customers get from your brand. And with that you’ll know whether your marketing and branding strategies are working or whether you need to give them a rethink.

Here are some possible answer options you could use for a question on brand perception like this:

- It offers quality products

- It’s trustworthy

- It’s good value

- It’s expensive

- It’s innovative

7. On a scale of 1-10 how do you rate X Brand’s customer service?

For this question, you want to pick a few competitors who sell similar products, and have a little competition. That’s right: have them rate competitors as well, using the same question format. You can include a scale that measures different aspects, from customer service to price-quality.

8. Which of the following, if any, have you purchased in the past 12 months?

Present respondents with a list of options here, of products that are relevant: it doesn’t have to be the exact same products, but also substitutes or complementary products.

9. How likely would you be to recommend X Brand’s products to others?

Ah, there’s the NPS!

We had to include it in this list, because it’s a must-have in any brand preference or brand perception survey. The NPS divides your respondents into three levels of loyalty:

- Detractors, the ones who would recommend others not to buy from you

- Passives, who don’t say anything about your brand at all

- Promoters, who want to recommend your brand to others.

It’s unrealistic to expect everyone to be a promoter for your brand (although that shouldn’t mean you don’t strive for promoters), so it’s important to find out why some people wouldn’t recommend your brand to others. Don’t just focus on the positives!

10. How likely are you to continue using the services from X Brand?

Maybe someone was loyal up to the point they last bought from you, but now something has changed. Or they happily continue being your customer. Both scenarios are important to investigate, and this question kicks it off perfectly.

11. How interested would you be in checking out other products or services from X Brand?

Is someone loyal to your brand because of one specific product, or do they trust that your brand could fulfil other needs as well? Think back to those Apple fans for this question, and you see how essential it is to build brand trust.

12. Complete the following sentence: I think X Brand is…

If you ask people how they feel about a brand, they’re probably lost for words. So for this question, present them with a list of adjectives, both positive, neutral and negative, to find out what people think about your brand.

13. What are the top three features that are most valuable to you in [specific product]?

This is not just for flattery—asking your respondents this will show you what you have to double down on and, more importantly, what not to change. Give them a list of features to choose from that your product team can also work with and understands what it is: you want to avoid people naming features that you don’t recognize or aren’t sure about what they mean.

14. If you could change just one thing about [specific product], what would it be?

Don’t assume customer loyalty lasts forever—also ask questions that investigate what they don’t like about your product. This style of survey question keeps the negative connotation out but can give you a clear picture of what they don’t like or what you’re lacking.

15. How often do you use X Brand’s products or services?

Are they seemingly loyal to you, but also mix it up with other brands? Do they religiously only use your product? Or was this just a one-time thing? This type of question should give you some answers. Give them several options to choose from to categorize your users.

16. How would you feel if you could no longer use X Brand’s product or service?

We know for a fact that some people would have a minor meltdown if Apple’s next radical move would be to simply stop selling any products.

This question will help you gauge the intensity of customer loyalty to your brand. If you’re leaving the market and that would leave them feeling indifferent, it’s time to step up your game.

17. What makes you feel valued as a customer?

We’re finishing the list off with this banger: how could you make your customers feel more valued, thus making them more loyal?

In some cases, people want to receive rewards, or can be incentivized into being loyal. Other times, they just want customer service to be attentive, or to have a say in how your products or services are shaped.

How is your brand performing over time?

Understand how consumer preference and opinion changes over time with a continuous brand tracker

Before you start crafting your very own brand preference survey, take a step back and look at these tips to make your market research a success.

Mix things up

The questions we showed above are a mix of open, closed and scale questions, and it’s important that you mix things up in your survey as well. It might be tempting to only ask open-ended questions, thinking you’ll get a lot of valuable insight, but people might get bored or tired after a long list of open-ended questions.

Keep people interested with a genuinely interesting survey experience.

Add something to reward loyalty and assistance

For branded surveys, it could be fun to reward respondents for participating. This is another way of thanking them for their loyalty, which is completely in line with the survey.

Learn about what your customers don’t like

Don’t just focus your questions on what your customers prefer, also find out what they don’t like. After all, it’s easier to break loyalty than to build it, so be wary of what might ruin your relationships.

Combine brand perception with other data

Your survey should match the metrics you already have or want clarified about customer loyalty.

For instance, if you compare your CLV data and upsell ratio and see that a certain audience group spends more than others, a brand preference survey can give you some interesting information on that.

How do you select the right audience for your brand perception survey? With the focus on loyalty here, it’s important that you survey people who’ve bought from you at least twice.

Your target customers have experience with your brand and their customer satisfaction isn’t based on a one-time experience.

Depending on your market research, for instance, if you’re thinking of launching a new product or brand, you could also be interested in people’s loyalty to competitor brands in the current market. This means you can find current customers in a specific product category and find out if they’re too loyal, or if you could steal them from the competition.

For these kinds of brand perception surveys, it’s less valuable to target non customers who have no experience within your own product category or a particular product. Luckily, Attest lets you hyper-specialize when it comes to selecting the right audience for your survey.

Finding out what your target market wants is easier said than done—but it all starts by simply asking, and using online consumer surveys is the easiest way to do that.

Attest comes with all the brand management tools you need to start the conversation, and analyze the results of your brand perception survey. Start with tweaking our brand tracking templates and see how easy it is to measure brand preference and customer loyalty!

And to give you the perfect intro, here’s our quick summary of brand tracking and how you can use it to properly understand what consumers think about your brand over time.

See our brand tracking case studies to learn how your brand can also benefit.

In a brand preference survey, you gauge to what extent consumers prefer a certain brand over others. You will have to ask questions about competitor brands, preferences in products and shopping, and their intentions when it comes to repeat purchases. Ask the right questions (and get the best insights) with our brand tracker template .

Mix metrics with questions that give context to the data to get a clear view of your brand perception. Dive into the reasons people buy from you more often with open-ended questions and comparisons to your competitors. For detailed insights, try our brand tracker template .

Improving the channels and being consistent in marketing messaging and branding can help you stay top of mind in your target audience, aiding both in brand awareness and brand preference. See our brand tracking guide for further guidance.

Learn more about how to build awareness of your brand .

Get started with Attest

Start using consumer research to provide confidence in every decision with the right insight, at the right time.

Elliot Barnard

Customer Research Lead

Elliot joined Attest in 2019 and has dedicated his career to working with brands carrying out market research. At Attest Elliot takes a leading role in the Customer Research Team, to support customers as they uncover insights and new areas for growth.

Related articles

Defining your brand purpose: what it is, why it matters, and how to start, brand tracking, turning poop into gold: baby brezza finds global opportunity for diapering product, how to kick up a stink with clean deodorants, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

Customer Loyalty: 25 Survey Questionnaires Examples

by Formplus | Last updated: May 28, 2020

Related Posts

45 employee survey questions + [free template], 25 ways to write gender survey questions, 55 relationship & couple survey questionnaire, 25 student survey questions + [template examples].

Ever heard the saying, "Customer is King"? Well, this is true as every business depends on its customers in order to grow its brand, achieve development, and make a profit. Whether you are a small-scale or large-scale business, achieving customer loyalty must be top of your priority.

Customer loyalty results from brand intentionality in terms of top-notch service delivery, good customer retention practices, and value creation. It is important for every organization to understand the importance of customer loyalty and continuously track this using the different methods available.

What is Customer Loyalty?

Customer loyalty refers to a customer's commitment to continually patronize a brand due to positive customer experience, a high degree of customer satisfaction, or the value received from the brand. It is an important aspect of a business that speaks to customer satisfaction.

It connotes an allegiance to a brand to the extent that the customer subscribes to an organization's product or service, solely and is not willing to switch to a competing brand. Customer loyalty is a reward for excellent service delivery and brand loyalty.

Customer loyalty provides a lot of benefits to your organization. The organization enjoys free mouth-to-mouth advertising, customers patronize the organization regularly, customers spend more money leading to more revenue and profit and the customers enjoy an overall positive business experience.

How to Measure Customer Loyalty

Share of wallet.

Share of wallet is an important method of tracking customer loyalty in your organization that measures the level of your customer's expenditure in particular sales or service business categories. Understanding how it works would enable your organization to develop better customer loyalty and retention strategies.

Technically, if a customer continues to patronize a particular sales or service business category, it connotes some degree of customer loyalty. This is different from getting more customers to patronize a particular business category since an Individual's capacity to incur expenditure in a particular category is fixed.

- How to Calculate Share of Wallet

Share of Wallet = customer spend/ Customer category spend

Customer Lifetime Value

Customer lifetime value is a method of scaling how long a customer would patronize your business in terms of goods and services before lapsing. It helps you to track a customer's performance over a period of time.

In addition, customer lifetime value allows an organization to determine how much it should invest in sustaining the business relationship with a viable customer(s). This information is extremely useful when an organization is coming up with customer retention strategies and its business case.

- How to Calculate Customer Lifetime Value

Customer Lifetime Value = (Average transaction value multiplied by the average number of times a customer transacts before lapsing) - your cost per acquisition (CPA).

Recency is a method of tracking how recently a customer patronized your organization in terms of goods and/or services. If your organization sells everyday goods or provides everyday services, such as online retail or e-commerce organizations, Recency can be an extremely useful indicator of loyalty.

As an organization, you should track how often your customers return to transact business with you. Even if spend per customer visit continuously increases, if recency is on the decline, the business or organization may have a customer loyalty problem.

Visit Frequency

Visit frequency refers to the number of times a customer makes use of your business in terms of goods and services. Tracking visit frequency can help you to understand the trends in customer behavior, and it can serve as an alternative for Share of Wallet method.

Weight of Purchase

This is also referred to as the spend per transaction method and it shows how much of investment a customer is making in your business every time he or she patronizes you. The weight of purchase helps you track any changes in the customer's financial behavior.

Factors such as an increase in pricing can affect a customer's spend per transaction. If there's a decline in the weight of purchase, it could suggest that a customer is splitting his or her purchasing power with a competing business.

Active Customer Value

Active customer value refers to the number of active and consistent customers an organization has. Having a clear idea of the number of active customers in terms of business transactions and content engagement would help an organization to track customer loyalty.

Customer Loyalty Index

This is an important tool that is used to track loyalty over a period of time. It takes into cognizance; the customer's repurchasing and upselling rates plus values of the Net Promoter Score or NPS.

25 Customer Loyalty Survey Questions

- How likely are you to recommend our services?

- Very likely

- Somewhat likely

- Not likely

Face-to-face marketing is one of the strong indicators of customer loyalty. If your customers are willing to recommend your services to friends and family, then they believe in what you have to offer.

2. For how long have you been patronizing our organization?

- 10-15 years

- 15-20 years

- 20 years and above

This question helps you to determine your firm's customer retention capacity.

3. How likely are you to switch to a competing organization?

This is another strong indicator of customer loyalty. If your customers are willing to switch to a competing brand, then it shows that you still have to do a lot of work in terms of earning their loyalty.

4. How likely are you to keep patronizing us?

This also helps your organization monitor its customer retention rate.

5. How likely are you to convince others to patronize us?

This question is one of the greatest indicators of customer loyalty. Loyal customers are more likely to recommend an organization to their friends and family.

6. How likely are you to expand the use of our product or service?

Loyal customers would be willing to improve on their patronage to your organization.

7. How convenient is our product or service?

This question would help you get feedback on your product or service. Fine-tuning your product to speak to your customer's needs would help you achieve customer loyalty.

8. How well do our customer support team answer your questions?

- Worst

9. How likely are you to patronize us in the future?

10. Would you be willing to try out our other services?

11. What do you like most about our services?

This is a feedback question that allows customers to highlight what they enjoy most about an organization's services.

12. How would you rate our service delivery?

13. How would you rate our customer support team?

14. Would you like a customer reward system?

15. How much do you trust this brand?

Customers who trust your brand are more likely to be loyal to it.

16. How reliable is this brand?

Brand reliability is an important prerequisite for customer loyalty as customers would only stay loyal to brands they consider reliable.

17. Did our product meet your expectations?

Customers are most likely to repeat patronage if the product or service that they purchased satisfied the required need.

18. Any other comments, suggestions, or observations?

It is important to provide an opportunity for customers to provide suggestions on your organization's service delivery.

19. How can we make our service delivery better?

To earn customer loyalty, your organization must be a customer-oriented organization. This can be achieved by requesting feedback on your service delivery.

20. How would you describe our products or service?

21. On a scale of 1-5, how well do our products or services meet your needs?

22. On a scale of 1-10, how satisfied are you with our organization?

23. How would you rank the quality of our product?

24. How would you rate the value for money of our service?

25. How helpful have we been in providing responses to your observations, inquiries, and complaints?

Best Survey Templates to Measure Customer Loyalty

One of the easiest methods of tracking customer loyalty is by carrying out a survey; whether online or offline. A customer loyalty survey typically contains questions that revolve around customer feedback, brand satisfaction and reliability, which are important for any organization.

Here are 7 different survey templates from Formplus which you can use to track customer loyalty for your brand.

- Customer Complaint Form Template

This template allows the organization to effectively profile and treat customer complaints in real-time. It contains different fields that request both the bio-data of the customer and the details of the complaint at hand and the customer's signature which authenticates the complaint.

With this form, you can swiftly respond to all complaints as there's no need to have extended waiting periods that can affect your customer's loyalty.

Use This Template

- Customer Satisfaction Survey Template

This online survey form allows you to measure your organization's service delivery and overall customer disposition. It contains specific questions that would require the customer to communicate his or her true experiences with your organization in terms of customer treatment and service delivery.

- Hotel Feedback Form Template :

The Formplus hotel feedback template requires the customer to state how satisfied he or she was with different services rendered by the hotel. These include the pricing, food, neatness and comfort, and general staff attitude.

- Product Pricing Form Template

The product pricing survey form allows you to get an idea of your customers' expected price range for your product. It also gives you an idea of the pricing of your competitors.

- Restaurant Satisfaction Form Template

Restaurant satisfaction survey form helps you to get feedback from your customers with regard to your quality of service. It contains specific questions requiring the customer to rate specific areas of service.

- Refund Request Form Template

A refund request form helps you to quickly receive and process any requests for a refund made by your customer. This form template requests specific information including the order date and order ID of the customer.

- Website Evaluation Survey Template

The website evaluation survey helps you to determine the degree of customer functionality of your organization's webpage. Customers provide feedback on the site's user interface, appearance, and appeal.

How to Conduct Customer Loyalty Survey on Formplus

Formplus is a data-gathering platform that allows you to carry out customer loyalty surveys using online survey forms. You can make use of available customer loyalty survey form templates or you can create your unique customer loyalty survey form using the Formplus builder.

Here's a step-by-step guide on how to conduct customer loyalty survey on Formplus.

Sign in to Access Formplus Builder

To access the Formplus builder, you will need to create an account on Formplus.

Once you do this, sign in to your account and click on "Create Form " to begin.

Edit Form Title

- Click on the field provided to input your form title, that is, Customer Loyalty Survey Form.

Edit Form

- Click on the edit button to edit your customer loyalty survey form.

- Add Fields: Specify form field inputs from the Formplus builder inputs column. There are several field input options for customer survey forms on the Formplus builder.

- Edit fields to include different customer loyalty survey questions.

- Click on "Save"

- Preview form.

Customize Form

Formplus builder allows you to add unique features to your customer loyalty survey form. You can personalize your form in the builder's customize section.

Here, you can add relevant background images, embed your organization's logo, and other features. You can also change the display theme of your form.

- Save and Share: Save your customer loyalty survey form and share the link with respondents. You can share your customer loyalty survey form via email, on social media or embed it in your organization's website feedback section.

How to Increase Customer Loyalty

- Prioritize Good Customer Service

Good Customer service often reveals the extent to which an organization values and respects its customer base. According to the 2015 Aspect Consumer Experience survey , 67% of customers are of the opinion that an organization's customer service culture is a reflection of how much value they place on their customers.

It is pertinent for every organization to develop a good customer support culture. Usually, customers keep scores of every interaction they have with an organization and this goes a long way in determining how loyal they are to a brand.

Ensure that your team is friendly, approachable, well-mannered, and prompt; especially with responding to online inquiries as research shows that customers expect almost-immediate feedback when they interact with a brand online. With great customer support, your business is sure to earn the absolute loyalty of its customers.

- Connect with your Customers

Ensure that your relationship with your customers is not merely transactional. Customer loyalty is earned when your customers feel like an important part of your brand; not just as individuals helping you to make a profit and stay in business.

To achieve this, ensure that you regularly reach out to your customers and become a part of their lives. Create a community by sending encouraging emails, newsletters; involve them in your organization's decision-making process, organize a meet-and-greet with their favorite celebrities, or host a customer appreciation event.

- Provide Incentives and Discounts

A good way to earn customer loyalty is to reward your customers for patronizing your brand. Often times, you may have to give your customers a head start by offering free products or services for a limited period of time.

- Prioritize Excellent Service Delivery

One of the surest ways to earn your customer's loyalty is to ensure that you provide top-notch service delivery. When your customers are convinced that your brand provides the best service or product, they would be completely devoted to you.

Examples of Customer Loyal ty

- Starbucks Rewards

Starbucks Rewards is a customer loyalty program that was targeted at making it easier for customers to place and manage orders on Starbucks. The first-of-its-kind mobile application made it possible for customers to make orders from the comfort of their mobile devices and earn loyalty points (stars).

- Moosejaw Rewards Program

Moosejaw rewards program allows customers to enjoy 10% cashback on fully-priced items and 40% cashback on special-priced items which is a great way to stimulate continuous patronage from customers. It also offers free shipping on outdoor clothes like jackets and free 2-day shipping on orders over $49.

Advantages of Customer Loyalty

- Free Brand Advertising/Advocacy

Brand advocacy occurs when your customers willingly advertise your brand without any prompts from your organization or team. Customer loyalty earns your brand fee advertisements on different platforms as loyal customers are die-hard fans who would continuously go out of their way to promote your brand without any form of payment.

- Price Insensitivity

Price insensitivity occurs when customers are so loyal to a brand that pricing because inconsequential in influencing patronage. This means that even if the price is increased, customers would still opt for your brand because they trust your service delivery.

Referrals are new customers who are acquired through direct marketing from an existing customer. Recommendations from existing customers are one of the most powerful marketing tools for any brand because they often translate to direct sales or patronage; without any extra nudge from the organization.

- Increased Revenue

Naturally, customer loyalty leads to an increase in revenue as the organization enjoys more patronage, increased sales, free marketing, and referrals.

- Improved Reputation

Customer loyalty ensures that existing customers feel esteemed, and encourages new clients to keep patronizing your business. It further expands customer appreciation and increases the chances that current clients will share their satisfaction with others around them.

The more a customer feels that your business acknowledges them, the more he or she will get the message out. Word-of-mouth advertising is one of the cheapest and most effective methods of growing a business.

Conclusion

Customer loyalty is an important area that every organization should pay attention to as it offers so many benefits. It is a proven means of growing an organization's customer base, earning more revenue and profit, and entrenching your brand in its target market.

Every organization should track its level of customer loyalty and this can be done through the use of a customer loyalty survey form. A customer loyalty survey form contains questions that cut across the different important aspects of your business.

You can create your personalized customer loyalty survey form on Formplus using the Formplus form builder. Formplus also allows you to access different customer loyalty survey templates that can be used to gather useful information from your client-base.

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Creating loyalty in volatile times

PwC Customer Loyalty Survey 2022

of consumers stopped using or buying from a business in the past year

would share some type of personal data for a better customer experience

would be less loyal if the online experience isn't as enjoyable as in person

Volatility in consumer behavior is at an all-time high. The COVID-19 pandemic fundamentally changed many needs and preferences. Inflation and a turbulent economy are influencing buying decisions. Technology creates unprecedented connectivity and access to goods and services. Consumers know more about where companies stand on environmental, social and governance (ESG) issues and expect businesses to share their beliefs. And let’s be honest: Consumers as a whole are more discerning than ever.

This all leaves companies wondering how they can better shape consumer demand and drive engagement with their brands. Unlocking what drives consumer loyalty has companies asking, “How do I attract and retain my customers?” Along with providing new insights from more than 4,000 consumers in the US, our PwC Customer Loyalty Survey 2022 reveals several opportunities for businesses to strengthen relationships, increase customer lifetime value and reduce the likelihood that they’ll leave.

What wins — and can lose — a customer’s loyalty

More than one-fourth of survey respondents told us they stopped using or buying from a business in the past year, and bad experiences — with products or services and/or customer service — were the overwhelming reasons why.

As inflation persists, more than half of respondents said getting good value for the price of a product or service is a top reason why they keep using or buying from a business.

Personalization is a priority, too. Four out of five consumers would share some type of personal data for a better experience, with such information as email address, birthday and age, and sex/gender identity topping the list.

In an increasingly automated world, the human touch still matters. At least one-third of respondents said human interaction is important to their loyalty, and for many types of businesses it was more than 50%.

Ignore the digital dimension at your peril. More than half of respondents said they’re less likely to be loyal to a brand if its online shopping experience isn’t as easy or enjoyable as shopping in person.

As you might expect, generations differ significantly when it comes to loyalty. Generation Z (ages 18-25) and Millennials (26-41) are generally more mobile than Generation X (42-57) and Baby Boomers (58 and older), but they’re also more open to personalization and perks that can build loyalty.

Loyalty in a dramatically different world

The pandemic disrupted a wide range of industries and left businesses scrambling to adapt to shifting customer needs. Nearly three out of ten consumers in our survey say today they’re more likely to try a new brand, and younger generations are even more likely. Those percentages are higher for certain types of businesses, such as restaurants (44% more likely to try a new brand), consumer goods (38%) and supermarkets (36%).

Consumers are not only willing to walk away, they’re actually doing it: 26% of respondents said they stopped buying from a specific business in the past year. That percentage was higher — in some cases much higher — for many types of businesses, including airlines, restaurants, banks and hotels. And again, the younger the consumer, the greater chance he or she left a brand behind.

In addition to COVID-19, consumers are dealing with inflation. Among the many reasons why people regularly patronize a business, getting good value was the top reason at 53%. In addition, 30% said they like the benefits, rewards and privileges — discounts, rebates and special access or offers — they get with a preferred company’s loyalty program. By comparison, only 13% said they don’t consider price.

Among consumers whose loyalty has changed since before the pandemic, 15% say they’re now less loyal to brands they regularly bought from before COVID-19.

Customer experience is critical to loyalty

Bad experiences — even just one — can cost you customers. More than half (55%) of respondents said they would stop buying from a company that they otherwise liked after several bad experiences, and 8% said they would stop after just one bad experience. While 8% may not seem like much, it is when you're talking about a market-leading company with millions of customers. Are you willing to lose that many customers because of one bad experience? And it doesn’t just have to be “bad” experiences for some to leave: 32% said they’d drop a company if it provided inconsistent experiences.

And it isn’t just talk either. Among survey respondents who stopped using or buying from a specific business in the past year, a bad experience with products or services and a bad experience with customer service were top reasons. That indicates that service recovery is more important than ever for companies. In addition, younger generations were more likely than older generations to leave a brand because they liked the experience with another brand better.

What could improve those experiences and help retain customers? More humanity would help. In this automated age, consumers still want to talk to a real person. Respondents said human interaction is important or very important for their loyalty to restaurants (58%), financial services (55%), pharmacies (53%) and hotels (52%). In fact, for each type of business, at least one-third of respondents said human interaction is important. Companies also should determine how to balance investments in human interaction with offering an engaging digital experience. More than half (51%) of consumers said they’re less likely to be loyal to a brand if its online shopping experience isn't as easy or enjoyable as shopping in person. That number jumped to 69% for Generation Z and 57% for Millennials.

When it comes to the subscription services they use, 33% of consumers said they like discounts and rewards the most, 27% said subscriptions are less expensive than alternatives and 23% said they get faster and/or easier service.

Capturing customers through subscriptions

More than half (55%) of consumers in our survey said they belong to at least one type of subscription service that allows them to make regular payments for access to a product or service. Benefits of subscriptions also factor in customer loyalty, as discounts, lower prices, faster and/or easier service and automatic renewals were what survey respondents liked most about the services. As expected, participation varies greatly by age: 81% of Generation Z members and 72% of Millennials said they have at least one subscription, compared to only 31% of Baby Boomers. Music, television and entertainment services are most popular overall, with 36% of respondents saying they subscribe. In addition, 17% said they subscribe to a bundled service that provides multiple services, and more than 10% have subscriptions for household goods, personal care items, food or alcohol, or clothing and fashion items.

Get personal or get lost

Just as loyalty can hinge on a customer’s experience with a business, so can an experience be shaped by how personal it feels to a customer. When asked about getting a personalized experience from a business, 87% of survey respondents named at least one part of that experience that’s most important to them.

In addition, 82% are willing to share some type of personal data for more personalized service. Comfort levels were strongest with personal identifiers, with 48% willing to share their birthday and age, 45% their sex/gender identity and 37% their race/ethnicity. Many consumers also are OK with contact information such as an email address (61%), mailing address (40%) and phone number (35%). Specifics about usage and biometrics are a harder sell. Only 22% said they’re willing to share product usage data, 15% their current location (via mobile phone), 5% facial recognition and 3% a fingerprint.

Consumers also prize flexibility in personalization, with one of the top preferences being “rewards my way” in a loyalty program. That priority offers businesses an opportunity to experiment more with experiential loyalty to improve customer retention. Among age groups, Generation Z is more likely than older generations to want easy or fast access to products or services, brands to remember their preferences and to be able to seamlessly switch between mobile, online and in-store experiences.

Expression of loyalty varies across generations

Between longer lifespans and people interacting with brands at younger ages, businesses have more opportunities to connect with consumers and win their loyalty. Our survey found that Millennials and Generation Z show loyalty in more ways than Generation X and especially Baby Boomers.

While getting good value for price and the quality/consistency of products or services are top reasons why younger people keep using a business, those consumers overall don’t feel as strongly as older ones about those factors. By comparison, more Millennials and members of Generation Z value fast service, feeling like they’re part of a community and having a personalized experience. To that end, more Generation Z members (41%) and Millennials (37%) were willing to share their personal interests, preferences or habits with a business to get a more personalized experience.

Generations also differed in why they stopped buying from a business in the past year. Generation Z and Millennials were more likely to cite more than one reason for leaving compared to older generations. But larger percentages of Generation X and Baby Boomers said they left a brand to support or boycott issues they feel are important in society, such as the environment, diversity and charitable giving.

69% of co-branded credit cardholders say they likely would buy from the brand that issued the card.

Co-branded credit cards help drive customer loyalty

As companies explore other ways to earn loyalty and consumers seek more benefits, co-branded credit cards — offered by businesses in partnership with a bank or credit card company with rewards such as airline miles and fuel points — have grown in popularity. Three out of five survey respondents have some type of co-branded credit card, with higher percentages of men than women and older consumers than younger ones being cardholders. More than two-thirds of cardholders said they’d likely buy from the brand that issued the card, including more than a third who said very likely. But almost one-fourth said the card doesn’t drive more loyalty — they’re neither likely nor unlikely to buy from the brand on the card. Also, similar to the overall shift in customer loyalty during the pandemic, 30% of co-branded cardholders said the benefits or rewards were more valuable now than before COVID-19, while only 10% said less.

Seven ways to win loyalty

The challenges of winning and keeping a consumer’s business are very real, but so are the opportunities for businesses in many industries. Here are some ways you can better connect with your customers and increase the odds of earning their loyalty.

- Recognize the rise of emotional loyalty. Experience is all about how an individual feels when interacting with your brand before, during and after a transaction. The better you understand that, the more ways you can engage with customers — and the more likely they’ll continue engaging with your business.

- Invest in customer segmentation. As behaviors and preferences have changed, you should update analytic models that aim to help you better understand your customers.

- Assess how rigid your loyalty programs are and reconsider the selection of benefits, including expanding beyond points and discounts to experiential loyalty.

- Activate a data-driven personalization strategy to drive effective engagement and stronger individual connections with customers.

- Where feasible, test and learn with subscriptions, maintaining flexibility to quickly adjust in response to subscriber feedback. With existing models, acknowledge the potential for “subscription fatigue” and determine how you can adapt those models to address shifting customer needs.

- Develop a balanced approach to physical and digital customer engagement, including creating a consistent omnichannel experience for customers.

- Prioritize efforts to better understand younger and more racially and economically diverse groups, as recognizing their needs and preferences can provide opportunities to grow their loyalty.

About the survey

PwC surveyed 4,036 consumers in the US between May 5 and May 19, 2022. Respondents in the online survey were adults 18 and older, with demographic weighting to achieve census representation on age, gender, race, US region, income, employment status and marital status.

PwC 2023 Customer Loyalty Executive Survey

Read how 400+ marketing leaders are bridging gaps with customers to win long-term loyalty

Related services

{{filtercontent.facetedtitle}}.

{{item.publishDate}}

{{item.title}}

{{item.text}}

Principal, Customer Transformation and Loyalty, PwC US

George Korizis

Customer Transformation Leader, PwC US

John Rolston

Customer Transformation and Loyalty Partner, PwC US

Anjali Fehon

Customer Transformation and Loyalty Director, PwC US

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

Copyright © SurveySparrow Inc. 2024 Privacy Policy Terms of Service SurveySparrow Inc.

11 Best Customer Loyalty Survey Questions You Need to Ask

Kate Williams

Last Updated: 7 August 2024

23 min read

Table Of Contents

- Best Customer Loyalty Survey Questions

- Must-Have Customer Loyalty Survey Questions

- General Customer Loyalty Survey Questions

Brand Loyalty Survey Questions

Loyalty card questionnaire, questionnaire on customer loyalty in banks.

Do you want your customers to stay with you and keep purchasing (or renewing) your products? A customer loyalty survey can help you with that!

Everything that you do revolves around making your customers happy. Every good business goes out of its way to create fantastic experiences for its customers.

The ones that don’t have a hard time retaining customers. So, having loyal customers is something you need to strive for.

What is a Customer Loyalty Survey?

- 11 Best Customer Loyalty Survey Questions

- 35 More Loyalty Survey Questions

- The Importance of Customer Loyalty Surveys

How to Measure Customer Loyalty

- How to Increase Customer Loyalty

- How can SurveySparrow Help Increase Customer Loyalty

Let’s get started!

A customer loyalty survey is used to measure brand loyalty. The results of a customer loyalty questionnaire are to understand whether they will stick with your business. Moreover, loyalty surveys will give you an idea of the kind of efforts that would be required from your customer loyalty programs to ensure that they continue giving their business to you.

While your customer feedback survey results might not be able to pinpoint your customer’s experience with you, it will give you an understanding of how happy they are doing business with you. Going through a sample customer loyalty survey will help you understand what it will address.

By asking the right questions in your customer loyalty survey, you will be able to elicit answers that can help you understand and measure your customers’ loyalty. So, we created this sample customer loyalty questionnaire starter pack.

Customer Loyalty Questionnaire Template

Preview Template

Like the template? Feel free to use it. There are more such templates where it comes from and it’s all free. Yes! No cost..no fuss, you can get access to 1000+ survey templates. You just have to sign up, that’s it.

Now, let’s have a look at some of the key loyalty survey questions you can ask.

The 11 Best Customer Loyalty Survey Questions

Loyalty, in general, needs to be ensured no matter the type of business you run. So, while articulating a loyalty survey, make sure to include some of the following questions. We will list some questions depending on specific use cases further down the lane, but before that, go through the following to get an idea of what to ask in general.

Alternate Approach: Use AI to Generate Questions

Before we jump into the survey questions, we would like to let you know that there’s an alternate approach to generating loyalty survey questions. You can use SurveySparrow AI to generate not just survey questions but an entire survey from scratch in seconds.

The feature is available with the free plan offered by the tool. So, sign up and use the feature for free!

Create Loyalty Surveys with AI

1. How likely are you to recommend our services?

- Very likely

- Somewhat likely

The fact that your customers are likely to recommend your service to their friends and family is one of the best indicators of loyalty. It shows that they love what you offer to them.

2. How likely are you to continue using our services?

This is yet again an indicator of your customers staying with you. The ones who respond with ‘Very Likely’ are the ones who say that they will buy from you again.

3. How convenient do you think our product or service is?

The answer to this question will get you feedback on how your product or service is structured. It will give you an answer to how you can meet your customer’s requirements so that you can convince them to stay with you.

4. Would you be interested in checking out other products or services?

It is a ‘Yes’ or ‘No’ question, and obviously, the ones who say yes have had a great experience with you and are more likely to continue their patronage with you.

5. What do you like most about our service or product?

It is an open-ended question that can help you identify a lot of things about your service or product, depending on how verbose the customer is with their replies.

Based on this response, you can even ask follow-up questions that will help you solve the problem they are facing, if any.

When you do so, you are more likely to come across as a responsible organization that cares about its customers, and it will surely fetch you brownie points, including loyalty.

6. What are the top three features of our product that are most valuable to you?

This question is something that SaaS businesses should surely ask. SaaS businesses usually offer a variety of features, and most customers don’t use all of them.

So if you get to know which features are the most important for a majority of your customers, then you can ensure that those are your best talking points by making them stronger.

7. Were we able to meet your expectations in terms of product quality, features, and build?

Your customers buy from you with the belief that your product will meet their expectations. They will be happy doing business with you if it meets their expectations.

It would be best if you gave them more reasons to continue doing business with you with impeccable customer service.

8. On a scale of 1-10, how satisfied are you with our organization?

This is almost similar to the NPS question, and you can safely assume that the ones who respond with a 9 or 10 are extremely satisfied with your service.

They are not only likely to continue doing their business with you but will also recommend your service to their friends and family.

9. How can we make our service delivery better?

You must be a totally customer-focused organization if you want the best for your customers.

Asking your customers directly if they have any opinion on improving your service delivery is a sign that you want to give your best to your customers.

10. How helpful have we been in responding to questions and complaints?

The swiftness with which you respond to complaints should be the same speed as sending invoices. Most businesses are good at the latter, while the former doesn’t get the importance it deserves.

If your customers know that you will do everything in your power to solve their issues, they will never leave you.

11. How would you rate the value we provide for the money you pay?

This is an interesting question since not only does it dwell upon your pricing, but it also indicates how much they value your product.

The answer to this can give you many insights into these two factors.

30+ More Loyalty Survey Questions You Can Ask

Now that we whave understood the type of questions to be asked in a loyalty survey, let’s have a look at the top survey questions to ask.

NOTE: As we discussed earlier, you can always use AI to create survey questions.

General Loyalty Program Survey Questions

Loyalty programs, as you know, are all about rewarding repeat customers and ensuring retention. A loyalty program survey focuses on understanding the satisfaction level of the current one and looking for areas to improve.

The following are some survey questions you can ask.

- How satisfied are you with our loyalty program?

- How often do you take advantage of the rewards offered by our loyalty program?

- Which aspects of our loyalty program do you find most valuable?

- Are there any rewards or benefits you would like to see added to our loyalty program?

- How easy is it to understand and use our loyalty program?

- Have you ever experienced any issues with our loyalty program? If yes, please explain.

- On a scale of 1 to 10, how likely are you to recommend our loyalty program to others?

- What would make you more likely to participate in our loyalty program?

- How do you prefer to be informed about loyalty program updates and offers? (Email, SMS, Mobile App, In-Store, Other)

- What changes would you suggest to improve our loyalty program?

Brand loyalty surveys help you get a clear picture of how loyal customers are to your brand. You further understand the reason why they choose to be loyal and why they are not. Some brand loyalty survey questions to ask are as follows.

- How would you describe your overall perception of our brand?

- How often do you purchase products/services from our brand?

- What factors contribute to your loyalty to our brand?

- On a scale of 1 to 10, how likely are you to switch to a competitor if they offer a similar product/service?

- How do you rate the quality of our products/services compared to our competitors?

- What makes our brand stand out from the competition?

- How satisfied are you with the value for money offered by our brand?

- How likely are you to recommend our brand to others?

- What improvements would you like to see in our products/services?

- Have you ever participated in our brand’s promotions or events? If yes, please share your experience.

Loyalty cards are another type of loyalty program specifically designed for retail businesses. Retailers can issue loyalty cards and give points everytime customers make a purchase. Once the points reach a bare minimum, customers can avail of certain discounts or offers.

However, to make the most out of loyalty cards, one must know what exactly customers are looking for. For that, you can use the following questions.

- How satisfied are you with our loyalty card program?

- How often do you use your loyalty card when making purchases?

- What rewards or benefits do you find most valuable in our loyalty card program?

- How easy is it to earn and redeem rewards with our loyalty card?

- Have you ever experienced any issues with our loyalty card program? If yes, please explain.

- On a scale of 1 to 10, how likely are you to recommend our loyalty card program to others?

- What additional rewards or benefits would you like to see in our loyalty card program?

- How do you prefer to receive information about your loyalty card points and rewards?

- How do you rate the overall value of our loyalty card program?

- What suggestions do you have for improving our loyalty card program?

Customer loyalty is of the utmost importance in the Banking sector. With the sensitivity of handling monetary transactions and investment plans, banks have to tread carefully. And most importantly offer loyalty programs to retain loyal customers.

The following are some loyalty survey questions to ask.

- How satisfied are you with the overall services provided by our bank?

- How long have you been a customer of our bank?

- How likely are you to continue using our bank’s services?

- On a scale of 1 to 10, how likely are you to recommend our bank to a friend or family member?

- Which of our banking services do you use most frequently?

- How do you rate the quality of customer service at our bank?

- Have you ever encountered any issues with our bank’s services?

- How satisfied are you with the convenience of our online and mobile banking services?

- What aspects of our bank do you value the most?

- How likely are you to switch to another bank in the next 12 months?

- What improvements would you like to see in our banking services?

- How do you rate our bank’s security measures?

- Have you ever used any of our bank’s additional services?

- How satisfied are you with the transparency of our bank’s fees and charges?

- What can we do to improve your overall banking experience?

5 Reasons Why Customer Loyalty Surveys are Important

To give you a clear idea of why you should invest in customer loyalty surveys, let’s have a look at the crucial benefits they bring to the table.

#1. Customer Retention

The backbone of most businesses is having loyal customers who will stay with you through thick and thin. When you have customers who keep giving you their business, it gives a sense of stability.

#2. Ease of Upselling and Cross-selling

While it is important that you always have a new set of leads in the reckoning, it is even more important for you to take care of your existing customers.

An existing customer is more valuable than a new customer. Why? Because they like doing business with you and are more likely to pay a premium for your new products. They will also be easy to upsell and cross-sell as they have a great relationship with you and trust your expertise.

#3. Measuring Actual Customer Satisfaction

While most businesses understand that existing customers are important, the point that they miss out on is overestimating the latter’s reliance on you. In other words, most businesses assume that most of their customers are extremely satisfied with them.

That might not always be the case, and it is certainly the last thing that you should be relying on your intuition for. This is where customer loyalty survey questionnaires play a huge role.

#4. Getting Competitive Information

Asking customer loyalty survey questions will put you in a league separate from most of your competitors. In the customer loyalty survey, you need to ask the right questions so that you can get the details that you are looking for.

You can ask a variety of customer experience survey questions to understand what is going on in their minds. These loyalty questions are vital for cutting down on customer attrition .

In this world where competition is rabid, having loyal customers is the biggest gift any business can want. Thankfully, it is possible to quantify customer loyalty by measuring certain metrics . Here are some ways you can measure customer loyalty through loyalty questionnaires.

1. Net Promoter ScoreSM (NPS®)

By asking a simple question, the NPS® survey provides businesses with a great understanding of a customer’s loyalty. Regardless of which NPS software you use, it is always based on this question:

“How likely are you to recommend our service to your friends?”

The NPS® scale is 0 to 10, and it segments the respondents in the following ways.

- Promoters – Those who give you a score of 9 or 10 are called promoters and they are the ones who not only love your brand but will also go out of their way to recommend you to their friends and family.

- Passives – They give you a score of 7 or 8. These are people who are satisfied with your service or product but will leave you if they find a better offer.

- Detractors – The ones that give you a score of 6 or lower are called detractors. They are the ones who are highly likely to badmouth you on social media or forums. They can do a lot of damage to your brand by sharing their negative experience with their immediate circle and on the internet.

Thanks to the NPS® survey, you can take immediate steps to make amends with the detractors so that they can at least turn into passives. You can convert your passives into promoters as well.

Your NPS® score can be calculated by subtracting the percentage of your detractors from the percentage of your promoters. Please do remember that your NPS® score is the perception of your customers towards your brand, and does not necessarily talk about the quality of your products or services.

Get free access to NPS surveys here! Sign up with your email.

14-day free trial • Cancel Anytime • No Credit Card Required • No Strings Attached

2. Customer Lifetime Value (CLV)

It is considered as the total revenue you can expect from a customer over their lifetime. Not only does it help you identify your high-net value customers, but it also helps you prioritize areas where you need to concentrate on.

The Customer Lifetime Value is also a great metric that your marketers should concentrate on as it helps them understand how much they should spend on acquiring customers. If your customer acquisition value is greater than CLV, then you are a business that is doomed to failure.

3. Customer Loyalty Index (CLI)

The Customer Loyalty Index is a standardized tool that is used to track customer loyalty over a period of time. There are a lot of things that go into successfully arriving at how loyal your customers are. The CLI takes factors like upselling numbers, cross-selling numbers, repurchasing, and NPS® value to arrive at the number.

Here are the questions that are used extensively in CLI:

- How likely are you to recommend our service to your friends and family?

- How likely are you to buy from us again in the future?

The value of CLI is the average score of three responses. It evaluates the answers ranging from 1 to 6, with 1 being “Definitely Yes” and 6 standing for “Definitely No.”

4. Customer Engagement Score

If you want to know how loyal your customers would be, the answer lies in how engaged they are with your brand.

The Customer Engagement Score assigns a score to every customer based on the activity and the usage of their services. It groups customers into different segments to see how it performs against other segments and finds out who are the customers who are more likely to leave.

To track the engagement of these customers, it measures metrics such as activity time, visits frequency, and core user actions.

Try the Best Online Survey Tool

Choose SurveySparrow for 40% more Response Rate

14-Day-Free Trial • Cancel Anytime • No Credit Card Required • Need a Demo?

How to Improve Customer Loyalty