How to Write a Business Plan for Raising Venture Capital

Written by Dave Lavinsky

Are you looking for VC funding or funding from other potential investors?

You need a good business idea – and an excellent business plan.

Business planning and raising capital go hand-in-hand. A venture capital business plan is required for attracting a venture capital firm. And the desire to raise capital (whether from an individual “angel” investor or a venture capitalist) is often the key motivator in the business planning process.

Download the Ultimate VC Business Plan Template here

Writing an Investor-Ready Business Plan

Executive summary.

Goal of the executive summary: Stimulate and motivate the investor to learn more.

- Hook them on the first page. Most investors are inundated with business plans. Your first page must make them want to keep reading.

- Keep it simple. After reading the first page, investors often do not understand the business. If your business is truly complex, you can dive into the details later on.

- Be brief. The executive summary should be 2 to 4 pages in length.

Company Analysis

Goal of the company analysis section: Educate the investor about your company’s history and explain why your team is perfect to execute on the business opportunity.

- Give some history. Provide the background on the company, including date of formation, office location, legal structure, and stage of development.

- Show off your track record. Detail prior accomplishments, including funding rounds, product launches, milestones reached, and partnerships secured, among others.

- Why you? Demonstrate your team’s unique unfair competitive advantage, whether it is technology, stellar management team, or key partnerships.

Industry Analysis

Goal of the industry analysis section: Prove that there is a real market for your product or service.

- Demonstrate the need – rather than the desire – for your product. Ideally, people are willing to pay money to satisfy this need.

- Cite credible sources when describing the size and growth of your market.

- Use independent research. If possible, source research through an independent research firm to enhance your credibility. For general market sizes and trends, we suggest citing at least two independent research firms.

- Focus on the “relevant” market size. For example, if you sell a portable biofeedback stress relief device, your relevant market is not the entire health care market. In determining the relevant market size, focus on the products or services that you will directly compete against.

- It’s not just a research report – each fact, figure, and projection should support your company’s prospects for success.

- Don’t ignore negative trends. Be sure to explain how your company would overcome potential negative trends. Such analysis will relieve investor concerns and enhance the venture capital business plan’s credibility.

- Be prepared for due diligence. It’s critical that the data you present is verifiable since any serious investor will conduct extensive due diligence.

Customer Analysis

Goal of customer analysis section: Convey the needs of your potential customers and show how your company’s products and services satisfy those needs.

- Define your customers precisely. For example, it’s not adequate to say your company is targeting small businesses since there are several million of these.

- Detail their demographics. How many customers fit the definition? Where are these customers located? What is their average income?

- Identify the needs of these customers. Use data to demonstrate past actions (X% have purchased a similar product), future projections (X% said they would purchase the product), and/or implications (X% use a product/service which your product enhances).

- Explain what drives their decisions. For example, is price more important than quality?

- Detail the decision-making process. For example, will the customer seek multiple bids? Will the customer consult others in their organization before making a decision?

Finish Your Investor Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

And know it’s in the exact format that venture capitalists want?

With Growthink’s Ultimate Business Plan Template , you can finish your plan in just 8 hours or less!

Competitive Analysis

Goal of the competitive analysis section: Define the competition and demonstrate your competitive advantage.

- List competitors. Many companies make the mistake of conveying that they have few or no real competitors. From an investor’s standpoint, a competitor is something that fulfills the same need as your product. If you claim you have no competitors, you are seriously undermining the credibility of your business plans.

- Include direct and indirect competitors. Direct competitors serve the same target market with similar products. Indirect competitors serve the same target market with different products or different target markets with similar products.

- List public companies (when relevant, of course). A public company implies that the market size is big. This gives the assurance that if management executes well, the company has substantial profit and liquidity potential.

- Don’t just list competitors. Carefully describe their strengths and weaknesses, as well as the key drivers of competitive differentiation in the marketplace. And when describing competitors’ weaknesses, be sure to use objective information (e.g. market research).

- Demonstrate barriers to entry. In describing the competitive landscape, show how your business model creates competitive advantages, and – more importantly – defensible barriers to entry.

Marketing Plan

Goal of the marketing plan: Describe how your company will penetrate the market, deliver products/services, and retain customers.

- Products. Detail all current and future products and services – but focus primarily on the short-to-intermediate time horizon.

- Promotions. Explain exactly which marketing/advertising strategies will be used and why.

- Price. Be sure to provide a clear rationale for your pricing strategy.

- Place. Explain exactly how your products and services will be delivered to your customers.

- Detail your customer retention plan. Explain how you will retain your customers, whether through customer relationship management (CRM) applications, building network externalities, introducing ongoing value-added services, or other means.

- Define your partnerships. From an investor’s perspective, what partnership you have with whom is not nearly as important as the specific terms of the partnership. Be sure to document the specifics of the partnerships (e.g. how it will work, the financial terms, the types of customer leads expected from each partner, etc.).

Operations Plan

Goal of the operations plan: Present the action plan for executing your company’s vision.

- Concept vs. reality. The operations plan transforms business plans from concept into reality. Investors do not invest in concepts; they invest in reality. And the operations plan proves that the management team can execute your concept better than anybody else.

- Everyday processes. Detail the short-term processes and systems that provide your customers with your products and services.

- Business milestones. Lay out the significant long-term business milestones for the company, and prove that the team will execute on the long-term vision. A great way to present the milestones is to organize them into a chart with key milestones on the left side and target dates on the right side.

- Be consistent. Make sure that the milestone projections are consistent with the rest of the venture capital business plan – particularly the financial plan.

- Be aggressive but credible. Presenting a plan in which the company grows too quickly will show the naiveté of the team while presenting too conservative a growth plan will often fail to excite an early stage investor (who typically looks for a 10X return on her investment).

Financial Plan

Goal of the financial plan: Explain how your business will generate returns for your investors.

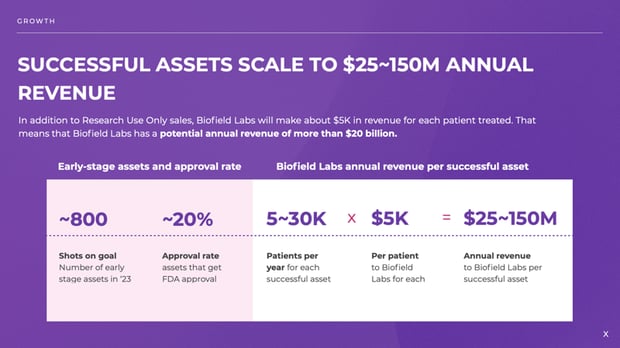

- Detail all revenue streams. Be sure to include all revenue streams. Depending on the type of business, these may include sales of products/services, referral revenues, advertising sales, licensing/royalty fees, and/or data sales.

- Be consistent with your Pro-forma statements. Pro-forma statements are projected financial statements. It is critical that these projections reflect the other sections of your newly formed business plan.

- Validate your assumptions and projections. The financial plan must detail your key assumptions, and it is critical that these assumptions are feasible. Be sure to use competitive research to validate your projections and assumptions versus the reality in your marketplace. Assessing and basing financial projections on those of similar firms will greatly validate the realism and maturity of the financial projections.

- Detail the uses of funds. Understandably, investors want to know what, specifically, you plan to do with their money. Uses of funds could include expenses involved with marketing, staffing, technology development, office space, among other uses.

- Provide a clear exit strategy. All investors are motivated by a clear picture of your exit strategy, or the timing and method through which they can “cash in” on their investment. Be sure to provide comparable examples of firms that have successfully exited. The most common exits are IPOs or acquisitions. And while the exact method is not always crucial, the investor wants to see this planning in order to better understand the management team’s motivation and commitment to building long-term value.

Above all, the business plan is a marketing document that helps to sell the investor on the business opportunity, the team, the strategy, and the potential for significant return on investment.

How to raise venture capital is a difficult and time-intensive challenge. There is no easy shortcut or silver bullet. However, you can greatly improve your chances of raising venture capital by writing a business plan that speaks directly to the investor’s perspective. A VC business plan template will significantly help in cutting down the time it takes to complete your plan.

Finish Your VC Business Plan in 1 Day!

Raising venture capital faqs, what is the purpose of a business plan for raising venture capital.

The purpose of writing a business plan for raising venture capital is to convince investors that the proposed new or existing company has a good chance of being successful and can earn them a favorable return on investment (ROI).

A VC Business Plan Template will help you in creating an investor ready plan quickly and easily.

What Does VC Funding Entail?

VC funding is a type of financial transaction in which the venture capital firm invests in startup companies or early-stage companies. The firm invests its own capital (which it receives from other entities that invest in the VC firm) in these nascent companies with the goal of rapidly expanding them. Generally, early-stage companies use bootstrapping, self-funding, bank loans, and/or angel investment before raising their first round of venture capital. Companies might receive several rounds of VC funding.

What is a Typical Amount of Capital to Raise?

Typically, the first round (Series A) of venture capital amounts to $2-10 million. To raise that amount from VCs at the very start of your company is often very difficult. Rather, you should consider approaching angel investors and banks to provide initial financing to get you to the point at which venture capitalists are interested in providing funding. Gaining customer traction is generally the point in which VCs are ready to provide Series A financing. VCs will provide Series B funding, Series C funding, etc. to help continue to fund a company’s growth if the company seems poised for success. These funding rounds are usually much larger than Series A rounds.

How Long Does It Take For Investors To Decide If My Business Is Worth Investing In?

It varies from investor to investor, but prepare yourself to wait up to three months before receiving a check from a VC. The process typically includes sending the VC a teaser email to get their interest, following up with a business plan, giving a pitch presentation, and negotiating the terms of the funding round.

How Do I Find Venture Capitalists?

There are many venture capital firms and virtually all of them have websites and are thus fairly easy to find. There are also directories of them available on the internet. You may also be able to find VCs through personal introductions or by attending industry events.

Look for VCs that have funded companies in your industry/sector, at your stage of development and in your geographical area.

What Capital Raising Options are Available For a Business?

There are four broad options for raising money or venture capital when you run a business. These include venture capital firms, angel investors, loans and venture debt, or bootstrapping.

Venture Capitalists

A Venture Capitalist is an investor that provides equity financing for companies that have already achieved some traction but lack the financial resources to scale up their operations. Their investment objective is typically to grow the company so it can be sold or go public at a later date so the VC can exit or cash in on their success.

Angel Investors

Angel investors are wealthy individuals who invest their own money into startup companies because they believe they will get an above-average return on their investment. They also invest if/when they like the entrepreneurs and/or management team, they are passionate about the concept, or if they’d like to get involved in an exciting new venture.

Loans and Venture Debt

Business loans or venture debt is money given to a company in return for interest and principal payments over time, but without the investor taking an ownership stake in the company. Such funding is typically issued by local banks. Debt funding is typically less expensive than equity financing, but it is much harder for early-stage companies to raise significant amounts of debt capital.

Bootstrapping

Bootstrapping is the process of a startup company funding its own growth from internal sources such as the founder's savings, loans from friends and family, or credit card debt.

Firms that are bootstrapped can grow at a more controlled rate while they achieve product-market fit before an angel investor or venture capital firm injects their money to scale up the company.

Bootstrapping is best for companies with low capital needs because there’s only so much you can raise in this manner. If you need millions of dollars, bootstrapping just won’t work and you’ll need to tap venture capital.

How exactly will your small business persuade these potential investors to sign a check? Once you know what type of capital you are trying to raise, you can develop business plans to suit their exact requirements.

Need help with your business plan?

Speak with one of our professional business plan consultants or contact our private placement memorandum experts.

Or, if you’re developing your own PPM, consider using Growthink’s new private placement memorandum template .

Other Helpful Funding & Business Plan Articles

- Start your Journey

- Accelerate your Progress

- Raise Capital

- Get Incorporated

- Get Started

How much time does it take for a VC to respond to a business plan?

Unfortunately, VCs do not typically review business plans. Instead, they look at a brief summary and then decide if they want to invite you in for a meeting.

And because VCs, particularly the larger ones, receive many hundreds (or even thousands) of business plans each month, most submissions that come in “over the transom” (that is, ones that are blindly sent to their general email address) don’t actually receive a response at all. Ever.

No one on either side of the table likes this state of affairs, but that’s the unfortunate reality.

*original post can be found on Quora @ http://www.quora.com/David-S-Rose/answers *

Gust Launch can set your startup right so its investment ready.

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.

Ready to launch your startup?

We have everything you need to build a successful, high-growth company—the right way.

" * " indicates required fields

What Is Venture Capital (VC) and How Does It Work?

| Written by

Venture capital (VC) plays a pivotal role in the startup ecosystem, providing vital financial support to promising businesses with high growth potential. It refers to a form of private equity financing that is typically provided by high-net-worth individuals, institutional investors, or specialized firms, known as venture capital firms.

Throughout this guide, we’ll explore the basics of venture capital funds, including how VC firms operate, the different stages of funding, and the process of securing investment. Whether you’re an entrepreneur seeking funding or an investor looking for promising ventures, this guide will equip you with the knowledge and strategies necessary for success.

Venture Capital 101

Venture capital has a rich history that dates back to the mid-20th century. Initially emerging in the United States, venture capital gained traction as a way to fund and support innovative startups with high growth potential. Early pioneers like Georges Doriot and Arthur Rock paved the way for a new model of investing, injecting capital into promising ventures in exchange for equity ownership.

Over the decades, the venture capital industry evolved and expanded globally, playing a pivotal role in fueling technological advancements and driving economic growth. The industry witnessed significant milestones, such as the establishment of iconic venture capital firms like Kleiner Perkins and Sequoia Capital, which funded revolutionary companies like Apple, Google, and Amazon.

Let’s delve into the world of venture capital, exploring its fundamentals, key players, investment strategies, and the lifecycle of a typical venture capital deal.

How Does Venture Capital Work?

Venture capitalists are individuals or firms who provide venture capital financing, but it’s not a gift or a loan. They’re actually buying a piece of your company. Here’s how it works:

Identifying Promising Startups & Initial Screening

VCs actively search for promising companies with high growth potential. They often specialize in specific industries or sectors and have a keen eye for innovation and market trends.

VCs may find potential investment opportunities through various channels, such as networking events, industry conferences, referrals from trusted sources, or even online platforms.

Once a VC identifies a potential startup, they initiate an evaluation process to assess its viability and growth prospects. This evaluation typically involves a thorough examination of the startup’s business model, market potential, team capabilities, and competitive landscape.

VCs also consider the level of risk associated with the investment and how it aligns with their investment strategy and portfolio companies.

Pitching & Due Diligence

If the startup passes the initial screening, the entrepreneur gets an opportunity to pitch their business idea and present their growth plans to the VC. This pitch is crucial as it allows the entrepreneur to showcase the unique value proposition of their company.

If the venture capital partners find the pitch compelling, they move on to the due diligence stage. During due diligence, they conduct a deeper investigation into the startup’s financials, market positioning, intellectual property, and legal compliance to ensure the investment is sound.

Terms & Investment

If the VC is satisfied with the due diligence results, both parties enter into negotiations to agree upon the terms of the investment. This includes determining the amount of funding the startup will receive in exchange for a percentage of equity stake or ownership in the company.

Negotiations also cover other aspects, such as investor rights, governance, and milestones that the startup must achieve to unlock additional funding rounds.

Post-Investment Support

Once the investment is made, the VC becomes an active partner, providing guidance, mentorship, and industry connections to help the startup grow.

VCs often leverage their experience, network, and resources to assist the entrepreneur in scaling their business, accessing new markets, and attracting further funding rounds if needed.

Growth & Exit

The goal is for your startup to grow and become very successful. Eventually, there might be an “exit event”. This could be your company getting sold to a bigger company or going public in the capital markets through an IPO (initial public offering). When this happens, the venture capitalists sell their shares and make a profit.

Here are some hypothetical examples to make the VC process a little clearer:

Imagine Sarah has an exciting technology startup that aims to revolutionize the transportation industry. She pitches her startup to a venture capitalist, and they invest $1 million in exchange for 20% ownership.

With this funding, Sarah can hire more engineers, conduct further research, and bring her innovative product to the market.

Her company grows and is later sold for $50 million. The VC makes $10 million (20% of $50 million) from their original $1 million investment.

David has a promising biotech startup with a breakthrough medical device. He successfully secures a venture capital investment of $5 million in exchange for a 25% ownership stake.

With the VC’s backing, he can conduct clinical trials, obtain regulatory approvals, and launch his life-saving product to make a positive impact on patients’ lives.

After several years, his company is sold for $200 million. The venture capitalist receives $50 million (25% of $200 million) from their investment.

Emma starts a new fashion brand that becomes popular. A VC gives her $2 million in return for 10% of her company. She is able to refine her product, expand her customer base, and secure partnerships with key players in the market.

Her brand takes off, and she decides to go public through an IPO. The company’s value rises to $100 million. The venture capitalist can now sell their shares and make $10 million (10% of $100 million).

In all these cases, the venture firm takes a risk by investing in a startup, but the potential rewards are very high. Your startup gets the money it needs to grow, and the venture capitalist has a chance to make a big profit if your company succeeds.

Venture Capital Pros

Venture capital investments can provide significant advantages to entrepreneurs looking to grow their startup companies. Here are some key benefits:

- Large Funding Amounts: A venture capital firm is usually able to provide large amounts of funding. This can help your company grow quickly and allow you to tackle larger projects and goals.

- Expert Advice & Mentoring: Venture capitalists often have experience in the industry and can provide valuable advice and guidance. They might have insights that can help you avoid common business pitfalls and make smarter decisions.

- Validation & Credibility: When a reputable VC firm invests in a startup, it adds a level of validation and credibility to the business. This endorsement can boost the startup’s reputation in the eyes of other investors, customers, and potential partners.

- Long-Term Partnership: VCs have a vested interest in the success of the startup and are committed to helping it reach its full potential. This long-term partnership can provide stability and support as the business navigates various growth stages.

- Network Access: Venture capitalists often have extensive networks in the business world. They can introduce you to potential clients, partners, and even other investors.

Venture Capital Cons

While venture capital funds can provide a lot of benefits, it’s not without its drawbacks. It’s important to understand the potential downsides before deciding to pursue this type of funding. Here are some of the main cons:

- Loss of Control: When you accept venture capital funds, you’re giving up a portion of your company’s ownership. This can result in less control over your business decisions, as the investors may want a say in how the company is run.

- Pressure to Perform: A venture capital firm will often push for rapid growth and possibly an eventual sale of the company. This can put a lot of pressure on you and your team and might not align with your personal business goals.

- Equity Dilution: To get the money, you have to give up a part of your business, or “equity.” This means when your business makes money, you have to share more of it. If your business becomes very successful, you could end up with a smaller piece of a big pie.

- Possible Loss of Privacy: Your company’s finances and strategies may become more transparent to outsiders. Investors will likely want regular updates and reports on your business’s progress, which means sharing more information than you might be comfortable with.

Stages of Venture Capital Investing

The VC funding process typically consists of several stages , each with its own characteristics and requirements. Let’s explore these stages in further detail:

Pre-Seed – Seed

Pre-seed funding is the very first stage of the funding process. At this point, your business idea is still in its early form, and you might not even have a product yet. The funds raised during this stage are usually used to develop a prototype or conduct market research.

Pre-seed funding often comes from the founders themselves, friends and family, or angel investors—people who provide capital for a business startup, usually in exchange for convertible debt or ownership equity.

Then, seed is where you might have a prototype or a minimum viable product (MVP) , but you’re still testing the waters and figuring things out. The money from seed funding often goes toward market testing, hiring a small team, or fine-tuning the product or service.

Like pre-seed funding, seed funding can come from angel investors, but it may also come from an early-stage venture capital firm.

Series A – B

Series A is where a VC firm usually comes into the picture. By the time you reach this stage, your business should have a clear plan for generating revenue and a good understanding of its target market.

The funds raised in Series A are often used to improve the product or service, reach new customers, and strengthen the business model.

Then, Series B funding is all about taking the business to the next level. This usually means expanding the market and increasing the scale of operations. At this point, your business should have a steady customer base and consistent revenue.

The funds raised during Series B are often used for hiring more staff, launching more expansive marketing efforts, and potentially acquiring other businesses.

Series C and Beyond

The Series C funding stage is typically the last stage, but there can be more (Series D, E, etc.). By this point, your business is usually successful and looking to expand further, perhaps to new markets or through more acquisitions.

Series C and beyond funding often comes from private equity firms , hedge funds, and investment banks. The focus of these funding rounds is often on fueling growth, acquiring competitors, or preparing for an initial public offering (IPO).

Learn more about the VC process by reading our guide.

Angel Investors vs. Venture Capital

Understanding the differences between angel investors and venture capital is a key step in identifying the right funding source for your startup. Let’s break down the key differences.

Source of Funds

Angel Investors: Angel investors are individuals who use their personal funds to invest in companies. They’re often experienced entrepreneurs or executives who want to support new businesses. They might be someone you know, or they might be a stranger who believes in your business idea.

Venture Capitalists: VCs manage pooled funds from multiple investors. These funds often come from large entities like pension funds, insurance companies, or wealthy individuals. The goal of VCs is to make a return on investment for their fund’s investors.

Amount of Investment

Angel Investors: Angels typically invest smaller amounts of money, usually ranging from a few thousand to a couple of million dollars. This makes them a good choice for startups in the early stages of development that need seed money to get started.

Venture Capitalists: VCs usually invest larger amounts, often millions of dollars. This makes them suitable for startups that are more established and are ready to scale up their operations.

Decision-making Process

Angel Investors: Decisions to invest are usually made quickly, as there are fewer parties involved. The decision is often based on the individual’s belief in the entrepreneur and the business idea.

Venture Capitalists: The decision-making process is often more complex and slower. They need to convince other members of the venture capital fund that your business is a good investment.

Venture Capital vs. Private Equity

Distinguishing between venture capital and private equity (PE) can be quite challenging, but it’s an essential aspect in securing the right funding for your business. Here, we’ll explain the main differences between these two types of investment.

Stage of Investment

Venture Capitalists: VCs typically invest in startups and young companies that are in the early stages of their operations. These businesses often have a high potential for growth but also carry a significant amount of risk due to their unproven nature.

Private Equity Firms : PE firms usually invest in mature companies that have a proven track record of stability and profitability. These companies are often in need of funds to facilitate growth, streamline operations, or for strategic acquisitions.

Investment Size

Venture Capitalists: VC investments can range widely, but they are generally smaller than PE investments. They often range from a few hundred thousand to several million dollars.

Private Equity Firms : PE investments are usually much larger, often in the hundreds of millions or even billions of dollars. This reflects the larger scale and established nature of the companies they invest in.

Exit Strategy

Venture Capitalists: VCs typically look for a return on their investment through an exit strategy such as an initial public offering (IPO) or a sale to another company.

Private Equity Firms : PE firms also aim for a return on investment through an exit strategy. This can include selling the company to another firm, a management buyout, or taking the company public through an IPO.

Is Venture Capital Right for You?

Venture capital can be a powerful tool to help grow your startup. However, it’s important to evaluate if this type of funding is the right fit for you and your company. Here are some key factors to consider:

Understanding Your Market

Before seeking VC funding, ensure you have a thorough understanding of your market. This includes knowing the addressable market (everyone who might find your product useful) and the obtainable market (the customers you can realistically reach). This knowledge demonstrates to potential investors that you have a clear vision for your business’s potential growth.

Pitch Deck & Product-Market Fit

Your pitch deck should effectively communicate your business idea, the problem it solves, and why your solution is unique. It should also show evidence of product-market fit , meaning there’s a demand in the market for your product or service.

All of these elements should be woven together into a coherent, compelling, and cohesive story . This story should not only communicate your business idea and plans but also ignite passion in potential investors.

Technical Expertise

Having a technical founder or a key team member with a deep understanding of your product or service’s technical aspects can be a significant advantage. This expertise not only reassures investors about your team’s capabilities but also that you can overcome technical challenges that may arise in the future.

Use of Funds

Investors want to know specifically how you’ll use their capital. Be prepared to provide a detailed breakdown of how the funds will be allocated. This could include areas like product development, marketing, hiring, and more.

Before you seek venture capital, ensure that your startup meets these criteria. VC funding involves giving up a degree of control and equity in your company, so it’s important to consider whether this is the best path for you. Remember, venture capital is just one of many funding options, and it’s crucial to explore all your options before making a decision. Always seek expert advice if you’re unsure.

Explore More VC Resources

- Best Venture Capital Books

- How to Invest in Venture Capital

- Startup Investing Platforms

- Venture Capital Terms You Should Know

- Raising Venture Capital 101 with Jules Miller of Mindset Ventures

- Strategic Growth & The Danger of Vanity Metrics with Kyle York of York IE

- Tips for Navigating Economic Downturn From Venture Capitalist Andrew Gershfeld

- Anyone Can Be a Venture Capitalist with Sweater Ventures

Further Reading

- 24 Top Venture Capital Firms (2024) July 10, 2024

- How to Get Venture Capital Funding for a Startup July 2, 2024

- Angel Investors Vs. Venture Capitalists: What Is the Difference? July 2, 2024

Topics to Explore

- Startup Ideas

- Startup Basics

- Startup Leadership

- Startup Marketing

- Startup Funding

Browse Tags

The 5 Steps a VC Takes to Value Your Business – And the 3 Things You Can Do About It

Today, we’ll discuss how VCs think about valuing your round, and how you should think about it. We’ll admit that everyone thinks venture valuations are black magic and arbitrary. But there’s actually some science behind it. The methodology below is a grounded way that VCs arrive at valuations – for example, in this blog post , Fred Wilson is using the methodology we discuss below.

In practice, the later-stage the investment, the more grounded the valuation becomes. So while this may not always be used at the seed stage, by Series B and later the below almost always drives the starting point for setting your company’s valuation.

The Five Steps a VC takes to value your business:

1.Estimate exit valuation range

VCs start with the end. They’ll triangulate your business model, your addressable market, and your buyer universe to identify a range of likely exit values for your business. For example, if you’re a vertically-oriented SaaS business, that might be two hundred million US. If you’re a next-gen ad tech company (with a larger market and more potential buyers), it might be a five hundred million.

Note that likely is the key word here – VCs know that the typical exit is in the low $100s of millions so it takes a pretty strong case to convince them a unicorn valuation is in the exit range

2. Build target ROI with safety margin

They work backward by an expected ROI. The average multiple for a “home run” VC exit (which drives a portfolio) is 16x . This is driven by the pareto rule in venture investing – because of the high failure rate of startups, the successes need to be home runs to drive portfolio returns.

But of course, VCs will actually need more than the 16x at the outset. This is for two reasons:

- First, the math here doesn’t account for dilution from future rounds. So earlier investors will demand a higher “expected ROI” than growth stage investors – probably at least double the ROI

- Second, VCs are wrong often and they know it, so they’ll build in a safety margin into their ROI to compensate for mistakes. They don’t know how many of their portfolio companies will be home runs, so they’ll actually shoot for a little higher than 16x to compensate for this.

So the big question is what ROI do VCs look for? There’s a lot of chest-thumping around “we need 100x!” but we feel it’s not actually that high. We think a good estimate is anywhere from 20x-40x (that’s exit cash divided by invested cash). This is actually a great question to talk about with your VCs, so you can tune this even more specifically with each potential investor. Some VCs might consider this controversial, but if you can’t have this discussion openly, you probably don’t want them as your investors.

3. Divide Exit Valuation by target ROI

If we take our exit ranges of $100m-$1bn, and divide by target ROIs of 20-40x, we end up with a rough startup valuation range of $2.5m to $50m.

That’s a pretty common range of valuations you see for venture stage startups. The range feels large, but bear in mind this is for startups from Seed to Series B. For brevity, we won’t do the math for each individual series here, but the calculations for Seed, Series A, etc individually all fall within their more specific ranges.

4. Sense-check strongly against rule-of-thumb values

After all of this precise, results-driven math, the dirty secret of venture capital is that everyone still triangulates against market values.

The good news is those ranges are wide – Christoph Janz ballparks US SaaS businesses at $2-6m for seed, $10-40m for Series A, and $30-$200m for Series B in 2017. So all of the work we’ve done so far isn’t a write-off, but the market will definitely encourage a VC to nudge the valuation in either direction.

One example to determine that nudge is revenues – a seed/A/B startup should be in the $500k/$2m/$10m revenue range, respectively. And if you fall above/below that for your stage, expect to be on the high/low side of your above range, respectively.

5. Check if this is too much/too little money for the business plan

VCs generally look for about 20% per round , so divide your valuation by four to figure out how much is the ticket size (glossary: ticket size = how much their investment amount is).

This again gets a nudge and is a big driver of what pushes valuations around within their market ranges. The key here is that (honestly, for reasons unknown) the 20% is fairly constant. So if there’s a strong case for you to raise a larger round, then you’ll get both more cash AND a high valuation. Great!

For example: if you’re a Series A company, the valuation ranges start to widen – in Christoph’s chart, from $10-$40m. What’s the difference between $10m and $40m valuation? The $40m business here would have strong proof that they’re ready to productively scale up their sales force (such as proven CAC:CLTV at scale, numerous large enterprise customers, etc). This will drive a larger ticket size (roughly $10m). So they would ideally show that they can invest $10m in scaling the business NOW and achieve solid ROI.

What you can do about it

So this is all thrilling, but what does it mean for someone who’s negotiating their next round? Learn which parts of this you can influence and which you can’t.

1. Show you can spend it: Bring data

Checking the ticket size is the last step for a reason – it has the highest power to swing both valuation and ticket size.

How can you show that you’re ready for the big ticket? Bring data. Bring historical performance against conventional metrics that shows a strong growth ROI.

And most importantly (this is the part everyone misses) – bring data that shows scalability! There are many pitches where the entrepreneurs played with Facebook ads for a few hours and failed to account for the fact that their 300,000th user will be much more expensive than their 3000th.

2. Don’t sell your company, sell your exit

Likewise, the exit size is the first step for a reason. This will anchor your entire valuation discussion, which is why showing exit potential is the best way to demonstrate value.

Too many entrepreneurs go in and pitch how cool their product is instead of painting a rich narrative ending in the exit. Who will buy you? For how much? Why? Why won’t they build it themselves ?

3. Understand your investor’s ROI expectations

This is a good idea for aligning interests generally. But make sure to ask your own questions in the pitch sessions – especially around the investor’s return appetites for various investments. If you know an investor is used to making higher-risk investments, you might get a premium for the round (and vice versa).

This legwork expands to more than just the meetings – do some desk work and figure out if an investor has already had a big hit in their current fund this could influence their risk appetites (and your ROI safety margin).

Hopefully this provides some context for your improving your next fundraise – but ultimately, don’t fall into the high valuation trap.

It happens often: a founder sees round sizes increasing, and their friend at that hot AI business just raised at $45m pre and they don’t even have any revenues! Don’t let those outliers fool you – you can see from this process that there’s a huge variety of situations that lead to different valuations.

And remember that pushing for a higher valuation takes work. You might achieve it, and you might not – but be prepared to spend months chasing it down when you could be building your business. Furthermore, overvaluing your company makes it hard to raise the next round or exit – it’s called the Valuation Trap and it’s really, really real. So weigh the cost of pushing hard for a better valuation against the value you’ll gain by growing the pie instead. This is true not only for late stage companies, that can box themselves into an “IPO or bust” situation, but even getting from Seed to A to B. If you are over-valued and can’t hit your milestones, you can face a easily face a serious downround, especially if the market turns and all the rules change, which can have a major negative impact on founder and employee holdings in the company.

For more information contact us at [email protected] . Disclaimer: These general perspectives are not legal advice. If you’re negotiating a round, get a lawyer.

A Guide to Venture Capital for Startups

Table of Contents

Introduction.

- What is Venture Capital

- Early Stage

- The Process

- Pros of Venture Capital for Startups

- Cons of Venture Capital for Startups

Every year, entrepreneurs create 50 million startups . But despite the millions of startup companies that exist in the world, only about 10% make it past their first year, and 90% of startups ultimately fail. One of the most common problems for startups? Cash flow.

As much as 82% of businesses that fail do so because of cash flow issues. Maybe they burn through funding too quickly, or they may fail to secure enough funding in the first place.

Venture capitalists know the risks of investing in businesses. But with the chance to help fund a unicorn —a private startup valued at over $1 billion—venture capitalists are more willing to take a chance on startups, even if they don’t have any other funding or assets in the early stages of the company.

What is Venture Capital?

Venture capital, sometimes abbreviated as VC, is a form of startup financing and a type of private equity that allows a startup business to offer a large share of their company to an investor or a few investors in exchange for funding or other benefits, like mentorship or talent.

Venture capital can come with high risks and high rewards for both investors and startups. Startups can secure funding through venture capital without needing to make monthly repayments, but they may need to give up some control over the creativity and management of the company. For investors, there’s a huge risk that the startup will fail, but there’s also an opportunity to make money if the startup takes off.

Types of Venture Capital

There are three main types of venture capital that a startup may pursue, depending on how new the business is. For instance, brand new startups that are still finalizing their ideas may pursue pre-seed funding , while businesses that are ready to start selling their product or service may seek out seed funding . Startups that have already had some success in their sales and are ready to expand production may try to secure early-stage funding .

Pre-Seed Funding

Brand new startups may seek VC through pre-seed funding. In this round of funding, a startup is beginning to form its business by creating a business plan and developing its first products or services to sell.

Although pre-seed funding typically involves a startup earning funding through bootstrapping or getting investments from family and friends, promising startups may gain attention from venture capitalists willing to take a risk on a disruptive idea.

Seed Funding

At the seed stage, a startup has a product or service that is ready to hit the market, but they need capital to start running the business until they make enough sales to turn a profit. This can be a great point for startups to seek out venture capital to fund the business without the stress of a repayment deadline, should sales not hit their goals.

Early-Stage Funding

Early-stage funding often involves rounds of funding that allow businesses to access more capital as they grow. Businesses that started selling a product or service and have had a lot of interest may seek out venture capital in early-stage funding to expand their operations and increase sales.

At this stage, a startup exhibits measurable growth, making it even more attractive for venture capitalists to invest.

The Process of Getting Venture Capital

The startup funding process for securing venture capital can be lengthy because venture capitalists are typically looking for a long-term partnership. They need time to thoroughly vet the startup and determine whether or not to invest. Securing VC funding typically takes about 3 to 9 months from initial contact to funding, although the time-frame will vary case by case. Then, it will be several years from when the firm or investor starts providing funding to when they exit.

Initial Contact and Meeting

Either the startup or the venture capital firm will initiate contact to express interest in funding. There are several ways a startup can reach out to a venture capital firm or investor, such as:

- Sending a cold email

- Connecting at an industry event

- Getting an introduction from someone in your network

After connecting, the parties will set up a meeting to discuss the startup and potential funding.

Share the Business Plan

If the venture capital firm is interested in the startup after the first meeting, they’ll want to see your pitch deck and business plan before you can move on to negotiating and signing a deal. The business plan should be thorough, spelling out the idea, the competition, the overall market, the target audience, how the business will operate, goals for the long-term, and how much funding the startup needs.

Due Diligence

The venture capital firm or investor will do due diligence by investigating the business. The firm or investor will need to thoroughly analyze the company, from its business plan to its management and operations.

The startup should also perform due diligence. Venture capitalists will often own up to half of the company’s equity, so the startup founder should review the VC firm or investor, such as reviewing the success of past investments.

Negotiation and Investment

Now that both parties have expressed interest and have gone through due diligence, they can begin negotiating the agreement terms. The negotiation will focus on how much funding the venture capitalist will invest and how much equity the startup will offer in exchange for the investor.

With the agreement signed, the venture capitalist will provide funding as outlined by the terms in the contract. This may involve providing all funding upfront, or the firm or investor may offer one amount upfront and additional funding as the company moves through series funding rounds. Typically, VC funding terms span 10 or more years , according to the U.S. Securities and Exchange Commission (SEC).

Unlike a bank or lender, a venture capitalist will have some ownership through equity in the company. That means they may be more involved in the operations, even joining the startup’s board of directors or advisory team.

The venture capital firm or investor may help with technical operations, management, or hiring new employees. The venture capitalist can also connect startups to other investors, talent, or customers.

Eventually, the venture capitalist will enact its exit strategy , or way of leaving the company by selling their shares. Typically, a venture capitalist will exit when they feel they have hit the maximum profit possible, or they may exit a startup that is on the down-trend in order to minimize the amount of money they are losing in the investment.

There are multiple exit strategies a venture capitalist might take, including:

- Initial public offering (IPO): The startup goes public, selling shares of the company to the public on the stock market. This is a popular exit strategy that is on the rise. In fact, 2021 was a record year with 1,035 IPOs in the U.S.

- Secondary sale: A venture capitalist may exit by selling their shares to another venture capitalist.

- Mergers and acquisitions (M&A): A merger is when two companies join to form one company, and an acquisition is when one company buys another. In acquisitions and some mergers, one company may buy the majority of shares in the startup, allowing the venture capitalist to exit.

- Buybacks: A successful startup may earn enough revenue and build up enough cash to buy out shares from investors.

Pros of Venture Capital

Venture capital for startups can be an accessible way to gain more than just funding but also to grow your network and gain mentorship, too. Some benefits of venture capital for new and growing businesses include:

Secure Funding Without Repayments

If a startup founder doesn’t feel comfortable making repayments to a bank or other lender by a set deadline, venture capital can be a more accessible path to funding. Venture capital provides funding in exchange for equity, so the repayment is in the form of part ownership of the company.

If the startup does fail, the founder doesn’t have to stress about repaying an institution. The venture capital assumes risk when they offer the investment, and they will have an exit strategy in place to sell their shares.

Tap Into Talent

In addition to funding, venture capitalists may also provide access to mentorship or other expertise. For startup founders who may not have all the skills needed to manage a business, bringing in a venture capitalist can help fill those gaps.

Venture capitalists may also assist in hiring new employees and can even offer connections to talent as the business looks to expand its team.

No Funds or Assets Needed

Although having a growing business that’s already making sales can help make your startup a less risky investment to venture capitalists, there are firms and investors willing to take on startups that are brand new.

In order to maintain the most control over the company, a startup should seek out other funding options first, but that’s not a requirement. Venture capitalists can offer a large amount of funding, and a startup doesn’t have to have funds or assets before seeking VC.

Cons of Venture Capital

Venture capital has a lot of potential benefits for new businesses. However, venture capital for startups can also come with challenges for founders—from high competition, to get funding in the first place, to losing majority ownership, to venture capitalists over time.

Give Equity

If a startup founder secures a loan or grant to start their business, they don’t have to give up equity, or ownership, in the company. But if they secure funding via venture capital, the VC investor or firm will typically take between 20% and 50% equity, making them a significant owner in the business.

Share Control Over the Company

By exchanging large shares of equity for large amounts of funding from a venture capital investor or firm, a startup is also giving up some of its control over the company. Venture capitalists can help strengthen the business by helping out with operations, but they may also influence the future of the company in a way that the startup founder(s) doesn’t always agree with.

VC negotiations typically offer 20% to 50% equity in a startup, already a significant portion of ownership in the business. But a Crunchbase analysis found that by the time a venture capitalist exits, ownership hits a median of 53%. Some of the companies in the study had much higher VC ownership numbers, such as Etsy (62%), TrueCar (82%), and Sabre (97%).

Difficult to Access

In some ways, venture capital makes it easier for startups to access funding, even if the business is more of an idea than an established company making sales. But there’s still a lot of planning and work that needs to happen before securing venture capital, and there can be a lot of competition to get attention from a firm or investor. In 2022, 5,044,748 new businesses were formed in the U.S. That same year, there were about 1,000 active VC firms in the country.

Startups not only need to have a solid business plan that shows how they are prepared to operate in the long-term, but the business idea needs to be innovative and the startup should have strong potential for growth to stand out from the thousands of other businesses competing for investments.

Is Venture Capital for Startups Right for Your Business?

Venture capital is one of several methods of funding a startup. The exchange of funding for private equity can be a great fit for startups expecting rapid growth, and it’s also a beneficial path for startups who don’t want to be stuck with monthly repayments on a loan. But venture capital for startups comes with its risks, too, including giving up some creative control to another firm or investor. Startup founders will need to weigh the benefits and risks and do their own due diligence when considering whether VC funding is the right path to jumpstarting their business.

More stories

10 Types of Startup Capital

The Killer Slide Every Pitch Deck Needs

What Is a Business Accelerator? Everything You Need To Know - HubSpot for Startups

More From Forbes

Vcs: how to get their interest and their capital.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

You've started your business. Now how do you get it funded?

Often, founders who need to raise funds for the first time will try to get a meeting with anyone and everyone that has invested in a business before. This includes angels, family friends, and of course, venture capital (“VC”) firms. While this shows a certain level of tenacity and commitment to your business, there is a more efficient way to go about fundraising. Not every outfit that invests is right for your business. Venture capital firms, in particular, vary in terms of their interests and stage of investing.

For example, VC firms tend to specialize in specific market verticals, such as healthcare IT, enterprise SaaS, fintech, and so on. If the startup doesn’t play in a category the firm focuses on, it’s unlikely to draw much interest. Likewise, if a VC firm tends to make only later-stage investments, such as in companies already generating $10 million in annual revenue or more, it probably won’t invest in early rounds where the company has yet to hit their revenue targets.

Without a thoughtful approach to finding a capital partner, founders are setting in motion a plan to not only waste time, but also reduce their chances of getting funded.

Ways To Identify Potential VC Partners

Founders should look at other startups in their market to determine which ones have recently received funding and from whom. They want to identify those VC firms that are making investments in companies that look the most like theirs in terms of industry, maturity, size, and even geography.

While there is certainly a web search component to this, talking with other startups in the founder’s ecosystem can also divulge more about a VC firm in terms of their management style, level of involvement with their portfolio companies, and success rates of their investments. This is yet another reason why it’s important to build a network with other founders and entrepreneurs going through similar stages of growth.

Russian Troops Captured One Of Ukraine’s Dutch Armored Vehicles, Rode It Back Into Battle—And Promptly Got Killed

Apple iphone 16 pro: new design echoed in latest leak, apple iphone 16 release date: new report hones in on precise date.

After a list of potential VC firms has been built, take the extra step to determine who in the firm is the investment lead within the vertical of interest and learn what you can about them—their personality, previous investments, and background.

How To Make The Connection

Once founders identify the VC firms they most want to meet with, the question becomes “how do I make a connection?”

“Warm intros,” the way most connections are made, are still the best way to get a VC’s attention. This means being personally introduced or referred by someone else who knows the firm. While such warm intros remain the most direct path, they are admittedly the outcome of founders who already have connections within the appropriate networks. There are many high-potential founders building great businesses across the country that do not yet have such an advantage.

For those founders, there are still other ways to capture VC attention. The simplest are to reach out via email or LinkedIn messaging, or to visit a firm’s website, which often has a page for applying to be considered for investment. (For example: see ours here. )

Conversely, good VC firms receive dozens, if not hundreds, of submissions like these each week. This is why finding ways to create buzz is also paramount, especially for early-stage companies. Presenting at investor conferences and pitch competitions are good methods for this, as the audience is made up of exactly who founders are trying to reach. Also, founders should explore working on their startup inside an accelerator or incubator (one example: ATDC at Georgia Tech ) as the mentoring, networking, and exposure can be highly beneficial. VCs often look to these aggregators for good companies when seeking investment opportunities.

What VC Firms Want

What VC firms look for in an investment varies by a company’s maturity. More mature businesses are expected to have things like product and go-to-market strategy nailed down, while earlier-stage businesses have a different set of expectations. For these companies, investors want to see real potential in their offering.

What is meant by real potential ? A company’s solution needs to uniquely address a significant problem that the market knows it has and wants to solve. I’ve written before about why simply having a good idea isn’t always enough . It’s surprising how many failed startups were born from a good idea but without a ready and willing market to support them.

It’s also important for even early-stage companies to have some initial market traction to confirm their solution is salable.

Finally, VC firms also assess the founder to ensure that he or she is someone they believe can scale a business and with whom they can work. While there are a number of intrinsic traits they look for, most of all they want someone with the ability to take charge of a team and who also possesses a willingness to learn from those around them. This is why founders should gravitate toward an investor that focuses where their business operates. With such experience at hand, the company’s industry knowledge is enhanced and established networks can be leveraged, increasing the likelihood of success for both the investor and the investment.

Be Prepared For The Conversation

After you get a meeting (congratulations, BTW), the best advice is to go in prepared. Founders should know their business’s KPIs and be ready to talk in-depth about their solution and market. It’s also acceptable to ask questions beforehand in order to have a better idea of what the VC wants to know and exactly who will attend the meeting.

At the same time, it’s okay to not have all the answers. This is where many founders get themselves into trouble. Be honest and admit when the extent of knowledge is limited. Too many founders try to “sell” their business to VC firms instead of giving an accurate picture of what is going well and what current obstacles the company faces.

That being said, any potential partnership is a two-way street. Remember that just as a VC firm is evaluating the startup, founders should also be assessing the VC firm. If you are fortunate enough to have more than one suitor, evaluate how well the firm can partner with you to help you grow your business, not just the terms of the term sheet.

- Editorial Standards

- Reprints & Permissions

How much and what to raise VC money for

You’re a SaaS founder and you’ve just raised startup funding or growth capital from a reputable VC. We tip our hats to you—that is no small feat in any times, and particularly in the lingering COVID environment.

As you discovered (or are about to, if you are embarking on a VC pursuit), raising venture capital takes a lot of time and attention. The equity funding process can take many months to complete (not particularly a form of founder-friendly SaaS financing when you’re building a team, working out your product rollout, and more). And with it, comes the issue of dilutive startup funding. UGH.

Venture capital for SaaS financing

VCs like the SaaS vertical for startup financing. SaaS companies offer long-term, predictable recurring revenue (who doesn’t love that?). They make decisions based on your business model, sales and marketing plan, and exit strategy.

On the SaaS founder side of the fundraising process, you make two important decisions:

- How much money to raise — i.e., how long of a runway will the raise support

- What to raise the money for — i.e., which investment areas will the raise support

Let’s unpack each of those in turn. We will leave the choice of your VC investor(s) aside — it’s easier to just work with hard numbers.

#1: How much venture capital should my SaaS company raise?

Typically, the decision of how much venture capital to raise is driven by your P&L /cash flow model and things you want to prove out—or hypotheses to test—by the time next fundraise comes around (e.g., series B if you just raised A). Here’s how a VC funding transaction may go, factoring in the “how much” and the “what for” elements.

- You present the VC with a plan full of ambitious milestones you need the money to achieve

- You build in a buffer of 25% to account for any unforeseen circumstances, thereby raising more than you need

- Let’s assume you are expecting an average burn of $500,000 per month, and you want a safe 13 months of runway. To achieve that, you raise $6.5M in A and gave away approximately 15% of the company

Let’s also assume:

- You have $5M in annual recurring revenue (ARR)

- 2/3 of your contracts are paid monthly or quarterly

- And you are waiting up to 12 months to see all cash flows associated with these contracts

What if I told you that instead of $6.5M, you could afford to raise only half the amount and keep about 8% of your company as a result? Sounds pretty good, right?

Closing the cash flow gap with alternative funding

As a SaaS founder, part of the reason for the first VC raise was to close the infamous cash gap Miguel wrote about in our previous blog post . This cash flow deficit resulted from cash lagging product investments and customer acquisition at your SaaSCo. Effectively, half of the dilution came about because of inability to recycle cash locked up in your business.

What’s the alternative funding source? Your recurring revenue. Your SaaS could be (gradually) unlocking up to $3M in cash from your monthly and quarterly paying customers. This amount could grow further to $5M+ assuming you keep on growing at a healthy rate.

Breaking it down: In practice, your VC investors give you $3M which means around seven months of runway. The other seven months of runway comes from unlocking cash tied up in your operations, while you keep 8% of the business. At Capchase, we enable SaaS founders to extend the runway by up to 50–60%. (And we hope you don’t have to fundraise from VCs again.)

#2: What to raise venture capital for?

You are working hard to grow your SaaS company into a large and successful business. You need growth capital funding; but selling equity to fund your business is the most expensive type of financing. Therefore, you should only use it to invest in true growth engines of your SaaSCo—your talented team that will turbocharge your business many times over in two areas:

- Product development – hire the best engineers and data scientists to enable construction of your rocket ship

- Customer acquisition & retention -- those brilliant AEs and marketers that spread the word about your incredible SaaS product

Does venture capital make sense to fund your entire operation?

Depending on the type of SaaS product you are selling, the payback can vary from a few months to several years when calculated on gross/contribution margin basis. This is before accounting for payment terms and the often-yawning gap between bookings and cash. Time for another funding solution.

Unfortunately, conventional thinking is to just go for that next VC raise. And many SaaS founders lack appropriate alternative funding options. Until now, this has meant that founders sold more of their equity to fund … working capital. (Can you see how this is not a founder-friendly option?)

There’s a better way to get additional startup funding or growth capital for your SaaSco.

Capchase: the non-dilutive funding option

With Capchase, you get to focus your VC dollars on the stuff that truly matters for your SaaS company’s success—developing amazing products and bringing them to market.

When it’s time for SaaS founders to raise more money, you may decide to go for round B or C and raise more venture capital. However, SaaS founders have an alternative to dilutive equity funding. With Capchase, you can support your raise with our non-dilutive SaaS funding solution.

Supporting your raise with Capchase

It takes some time for us to get to know your business and fully scale into a high addressable multiple of ARR. We advise founders to get in touch right after they raise equity, or even better, think of Capchase as complementary to their VC funding round. The sooner we start working with your SaaSCo, the faster we can scale and the better the cost of financing we can propose.

Don’t take our word for it; read our customer stories to learn how Capchase is helping SaaS founders fund their companies with non-dilutive financing. Come join our non-dilutive revolution.

Learn more about programmatic fund: Capchase.com/Grow

What are Your VC’s Return Expectations Depending on the Stage of Investment?

Scott Orn leverages his extensive venture capital experience from Lighthouse Capital and Hambrecht & Quist. With a track record of over 100 investments ranging from seed to Series A and beyond in startups, including notable deals with Angie’s List and Impossible Foods, Scott brings invaluable insights into financing strategies for emerging companies. His strategic role in scaling Kruze Consulting across major U.S. startup hubs underscores his expertise in guiding startups through complex financial landscapes.

It is incredibly important that startup founders know what their VCs are going for so that they can be aligned and make smart decisions.

Today, we’ll explore the question: what are your VC’s return expectations depending on the stage of investment? The TLDR; seed investors shoot for a 100x return; Series A investors need an investment to return 10x to 15x and later stage investors aim for 3x to 5x multiple of money. This translates into portfolio returns from 20% to 35% targeted IRRs.

Before we get into how these return expectations vary by stage, and how that impacts your startups’ valuation, let’s dig into an important part of how VCs construct their portfolios:

VC Returns - Understanding the Power Law

It is really important to think about venture capital in the sense that the power law is really at work in venture capital investing. They do big portfolios of startups and 20 to 100 investments in a given venture capital fund. So they know that two or three are going to power most of the returns of the entire portfolio because in the startup world the power law is, the big ones win big. Think about Uber, Facebook, Google. Those types of companies return their fund. The fund returns with 10X or 15X all because of, or mostly because of that one investment.

So that is the power law at work.

Now also remember, we are in a super hot market right now. I’m recording this in early 2021, and this is one of the hottest markets I’ve ever seen in my career. It’s reminding me of 1999; there’s IPOs every other day. There’s SPAC IPOs. There’s a lot of companies getting bought.

It is a great time to have been a venture capitalist and been investing five to 10 years ago. That portfolio of startups that you invested in as a VC are maturing at the perfect time.

Many of them are getting public and providing liquidity to both the VCs. Yet, more importantly, there are the limited partners, the funds, the endowments, the foundations, the high net worth people, the family offices that invested in the venture capital funds.

The cool thing about that is those groups tend to recycle that capital back into the venture capital ecosystem and commit to new funds. However, there are rough times and years where there are few to no IPOs. So, good times, like the current, have to feed everyone in the industry so that we can all survive the bad times. Just know we’re in a special moment right here.

UPDATE ON VC RETURN EXPECTATIONS IN APRIL 2024

Throughout 2023, the VC market declined significantly from the high investment levels of 2022. In addition, deal volume has dropped significantly, reaching its lowest level in a decade. Mega-rounds (financing rounds of $100 million or more) are lower than they’ve been since 2017. So startups are competing for financing in 2024, and VCs are spending more time to get to know founders and their plans . That carries over to due diligence , which is more thorough and detailed than during the 2022 investment cycle. Founders need to manage capital carefully, and focus on building profitable, resilient companies to attract investment.

When pitching, founders should emphasize their business fundamentals, including demonstrating solid gross margins and good customer acquisition costs, controlling burn rates, and managing tight resources. That’s going to put you in the best position to attract investors.

The good news is, the slower pace of investment also means there’s a lot of committed but unallocated capital (dry powder) available. And as everyone knows, when there’s a lot of supply, it puts downward pressure on prices – which, in this case, are the returns that VC investors are looking for. The nature of startup investment means that, with every fund, a few successes earn the returns the fund needs, but with a lot of capital in the ecosystem, VCs may be willing to accept lower return expectations for startups in their portfolios.

Ready to work with the best startup CPA?

Unlock your startup's potential with Kruze Consulting.

Contact Us for a Free Consultation

Minor Update on VC Return Expectations in May 2022

In 2022 - it’s no longer a hot market for VC funding! But does this mean that VC return expectations have changed?

Overall, no. VCs still hope to get the same overall portfolio returns that they were previously targeting. However, it can be a LOT harder for them to hit these returns given the market downturn. What we will likely see as a result of the market downturn is that VCs with dry powder to invest will slow their investment pace in the middle of 2022.

And so sometimes the return expectations also change depending on if you’re in a good time or bad time. OK, now that we have some background information, let’s dive into the question at hand, “what are your VC’s return expectations depending on the stage they invested in your startup?”

Venture Capital Return Expectations by Stage of Investment

Seed investors.

Seed investors typically have a lot of companies they invest in because it is so hard to pick the winner at the seed stage. They just have very, very low information. Oftentimes they’re investing in the people, the PowerPoint concept, and maybe an MVP, a minimum viable product or demo product, right?

So seed fund investors will do anywhere from 20 to 50 to 60 investments, depending on their fund size. They are targeting a 100X return pretty much for every company. They want every company to be 100X. However, the problem at seed is there’s a high failure rate relative to the other stages of venture capital.

Oftentimes it’s only two or three companies that are providing all the return and all the capital back to investors in the seed stage funds. Yet, when they are signing that check and sending you that wire, they are thinking about a 100X return. Can this be a 100X company? If they’re investing at a $5 million valuation or $10 million valuations, can this be a billion or multi-billion dollar company?

They also have to factor in all the dilution they and the company will take over the years as it goes through different funding rounds. So 100X rule of thumb for seed. They know they’re not going to get it on all the deals or even most of the deals. They know they’re going to get it on hopefully one, two, or three of the deals in their portfolio.

Series A Investors

Series A investors are writing bigger checks especially than they used to. They have a little bit more information. A lot of times, Series A investors are investing on more than a concept and can either see a million dollars or $2 million of revenue. They’re usually investing in an actual product at work.

Also worth noting, in life sciences , maybe there’s more clinical data or there’s an FDA approval or something like that but they are investing in bigger dollar amounts in startups than the seed stage fund. Whereas, the seed-stage fund might invest anywhere from $500K to $3 million in a specific company, Series A investors are investing five, 10, $15 million, even $20 million sometimes these days because again everything’s hot. They are looking for something like a 10 to 15X on their investments.

They know just like the seed investors that they’re not going to get it on all the deals but they are expecting to have a significantly lower loss rate than the seed funds. Because again, they just have more information.

Late-Stage Investors

Now late-stage investors typically target something like a 3 to 5X return. Although, the catch is that they’re very close to the M&A exit and IPO in the whole timeline. As a seed investor, it’s probably going to take five to 10 years series A. Maybe it’s three to eight years for your company to do an IPO or get bought. For institutional late-stage investors it’s one to three years. When they start getting a 3 to 5X return in that very short timeframe, their IRR and internal rate of return looks good.

Also, they have even more information than the series A, series B investors. So they should have an even lower loss rate.

Now the catch for them is that they’re investing much bigger dollar amounts. A late-stage round can be a hundred million, 200 million or even bigger. So when they take a loss, it is very, very painful for them; but they are investing out of bigger funds and they will still be diversified.

So just know that the late-stage round you’re raising right now, everyone’s doing the back of the envelope math and wondering, can this company do a 3X to 5X in the next 18 months and get public?

If that company can, it is a fantastic investment for late-stage investors and they will be all over you and you’ll have a lot of term sheets.

VC Returns are Based on the Portfolio’s Performance

Remember, VCs are judged by their investors on the overall fund portfolio performance. That means that any individual company in the VC’s portfolio can fail, yet the fund can be a high-performing fund if enough other startups produce returns.

So I hope this helps you know what your venture capitalists are expecting out of your company and the return horizons. If you are looking to, or are in the process of raising venture capital, and have any questions or need help, please feel free to reach out. You may also like our list of the top VC pitch decks . Our clients have raised over $10 billion in venture and seed financing, and our team knows how to navigate the VC diligence process.

Get the information you need

Startup CEO Salary Calculator

US Based Companies that have raised under $125M

Top Articles

Pre-Seed Funding + Top 20 Funds