Financial modeling spreadsheets and templates in Excel & Google Sheets

- Your cart is empty.

Exploring Break Even Analysis Business Plan: Strategies for Success

Break-even analysis is pivotal in a business plan to ensure financial viability. It outlines the point at which costs and revenue equalize, signaling no net loss or gain.

Developing a business plan requires a solid understanding of when the investment will start paying off. Break-even analysis emerges as a critical tool in this scenario, assisting entrepreneurs and managers in strategic planning and decision-making. This mathematical approach determines the necessary sales volume at a set price point to cover all costs, signifying the threshold of profitability.

By incorporating break-even analysis, businesses can set realistic financial targets, prepare for future investments, and manage cash flow more effectively. It serves as a vital compass for startups and established firms alike, enabling them to map out their financial journey with clarity and precision. Effectively leveraging this tool can mean the difference between a business flourishing or floundering, thus it constitutes a linchpin in any robust business plan.

Introduction To Break Even Analysis In Business Planning

Imagine starting a journey without knowing your destination. That’s business without break even analysis. It’s a map for your venture, showing when costs meet revenue. By knowing this point, you can make smart choices. Let’s explore this crucial tool in the business toolkit.

Defining Break Even Analysis: What It Is And Why It’s Important

Break even analysis is a simple way to understand your business finances. It answers a key question: “How much must I sell to cover my costs?” Knowing this helps avoid losses and plan for profit. It’s like knowing how much fuel you need for a trip.

The Role Of Break Even Analysis In Strategic Business Planning

Strategy means planning ahead. Break even analysis guides your strategy. It shows the sales needed to pay the bills. With this info, you set goals. You price better. You control cost. It’s your business compass, pointing to financial safety.

Understanding Costs: Fixed Vs. Variable Costs And Their Impact On Break Even

Costs in business are like ingredients in a recipe. Some are fixed costs , like rent, stable over time. Others are variable costs , changing with production, like materials. Knowing these helps find your break even point. It’s like balancing ingredients for the perfect dish.

| Cost Type | Description | Impact on Break Even |

|---|---|---|

| Unchanged with sales volume | Set the baseline for break even | |

| Change with sales volume | Alter break even as sales vary |

Step-by-step Process Of Conducting A Break Even Analysis

Knowing when your business will start making a profit is vital. Break even analysis helps achieve that. It’s a simple yet powerful tool. Let’s walk through the steps one by one.

Identifying Costs: Distinguishing Between Fixed and Variable

Identifying Costs: Distinguishing Between Fixed And Variable

First, understand your costs . Costs come in two types: fixed and variable.

- Fixed costs stay the same. Think rent and salaries.

- Variable costs change. They depend on how much you sell.

Calculating the Break Even Point: Formulas and Practical Examples

Calculating The Break Even Point: Formulas And Practical Examples

Next is finding your break even point. It’s where costs equal revenue. No profit, no loss.

Use this formula : Fixed Costs / (Price – Variable Costs per Unit).

| Fixed Costs | Price per Unit | Variable Cost per Unit | Break Even Point (Units) |

|---|---|---|---|

| $5,000 | $10 | $2 | 625 Units |

Analyzing Sales Volume: How to Determine the Necessary Levels for Profits

Analyzing Sales Volume: How To Determine The Necessary Levels For Profits

After the break even point, profits start. Aim for a sales volume higher than this point.

To find it , estimate how many products you need to sell. Make sure it’s more than the break even units.

Evaluating Pricing Strategies: Their Effect on Break Even Outcomes

Evaluating Pricing Strategies: Their Effect On Break Even Outcomes

Your pricing can change everything. It affects your break even point. Go for a price that covers costs and brings profit.

Think about : Cost-based pricing, value-based pricing, and competition pricing.

For each strategy, recalculate your break even point. Look for the best balance.

Utilizing Break Even Analysis To Drive Business Decisions

Utilizing Break Even Analysis to Drive Business Decisions is key for any business plan aiming for long-term success. This powerful tool helps owners understand when a company will be able to cover all its expenses and start making a profit. This insight guides strategic choices across various aspects of the business. Let’s explore how break even analysis can shape your business strategies.

Pricing Decisions: Using Break Even Analysis To Set Competitive Prices

Price is crucial in staying competitive. Break even analysis helps set prices that cover costs while remaining attractive to customers. It takes into account fixed and variable costs and the number of units you need to sell. By understanding this, you set prices that not only cover costs but also allow for a profit.

Cost Control: How Break Even Analysis Influences Cost Management

Keeping costs under control is vital. Break even analysis makes you spot high costs that need attention . It shows how lowering certain costs can reduce the break even point, allowing for an earlier return to profitability. This influences decisions about where to cut costs without reducing quality.

Profit Planning: Adopting A Break Even Perspective For Strategic Planning

Break even analysis is not just about covering costs. It’s about planning for profit . This view helps businesses set realistic sales goals and strategize on ways to exceed the break even point. This ensures a solid plan for generating profits after the initial goals are met.

Scenario Analysis: Assessing The Impact Of Market Changes Based On Break Even Points

Markets change, and businesses must adapt. Scenario analysis is about preparing for these changes. Using break even points, businesses can see how market shifts — like rising costs or falling prices — will affect them. This is key for making informed decisions ahead of time.

Challenges And Limitations Of Break Even Analysis

Break even analysis is a fundamental financial tool. It helps businesses determine when they will start making a profit. Yet, this analysis is not without its challenges. Critics often point out issues with its simplicity and assumptions. It is vital to recognize the challenges and limitations when incorporating it into your business plan.

Addressing The Oversimplification Critique In Break Even Analysis

Break even analysis can be deceptively simple. It assumes all units are sold. It also assumes prices and costs stay constant. Real-world scenarios are more complex. Costs can change. Sales volumes can fluctuate. It is crucial to add layers of detail to this model:

- Identify variable and fixed costs accurately.

- Assess the potential for cost changes and adjust the analysis accordingly.

- Review historical sales data to predict reasonable estimates for future sales volumes.

Managing Uncertainty And Variability In Cost And Price Assumptions

Uncertainty is a constant in business. Prices fluctuate. Market conditions vary. It can affect both costs and revenue. To manage this:

- Implement regular reviews of your break even analysis.

- Use multiple scenarios to understand different outcomes.

- Stay prepared with flexible strategies for unexpected changes.

Integrating Break Even Analysis With Other Financial Tools For Holistic Planning

Relying solely on break even analysis can be a pitfall. Other tools can give a more complete financial picture. For example, cash flow forecasts and ROI calculations offer additional insights. Combine them with your break even analysis. This approach ensures more robust and accurate financial planning .

| Financial Tool | Purpose | Integration with Break Even |

|---|---|---|

| Project future cash inflows and outflows | Identify when additional resources are needed | |

| Measure the profitability of investments | Quantify how investments impact break even |

Case Studies And Real-world Applications Of Break Even Analysis

Understanding how businesses achieve their financial targets is eye-opening. Break-even analysis illuminates this path. Through real-life cases, we see its role in planning and decision-making across diverse industries.

Small Business Success Stories: Break Even In Action

Small-scale ventures find break-even analysis vital. It’s a tool for survival and growth. Here’s how some enterprises made it work:

- A local bakery controlled ingredient costs to match sales.

- An indie bookstore used break-even points to manage inventory and staffing.

Adapting Break Even Analysis For Service-oriented Businesses

Service firms have intangible offerings. They adapt break-even analysis uniquely:

- Consulting firms consider hours as inventory and calculate service costs.

- Salons leverage the model to plan service pricing and promotions.

Break Even Analysis In Manufacturing: A Sector-specific Look

Manufacturing businesses use break-even analysis to streamline production. Efficiency is key. Success in this sector often means:

- Matching output with demand to avoid excess inventory.

- Investing in technology that reduces production costs.

Innovation And Break Even Analysis: Adapting The Model For New Business Ventures

New ventures push the envelope on traditional models. Innovative startups customize break-even analysis:

- They assess market readiness for novel products.

- They predict scale-up costs and revenue timelines accurately.

Strategies For Success: Optimizing Your Business Plan With Break Even Analysis

Break-even analysis is a key financial tool that helps businesses understand when they will start generating profit. It considers costs and revenues to determine the sales needed to cover expenses . This section explores strategies that make break-even analysis an invaluable component of a successful business plan.

Integrating Break Even Analysis Within The Business Planning Process

Integrating break-even analysis into your business plan requires a step-by-step approach:

- Identify fixed and variable costs that affect your business.

- Determine the average price of your products or services.

- Calculate the break-even point using these inputs.

- Make it a central component of your financial forecasts.

This integration supports strategic pricing, cost management, and informs sales targets.

Key Considerations For Accurate Break Even Calculations

Accuracy in break-even analysis hinges on several factors:

- Thoroughly evaluating all costs , including hidden ones.

- Understanding the industry and market trends to set realistic prices.

- Staying updated with economic changes that can impact costs or prices.

These considerations ensure your break-even analysis stays on point and reliable.

Using Break Even Analysis To Foster Communication And Alignment In Business Teams

Break-even analysis can be a communication tool . Share the findings with your team:

| Team | Benefit |

|---|---|

| Clear targets for revenue. | |

| Insight into budget and . | |

| Cost-benefit analysis for features. |

Use simple visuals and clear language to help each team understand its role in reaching the break-even point.

Continual Review And Adjustment: Ensuring Relevance Of The Break Even Analysis Over Time

To stay relevant, break-even analysis requires ongoing review and adjustment:

- Update the analysis with current data.

- Reflect changes in costs, pricing, and market conditions.

- Use it to assess the impact of new strategies or products.

By doing so, your business stays informed and can make proactive adjustments.

Frequently Asked Questions For Exploring Break Even Analysis Business Plan: Strategies For Success

How break-even analysis can be useful in business planning.

Break-even analysis helps businesses determine the sales volume needed to cover costs, ensuring informed pricing, budgeting, and financial planning decisions. It identifies profit thresholds, facilitating strategic planning and risk management .

What Is The Strategy Of Break-even Analysis?

The strategy of break-even analysis involves calculating the point at which revenue equals costs, indicating no net profit or loss. This financial assessment helps businesses determine necessary sales volume to avoid losses and plan for profitability.

Why Break-even Analysis Plays A Very Important Role In Success Of Any Business?

Break-even analysis is crucial as it helps businesses determine when they will cover costs and forecast profitability. It guides pricing strategies and informs decision-making for financial stability and growth.

What Is The Strategic Importance Of A Break-even Analysis?

A break-even analysis determines the sales volume required to cover costs, guiding pricing strategies and financial planning. It highlights profit margins and informs risk assessment, making it vital for business decision-making.

Mastering break-even analysis is crucial to your business plan’s success. Implementing these strategies can transform insights into profit. Remember, understanding costs and pricing is not just smart, it’s essential. Apply this knowledge, fine-tune your approach, and watch your business thrive.

Embrace the power of break-even analysis for a brighter financial future.

Leave a Reply Cancel reply

You must be logged in to post a comment.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

A Refresher on Internal Rate of Return

Understand this commonly used way to calculate ROI.

This article has been updated.

- Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast , and the author of two books: Getting Along: How to Work with Anyone (Even Difficult People) and the HBR Guide to Dealing with Conflict . She writes and speaks about workplace dynamics. Watch her TEDx talk on conflict and follow her on LinkedIn . amyegallo

Partner Center

How to Use IRR In Excel for Break-even Analysis

In today’s business landscape, making informed financial decisions is crucial for the success and growth of any organization. Break-even analysis is an essential tool that helps businesses determine the point at which their total revenue equals their total costs. This analysis enables business owners and managers to understand the minimum level of sales needed to cover expenses and make a profit. One powerful method for performing break-even analysis is by utilizing the Internal Rate of Return (IRR) formula in Excel. In this article, we will explore the basics of IRR in Excel and provide a step-by-step guide to performing break-even analysis using this effective tool.

Table of Contents

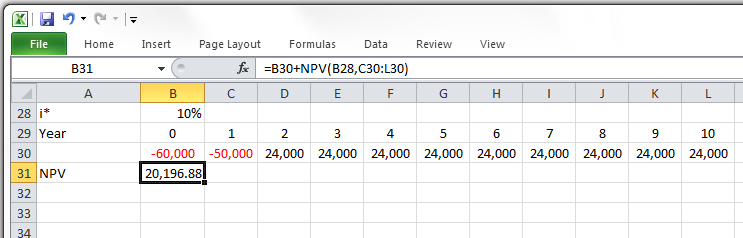

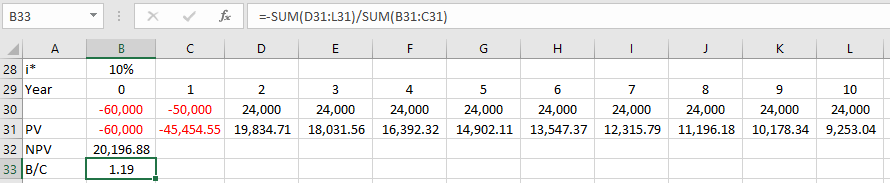

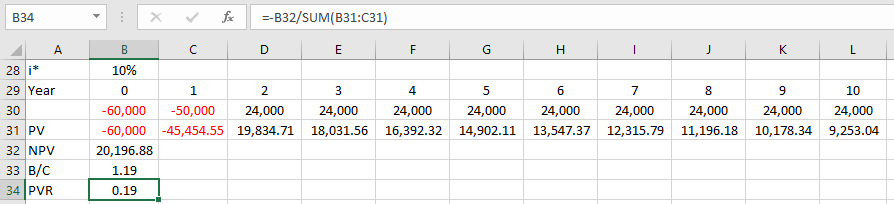

Understanding the Basics of IRR in Excel

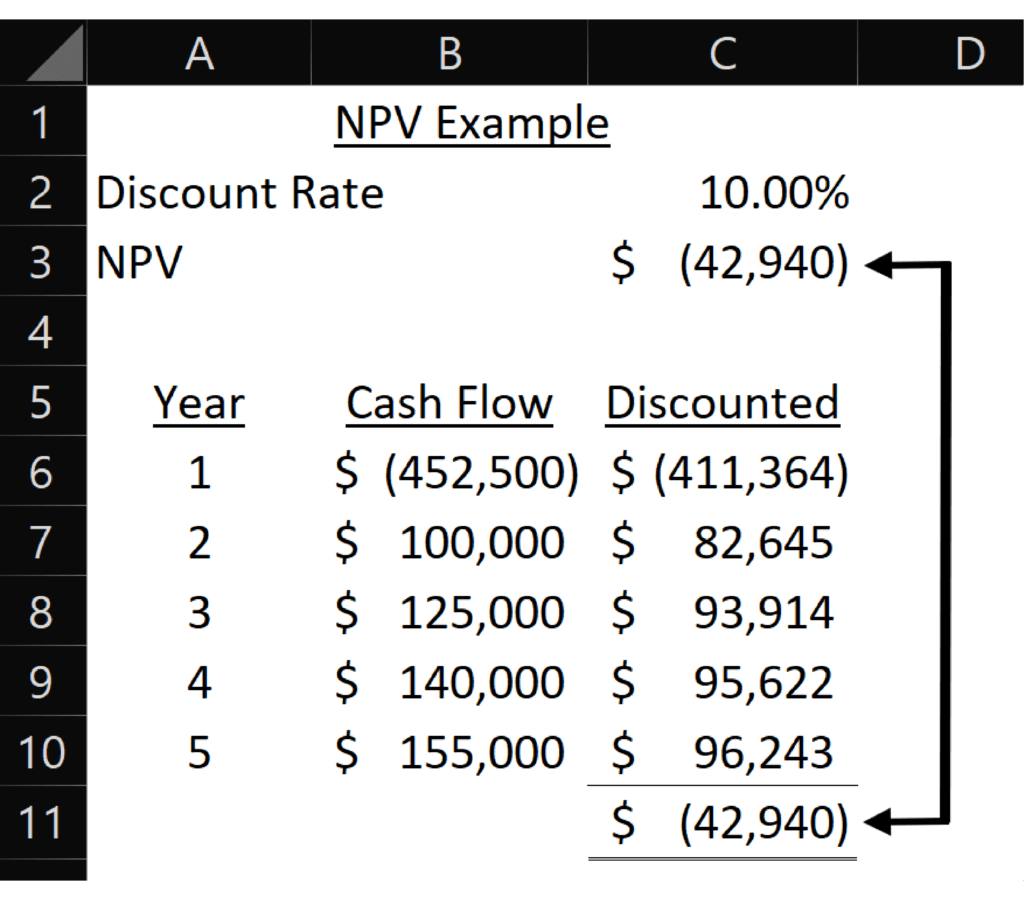

Before diving into break-even analysis, it’s crucial to have a solid understanding of what IRR is and how it works. The Internal Rate of Return is a financial metric used to determine the profitability of an investment or project. In simple terms, it is the rate at which the net present value of cash flows from an investment becomes zero. Excel offers built-in functions that make it easy to calculate IRR for a given set of cash flows.

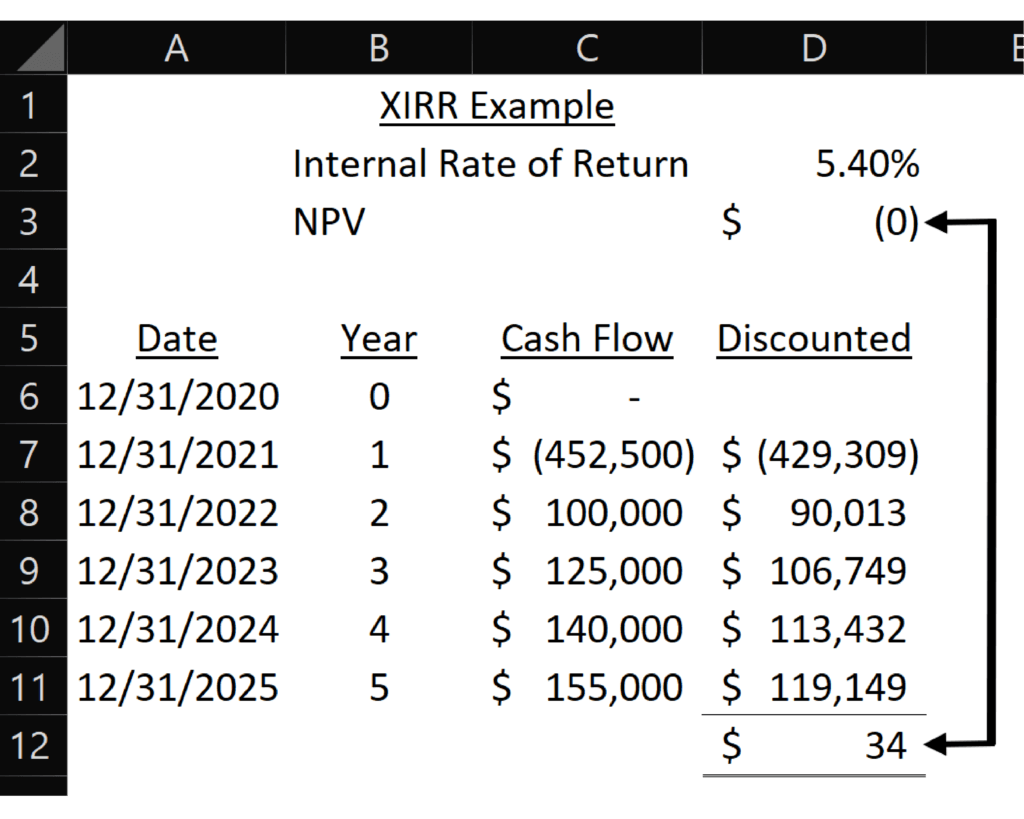

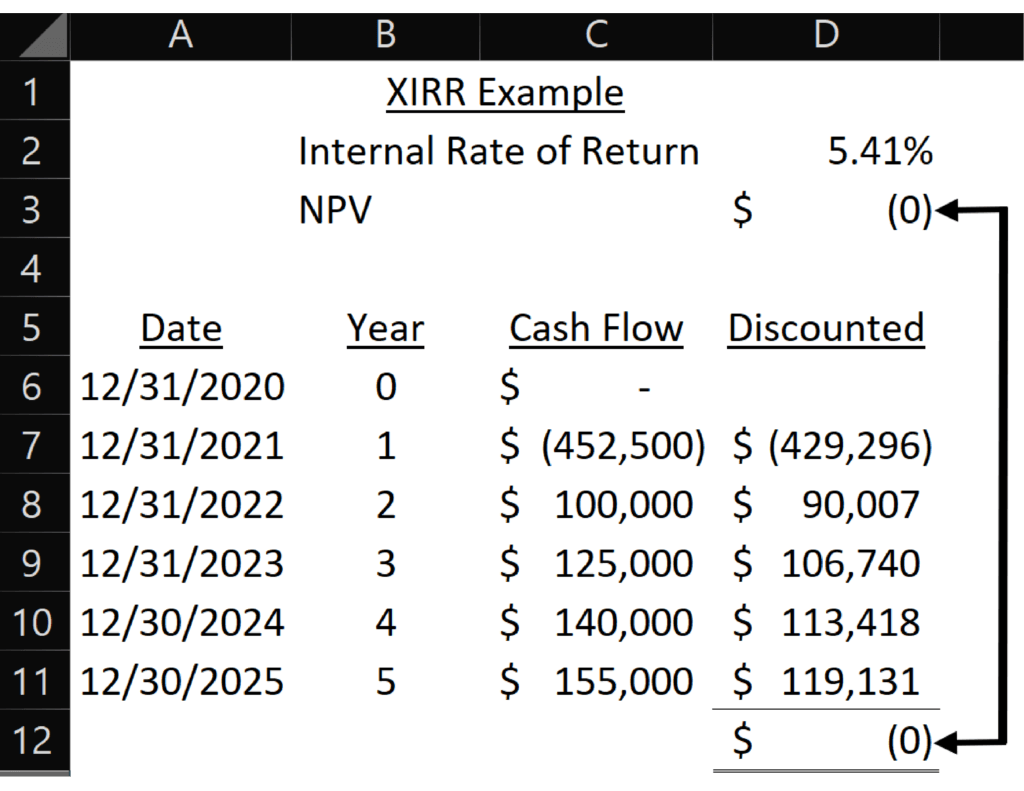

To calculate IRR in Excel, you need to enter the cash flows as a series of values in a spreadsheet. These cash flows can represent the revenue generated or costs incurred over a specific period. Excel then uses an iterative process to find the discount rate at which the net present value of the cash flows becomes zero. The calculated IRR can help businesses assess the potential profitability of a project or investment and make informed decisions.

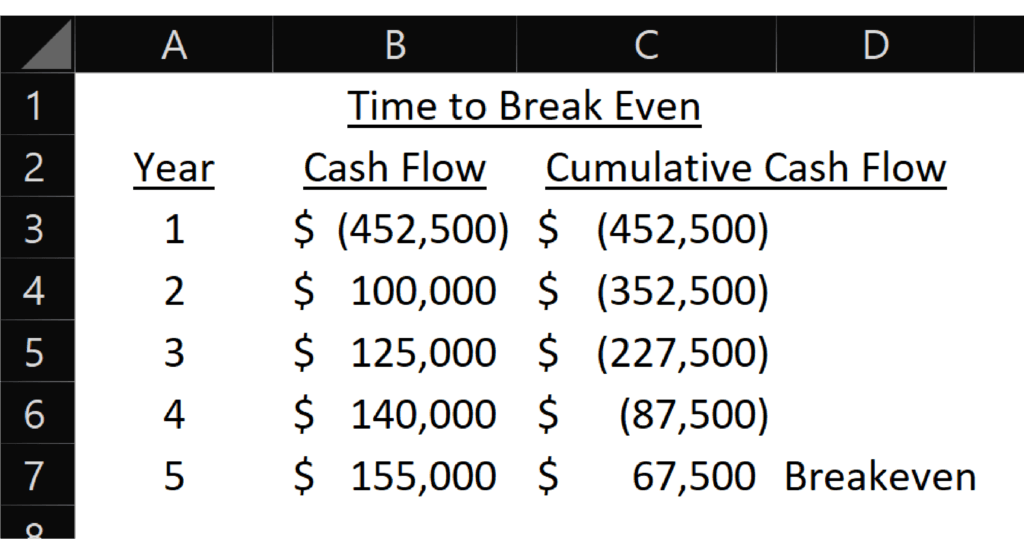

Step-by-Step Guide to Performing Break-even Analysis

Break-even analysis is a vital component of financial planning and decision-making. It enables businesses to determine the number of units or sales required to cover all costs and reach the break-even point. By using IRR in Excel, you can perform break-even analysis with ease. Let’s walk through the steps:

- Identify the fixed and variable costs: To perform break-even analysis, you need to distinguish between fixed costs and variable costs. Fixed costs are expenses that remain constant regardless of the level of production or sales, such as rent and salaries. Variable costs, on the other hand, fluctuate based on sales volume, such as raw material costs or direct labor expenses.

- Analyze revenue and cost structures: Once you have identified the fixed and variable costs, analyze your revenue and cost structures. Understand the price per unit and the variable cost per unit. This information will be vital in calculating the break-even point and assessing the profitability of your business.

- Calculate the break-even point: With the fixed costs, variable costs, and unit price in hand, you can now calculate the break-even point. The break-even point is the number of units you need to sell to cover all costs and achieve zero profit. It is calculated by dividing the fixed costs by the difference between the unit price and the variable cost per unit.

- Utilize IRR formula in Excel for break-even analysis: Now comes the exciting part. Utilize Excel’s built-in IRR formula to determine the internal rate of return for the investment or project. By inputting the cash flows, which represent revenues and costs over a specified period, Excel will calculate the IRR automatically. This IRR value can provide invaluable insights into the financial viability of your business.

- Interpret and analyze the IRR results: Finally, analyze the IRR results to make accurate financial decisions. If the calculated IRR is higher than the required rate of return, the project may be considered financially viable. On the other hand, if the calculated IRR falls short of the required rate of return, it may indicate a less profitable venture. IRR serves as a powerful tool in evaluating investment opportunities and optimizing break-even analysis.

By utilizing the steps outlined above, you can confidently perform break-even analysis using IRR in Excel. The comprehensive calculations and insights gained through this analysis will help you make informed financial decisions and set your business on the path to success.

Practical Examples of IRR Calculation in Excel for Break-even Analysis

Let’s delve deeper into practical examples to illustrate the calculation of IRR in Excel for break-even analysis. Suppose you are considering starting a new business venture – a bakery. You need to determine the break-even point and assess the profitability of the bakery. Here’s how you can utilize IRR in Excel for break-even analysis:

1. Identify the fixed and variable costs: In the case of the bakery, fixed costs may include rent, employee salaries, and utilities. Variable costs might include the cost of ingredients and packaging materials.

2. Analyze revenue and cost structures: Determine the price per unit of your bakery products and calculate the variable cost per unit. Let’s say your bakery sells cupcakes for $3 each, and the variable cost per cupcake is $1.50.

3. Calculate the break-even point: With the fixed costs and the difference between the unit price and variable cost per unit, you can calculate the break-even point. Suppose the monthly fixed costs are $5,000. The break-even point would be $5,000 divided by ($3 – $1.50), which equals 3,333 cupcakes.

4. Utilize Excel’s IRR formula: To assess the financial viability of your bakery, utilize Excel’s IRR formula. Enter the cash flows as positive and negative values representing revenues and costs over a specific period. Excel will automatically calculate the IRR. If the IRR is higher than your required rate of return, it indicates potential profitability.

Using IRR in Excel for break-even analysis empowers you to make data-driven decisions for your bakery. Detailed calculations and analysis can provide insight into the feasibility and potential success of your business venture.

Tips and Tricks to Optimize Break-even Analysis using IRR in Excel

While performing break-even analysis using IRR in Excel, there are a few tips and tricks that can help optimize the process and provide more accurate results:

- Regularly review and update your cost and revenue data: To ensure the accuracy of your break-even analysis, it’s crucial to regularly update your cost and revenue figures. As prices fluctuate and costs change, refreshing your data will provide more reliable insights.

- Consider different scenarios: Break-even analysis doesn’t always have a one-size-fits-all solution. Consider various scenarios, such as best-case and worst-case, to understand the potential range of outcomes. Utilize Excel’s sensitivity analysis tools to analyze different breakeven scenarios and understand their impact on profitability.

- Perform sensitivity analysis: Sensitivity analysis allows you to evaluate how changes in key variables, such as unit price or variable costs, can impact the break-even point and profitability. By performing sensitivity analysis, you can identify potential risks and uncertainties and plan accordingly.

- Use graphical representations: Visualizing your break-even analysis can make it easier to understand and communicate the results. Utilize Excel’s charting capabilities to create graphs and charts that showcase the relationship between sales volume, costs, and profitability. These visuals can provide a clearer picture of your business’s financial situation.

By following these tips and tricks, you can enhance the accuracy and reliability of your break-even analysis using IRR in Excel. These optimization techniques will enable you to make more informed financial decisions and drive the success of your business.

Common Mistakes to Avoid when Using IRR for Break-even Analysis in Excel

Performing break-even analysis using IRR in Excel can be a powerful tool in making informed financial decisions. However, there are common mistakes that people often encounter. By being aware of these mistakes and avoiding them, you can ensure the accuracy and effectiveness of your break-even analysis:

- Incorrectly identifying fixed and variable costs: It is crucial to accurately distinguish between fixed and variable costs to perform break-even analysis effectively. Misclassifying costs can lead to incorrect break-even calculations and potentially flawed financial decisions.

- Using incorrect formulas: Excel provides various functions for calculating IRR, such as the IRR function or the XIRR function for cash flows with irregular intervals. Using the wrong formula or applying them incorrectly can yield inaccurate IRR results. It is essential to understand the capabilities and limitations of each formula and use them appropriately.

- Ignoring external factors: Break-even analysis focuses on internal factors, such as costs and sales volume. However, external factors, such as market conditions or competitor behavior, can significantly impact break-even points. It is crucial to consider these external factors when interpreting and applying break-even analysis results.

- Overlooking ongoing cost adjustments: Costs are not static, and they often fluctuate over time. Failure to account for ongoing cost adjustments can lead to inaccurate break-even calculations and misinformed decision-making. Regularly update and review your cost data to ensure the reliability of your break-even analysis.

Avoiding these common mistakes will help you conduct break-even analysis using IRR in Excel more effectively. By ensuring accurate data inputs, utilizing the correct formulas, considering external factors, and continuously adjusting for ongoing costs, you can maximize the value of your break-even analysis and make more informed financial decisions.

Comparing Different Breakeven Scenarios Using IRR Sensitivity Analysis in Excel

Excel provides powerful tools for conducting sensitivity analysis, allowing you to compare different breakeven scenarios based on varying parameters. By utilizing these capabilities, you can gain valuable insights and make well-informed decisions. Let’s explore how to utilize IRR sensitivity analysis in Excel for comparing different breakeven scenarios:

1. Create multiple scenarios: Start by identifying the different parameters you want to evaluate. For instance, you could vary the unit price or the variable cost per unit to assess their impact on the breakeven point and profitability.

2. Utilize Excel’s data tables: Excel’s data tables enable you to input different values for the selected parameters and observe the resulting IRR calculations. By creating a data table that changes the parameters, you can compare and analyze the IRR results effectively. Excel will automatically calculate the IRR for each combination of values and present them in a clear and comprehensive format.

3. Interpret the results: Once you have generated the IRR sensitivity analysis data table, it’s time to interpret the results. Compare the IRR values under different scenarios to understand how changes in parameters impact the profitability of your business. This analysis can help you identify the most favorable breakeven scenario and optimize your financial decision-making.

Performing IRR sensitivity analysis in Excel enables you to explore various breakeven scenarios with ease. It provides a comprehensive overview of the financial implications of different parameter values and empowers you to make data-driven decisions accordingly.

Understanding the Relationship Between IRR and Breakeven Point in Excel

The relationship between IRR and the breakeven point in Excel is significant and provides valuable insights into the financial viability of a project or investment. The breakeven point represents the level of sales or production at which costs are covered, and the IRR measures the profitability of an investment by examining the rate of return at which the net present value of cash flows becomes zero.

When running break-even analysis using IRR in Excel, it’s essential to consider the breakeven point alongside the calculated IRR. If the IRR surpasses the required rate of return, it suggests that the project will generate a profit and is financially viable. On the other hand, if the IRR falls short of the required rate of return, it implies that the project may not achieve profitability.

The relationship between IRR and the breakeven point can be summarized as follows: a higher IRR indicates a greater potential for profitability and suggests that the project has a higher likelihood of reaching the breakeven point sooner.

To optimize financial decision-making, it is crucial to strike a balance between the breakeven point and the calculated IRR in Excel. Aiming for a higher IRR while keeping the breakeven point within an achievable range allows businesses to ensure profitability and sustainable growth.

Exploring Advanced Techniques for Break-even Analysis using IRR in Excel

Excel offers a range of advanced techniques that can further enhance break-even analysis using IRR. These techniques provide deeper insights into the financial viability of projects and enable businesses to make more informed decisions. Let’s explore some advanced techniques for break-even analysis using IRR in Excel:

- Monte Carlo simulation: Monte Carlo simulation is a powerful technique that allows you to assess the impact of uncertainty in key variables on the breakeven point and IRR. By simulating different scenarios with varying inputs, you can understand the range of possible outcomes and plan for potential risks.

- Scenario analysis: Scenario analysis involves evaluating several different scenarios and assessing their impact on the breakeven point and IRR. By varying input parameters, such as sales volume or costs, you can evaluate the potential outcomes and make data-driven decisions accordingly.

- Optimization models: Advanced optimization models in Excel can help identify the optimal sales volume or pricing strategy to maximize profits and achieve the desired IRR. These models utilize sophisticated algorithms to find the most profitable combination of variables, allowing businesses to make effective financial decisions.

By incorporating these advanced techniques into break-even analysis, businesses can gain a deeper understanding of the financial implications of different scenarios. This enables more accurate decision-making and enhances the chances of achieving desired profitability and growth.

In conclusion, understanding and utilizing IRR in Excel for break-even analysis can empower businesses to make informed financial decisions. By following the steps outlined in this article, businesses can perform break-even analysis with ease and gain valuable insights into their financial viability. By considering practical examples, tips and tricks, and common mistakes to avoid, businesses can optimize their break-even analysis and enhance the accuracy of their results. Exploring advanced techniques and understanding the relationship between IRR and the breakeven point further enhances the value of break-even analysis in Excel. Armed with this knowledge, businesses can confidently navigate financial decision-making and set themselves on the path to success.

By humans, for humans - Best rated articles:

Excel report templates: build better reports faster, top 9 power bi dashboard examples, excel waterfall charts: how to create one that doesn't suck, beyond ai - discover our handpicked bi resources.

Explore Zebra BI's expert-selected resources combining technology and insight for practical, in-depth BI strategies.

We’ve been experimenting with AI-generated content, and sometimes it gets carried away. Give us a feedback and help us learn and improve! 🤍

Note: This is an experimental AI-generated article. Your help is welcome. Share your feedback with us and help us improve.

From Idea to Foundation

Master the Essentials: Laying the Groundwork for Lasting Business Success.

Funding and Approval Toolkit

Shape the future of your business, business moves fast. stay informed..

Discover the Best Tools for Business Plans

Learn from the business planning experts, resources to help you get ahead, internal rate of return (irr), table of contents.

The Internal Rate of Return (IRR) is a financial metric used to estimate the profitability of potential investments. It represents the annualized effective compounded return rate that makes the net present value (NPV) of all cash flows (both positive and negative) from a particular investment equal to zero.

Key Takeaways

- IRR offers a way to estimate the growth potential of an investment, helping entrepreneurs assess the attractiveness of business ventures to investors.

- A higher IRR indicates a more desirable investment opportunity, making it crucial for startups seeking funding.

- Understanding the relationship between IRR, NPV, and cash flows can guide better financial planning and investment decision-making.

- Entrepreneurs should be aware of IRR’s limitations, including its inappropriateness for comparing projects of different scales or durations.

- Combining IRR with other financial metrics provides a more comprehensive view of an investment’s potential.

Introduction

Internal rate of return (IRR) is a critical financial metric that entrepreneurs must understand to effectively navigate the complex world of startup investments. This guide aims to demystify IRR, highlighting its importance, application, and how to leverage it for making informed business decisions. For pre-startup and pre-revenue entrepreneurs, mastering IRR before drafting business plans or financial projections is imperative, as it can be a game-changer in attracting investments and forecasting the potential success of a business venture.

Understanding IRR in Depth

The significance of irr.

At its core, IRR helps entrepreneurs and investors gauge the efficiency of an investment by comparing its potential return against other investment opportunities. It serves as a vital indicator of a project’s viability and attractiveness, often determining the flow of investor funds into a startup. A higher IRR suggests a more desirable investment opportunity, making it a crucial factor for startups seeking funding.

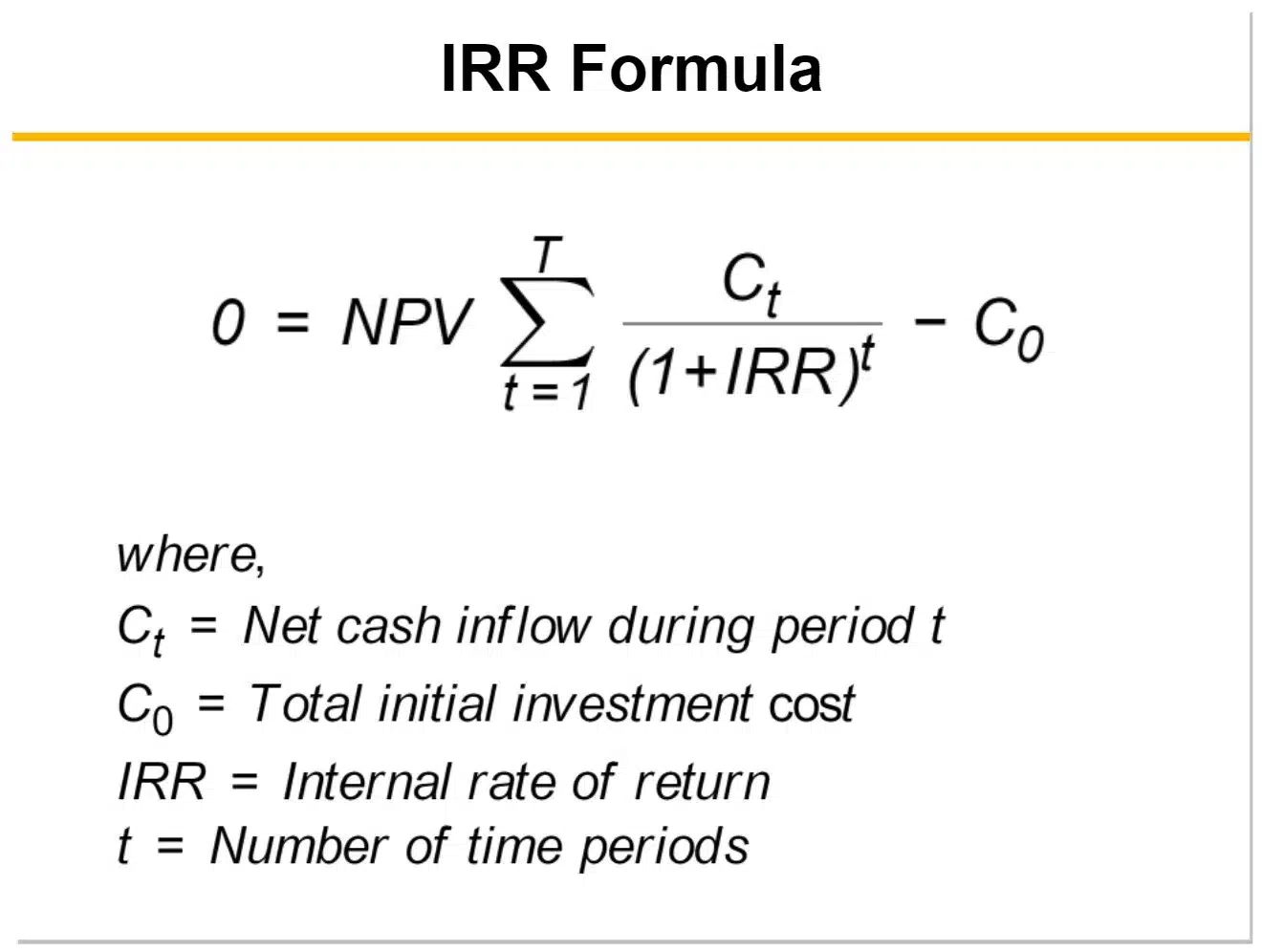

Calculating IRR

The goal of the IRR calculation is to find the discount rate that makes the net present value (NPV) of an investment equal to zero.

In other words, IRR is the rate at which the present value of an investment’s future cash inflows equals the initial cash outflow. This rate helps investors determine the potential profitability of an investment.

To calculate IRR, you need to consider the investment’s initial cost and estimate its future cash flows. Traditionally, this would involve trial and error using the IRR formula. However, with spreadsheet software like Microsoft Excel or Google Sheets, you can now input the initial investment and projected cash flows, and the software will calculate the IRR for you.

Calculating IRR in Excel

Step 1: prepare your data.

In an Excel spreadsheet, set up a single column for your cash flows. Begin with the initial investment at time zero, noted as a negative value to represent an outflow. Follow this with subsequent cash inflows (returns), which should be positive values. There’s no need to create a separate column for time periods, as the IRR function assumes cash flows occur at regular, annual intervals.

Step 2: Use the IRR Function

To calculate IRR, click on an empty cell where you want the result to be displayed. Type =IRR( to initiate the function, then select the range of cells containing your cash flow values, starting from the initial investment. Ensure you do not include any cells that contain time periods, as they are not needed for this calculation. Close the parentheses and press Enter. For instance, if your cash flows are listed from cells B1 to B6, enter =IRR(B1:B6).

Step 3: Interpret the Result

Excel will compute the IRR and present it as a decimal value. To convert this to a percentage, you can format the cell as a percentage by using the “%” button located in the “Number” group on the Home tab. Alternatively, multiply the decimal by 100. For example, an Excel result of 0.1234 implies an IRR of 12.34%.

It’s crucial to understand that IRR is a forward-looking metric, meaning it relies on projections and assumptions about the investment’s future performance. These projections take into account factors such as the expected growth of the startup and its ability to generate cash over time.

Since IRR is based on these projections and assumptions, it’s essential to be as accurate and realistic as possible when estimating future cash flows. The more precise these projections are, the more reliable the IRR calculation will be in helping investors and entrepreneurs make informed decisions about the potential profitability of an investment or startup venture.

IRR and Cash Flow Projections

One of the crucial applications of IRR for entrepreneurs is in planning and projecting cash flows. Understanding how different revenue models, cost structures, and investment timings affect the IRR can guide strategic decisions about product launches, marketing efforts, and expansion plans. By effectively utilizing IRR in cash flow projections, entrepreneurs can make informed decisions that optimize the potential return on their investments.

Navigating the Limitations of IRR

While IRR is a powerful tool, it is not without its limitations. One key assumption is that cash inflows are reinvested at the project’s IRR, which might not always be practical or realistic. Moreover, IRR alone does not provide a complete picture when comparing projects of varying durations or capital requirements. To overcome these limitations, entrepreneurs should complement IRR with other financial analyses, such as ROI, NPV, and the Payback Period.

Integrating IRR with Other Financial Metrics

To gain a holistic financial assessment of a startup or investment opportunity, it is essential to integrate IRR with other key metrics. This multidimensional approach allows entrepreneurs to present a compelling case to investors, showcasing not only the expected rate of return but also the project’s absolute profitability, risk profile, and alignment with long-term business objectives. By combining IRR with a comprehensive set of financial analyses, entrepreneurs can make well-informed decisions that drive sustainable growth and success.

The Internal Rate of Return is a powerful financial metric that serves as a lens through which investment opportunities are evaluated and strategic decisions are made. By understanding and effectively applying IRR, while being mindful of its limitations and integrating it with other analyses, entrepreneurs can navigate the complex investment landscape with greater confidence. This not only aids in securing funding but also in steering the startup towards long-term success. Mastering IRR is an essential skill for any entrepreneur looking to build a thriving business in today’s competitive market.

Frequently Asked Questions

- What is the importance of understanding IRR for pre-startup and pre-revenue entrepreneurs?

Understanding IRR is crucial for entrepreneurs in the early stages of their startup journey, even before writing a business plan or developing a financial model. IRR helps entrepreneurs assess the potential profitability and attractiveness of their business idea to investors. By incorporating IRR calculations into their planning process, entrepreneurs can make informed decisions about their startup’s direction and optimize their chances of securing funding.

- How can entrepreneurs use IRR to create more effective business plans and financial projections?

Entrepreneurs can leverage IRR to create more compelling business plans and financial projections by incorporating this metric into their cash flow forecasts. By understanding how different factors, such as revenue models, cost structures, and investment timings, impact the IRR, entrepreneurs can craft strategies that maximize their startup’s potential return. Including IRR calculations in their business plans and financial projections can also demonstrate to investors that the entrepreneur has a clear understanding of the financial viability of their venture.

- What are some common mistakes entrepreneurs make when calculating or interpreting IRR?

One common mistake entrepreneurs make is relying solely on IRR without considering its limitations. IRR assumes that cash inflows are reinvested at the same rate as the project’s IRR, which may not always be realistic. Additionally, entrepreneurs may incorrectly compare IRR values across projects with different durations or capital requirements, leading to flawed decision-making. To avoid these mistakes, entrepreneurs should use IRR in conjunction with other financial metrics and be aware of its assumptions and limitations.

- How can entrepreneurs present IRR effectively to potential investors?

When presenting IRR to potential investors, entrepreneurs should provide clear and concise explanations of how the metric was calculated and what assumptions were made. They should also contextualize the IRR by comparing it to industry benchmarks or other relevant investment opportunities. Entrepreneurs can strengthen their case by complementing IRR with other financial metrics, such as ROI, NPV, and the Payback Period, to provide a more comprehensive view of their startup’s potential. It’s essential to be transparent about the limitations of IRR and address any potential concerns investors may have.

- What resources are available for entrepreneurs to learn more about IRR and its applications?

Entrepreneurs can access a wide range of resources to deepen their understanding of IRR and its applications. Online courses, such as those offered by platforms like Coursera, Udemy, or edX, can provide comprehensive lessons on financial metrics and their use in startup planning. Entrepreneurs can also consult with financial advisors, mentors, or experienced entrepreneurs to gain insights and guidance on effectively applying IRR in their specific contexts. Additionally, there are numerous books, articles, and blog posts dedicated to IRR and its role in startup finance that entrepreneurs can refer to for further learning.

Related Terms

Net Present Value (NPV): NPV is the sum of the present values of all future cash flows, both inflows and outflows, discounted at a specific rate. IRR is the discount rate that makes the NPV of a project equal to zero.

Return on Investment (ROI): ROI measures the efficiency of an investment by comparing the net profit to the initial cost. While IRR takes into account the time value of money, ROI is a simpler metric that provides a percentage return on the investment.

Discount Rate: The discount rate is the interest rate used to determine the present value of future cash flows. IRR is the discount rate that makes the NPV of a project equal to zero, while other discount rates may be used to calculate NPV based on the investor’s required rate of return.

Payback Period: The payback period is the length of time required for an investment to recover its initial cost through cash inflows. While IRR measures the profitability of an investment, the payback period helps assess the liquidity and risk associated with the investment.

Modified Internal Rate of Return (MIRR): MIRR is an alternative to IRR that addresses some of its limitations, such as the assumption that cash inflows are reinvested at the same rate as the project’s IRR. MIRR takes into account the cost of borrowing money for the initial investment and the interest earned on reinvested cash flows.

Also see: Net Present Value (NPV)

Welcome to Businessplan.com

Currently in beta test mode.

Products available for purchase are placeholders and no orders will be processed at this time.

Let’s craft the ultimate business planning platform together.

Have questions, suggestions, or want a sneak peek at upcoming tools and resources? Connect with us on X or join “On the Right Foot” on Substack .

This site uses cookies from Google to deliver its services and to analyze traffic.

Ok, Got It.

Privacy Policy

- Cash Flow Projection – The Comple...

Cash Flow Projection – The Complete Guide

Table of Content

Join Our 100,000+ Community

Sign up for latest finance stories.

Key Takeaways

- Cash flow projection is a vital tool for financial decision-making, providing a clear view of future cash movements.

- Cash flow is crucial for business survival and includes managing cash effectively and providing a financial planning roadmap.

- Automation in cash flow management is a game-changer. It enhances accuracy, efficiency, and scalability in projecting cash flows, helping businesses avoid common pitfalls.

Introduction

Cash flow is the lifeblood of any business. Yet, many companies constantly face the looming threat of cash shortages, often leading to their downfall. Despite its paramount importance, cash flow management can be overwhelming, leaving businesses uncertain about their financial stability.

But fear not, there’s a straightforward solution to this common problem – cash flow projection. By mastering the art of cash flow projection, you can gain better control over your finances and steer your business away from potential financial crises. Cash flow projections offer a proactive approach to managing cash flow, enabling you to anticipate challenges and make informed decisions to safeguard the future of your business.

If you’re unsure how to accurately perform cash flow projections or if you’re new to the concept altogether, this article explains everything you need to know, provides you with a step-by-step guide to preparing cash flow projections and highlights the key role automation plays in enhancing the effectiveness of these projections.

What Is Cash Flow Projection?

Cash flow projection is a financial forecast that estimates the future inflows and outflows of cash for a specified period, typically using a cash flow projection template. It helps businesses anticipate liquidity needs, plan investments, and ensure financial stability.

Think of cash flow projection as a financial crystal ball that allows you to peek into the future of your business’s cash movements. It involves mapping out the expected cash inflows (receivables) from sales, investments, and financing activities and the anticipated cash outflows (payables) for expenses, investments, and debt repayments.

It provides invaluable foresight into your business’s anticipated cash position, helping you plan for potential shortfalls, identify surplus funds, and make informed financial decisions.

Why Are Cash Flow Projections Important for Your Business?

Managing cash flow is a critical aspect of running a successful business. It can be the determining factor between flourishing and filing for Chapter 11 bankruptcy .

In fact, studies reveal that 30% of business failures stem from running out of money. To avoid such a fate, by understanding and predicting the inflow and outflow of cash, businesses can make informed decisions, plan effectively, and steer clear of potential financial disasters.

Calculating projected cash flow is a crucial process for businesses to anticipate their future financial health and make informed decisions. This process involves forecasting expected cash inflows and outflows over a specific period using historical data, sales forecasts, expense projections, and other relevant information. Regularly updating and reviewing projected cash flow helps businesses identify potential cash shortages or surpluses, allowing for proactive cash management strategies and financial planning.

Cash Flow Projection vs. Cash Flow Forecast

Having control over your cash flow is the key to a successful business. By understanding the differences between cash flow forecasts and projections, business owners can use these tools more effectively to manage their finances and plan for the future.

|

|

|

|

| Definition | An estimation of future cash inflows and outflows based on historical data, assumptions, and trends. | A process of forecasting future cash movements based on current financial data and market conditions. |

| Purpose | Helps in planning and budgeting for future financial needs and obligations. | Aids in short-term decision-making and managing cash flow fluctuations. |

| Time Horizon | Typically covers a longer period, such as months or years. | Focuses on shorter time frames, often weekly or monthly. |

| Frequency of Updates | Updated less frequently, usually on an annual or quarterly basis. | Requires frequent updates to reflect changing business conditions and market dynamics. |

| Accuracy | Provides a more static view of cash flow with less emphasis on real-time adjustments. | Offers a more dynamic and responsive view of cash flow, allowing for timely adjustments and corrections. |

| Tools Used | Utilizes historical financial data, trend analysis, and financial modeling techniques. | Relies on real-time data, financial software, and predictive analytics tools. |

Step-by-Step Guide to Creating a Cash Flow Projection

An effective cash flow projection enables better management of business finances. Here is a step-by-step process to create cash flow projections:

Step 1: Choose the type of projection model

- Determine the appropriate projection model based on your business needs and planning horizon.

- Consider the following factors when choosing a projection model:

- Short-term projections : Covering 3-12 months, these projections are suitable for immediate planning and monitoring.

- Long-term projections : Extending beyond 12 months, these projections provide insights for strategic decision-making and future planning.

- Combination approach : Use a combination of short-term and long-term projections to address both immediate and long-range goals.

Step 2: Gather historical data and sales information

- Collect relevant historical financial data, including cash inflows and outflows from previous periods.

- Analyze sales information, considering seasonality, customer payment patterns, and market trends.

Pro Tip: Finance teams often utilize accounting software to ingest a range of historical and transactional data.

Step 3: Project cash inflows

- Estimate cash inflows based on sales forecasts, considering factors such as payment terms and collection periods.

- Utilize historical data and market insights to refine your projections.

Step 4: Estimate cash outflows

- Identify and categorize various cash outflow components, such as operating expenses, loan repayments, supplier payments, and taxes.

- Use historical data and expense forecasts to estimate the timing and amount of cash outflows.

Pro Tip: By referencing the cash flow statement, you can identify the sources of cash inflows and outflow s.

Step 5: Calculate opening and closing balances

- Calculate the opening balance for each period, which represents the cash available at the beginning of the period.

- Opening Balance = Previous Closing Balance

- Calculate the closing balance by considering the opening balance, cash inflows, and cash outflows for the period.

- Closing Balance = Opening Balance + Cash Inflows – Cash Outflows

Step 6: Account for timing and payment terms

- Consider the timing of cash inflows and outflows to create a realistic cash flow timeline.

- Account for payment terms with customers and suppliers to align projections with cash movements.

Step 7: Calculate net cash flow

- Calculate the net cash flow for each period, which represents the difference between cash inflows and cash outflows.

- Net Cash Flow = Cash Inflows – Cash Outflows

Pro Tip: Calculating the net cash flow for each period is vital for your business, as it gives you a clear picture of your future cash position. Think of it as your future cash flow calculation.

Step 8: Build contingency plans

- Incorporate contingency plans to mitigate unexpected events impacting cash flow, such as economic downturns or late payments.

- Create buffers in your projections to handle unforeseen circumstances.

Step 9: Implement rolling forecasts

- Embrace a rolling forecast approach, where you regularly update and refine your cash flow projections based on actual performance and changing circumstances.

- Rolling forecasts provide a dynamic view of your cash flow, allowing for adjustments and increased accuracy.

Cash Flow Projection Example

Let’s take a sneak peek into the cash flow projection of Pizza Planet, a hypothetical firm. In March, they began with an opening balance of $50,000. This snapshot will show us how their finances evolved during the next 4 months.

Here are 5 key takeaways from the above cash flow projection analysis for Pizza Planet:

Upsurge in Cash Flow from Receivables Collection (April):

- Successful efforts at collecting outstanding customer payments result in a significant increase in cash flow.

- Indicates effective accounts receivable management and timely collection processes.

Buffer Cash Addition (May and June):

- The company proactively adds buffer cash to prepare for potential financial disruptions.

- Demonstrates a prudent approach to financial planning and readiness for unexpected challenges.

Spike in Cash Outflow from Loan Payment (May):

- A noticeable cash outflow increase is attributed to the repayment of borrowed funds.

- It suggests a commitment to honoring loan obligations and maintaining a healthy financial standing.

Manageable Negative Net Cash Flow (May and June):

- A negative net cash flow during these months is offset by a positive net cash flow in other months.

- Indicates the ability to handle short-term cash fluctuations and maintain overall financial stability.

Consistent Closing Balance Growth:

- The closing balance exhibits a consistent and upward trend over the projection period.

- Reflects effective cash flow management, where inflows cover outflows and support the growth of the closing cash position.

Overall, the cash flow projection portrays a healthy cash flow for Pizza Planet, highlighting their ability to collect receivables, plan for contingencies, manage loan obligations, have resilience in managing short-term fluctuations, and steadily improve their cash position over time.

How to Calculate Projected Cash Flow?

To calculate projected cash flow, start by estimating incoming cash from sources like sales, investments, and financing. Then, deduct anticipated cash outflows such as operating expenses, loan payments, taxes, and capital expenditures. The resulting net cash flow clearly shows how much cash the business expects to generate or use within the forecasted period.

Calculating projected cash flow is a crucial process for businesses to anticipate their future financial health and make informed decisions. This process involves forecasting expected cash inflows and outflows over a specific period using historical data, sales forecasts, expense projections, and other relevant information. Regularly updating and reviewing projected cash flow helps businesses identify potential cash shortages or surpluses, allowing for proactive cash management strategies and financial planning.

Download our cash flow calculator to effortlessly track your company’s operating cash flow,

net cash flow (in/out), projected cash flow, and closing balance.

6 Common Pitfalls to Avoid When Creating Cash Flow Projections

At HighRadius, we recently turned our research engine toward cash flow forecasting to shed light on the sources of projection failures. One of our significant findings was that most companies opt for unrealistic projection models that don’t mirror the actual workings of their finance department.

| 6 Common Pitfalls to Watch Out For | ||

| Unrealistic Assumptions | Overestimating Collections and Payables | Inaccurate Sales Timing |

| Lack of Scenario Planning | Overlooking Seasonal Cash Flow Patterns | Ignoring Contingencies and Unexpected Events |

Cash flow projections are only as strong as the numbers behind them. No one can be completely certain months in advance if they will encounter any unexpected events. Defining a realistic cash flow projection for your company is crucial to achieving more accurate results. Don’t let optimism cloud your key assumptions. Stick to the most likely numbers for your projections.

A 5% variance is acceptable, but exceeding this threshold warrants a closer look at your key assumptions. Identify any logical flaws that may compromise accuracy. Take note of these pitfall insights we’ve gathered from finance executives who have shared their experiences:

- Avoid overly generous sales forecasts that can undermine projection accuracy.

- Maintain a realistic approach to sales projections to ensure reliable cash flow projections.

Accounts Receivable:

- Reflect the payment behaviour of your customers accurately in projections, especially if they tend to pay on the last possible day despite a 30-day payment schedule.

- Adjust the projection cycle to align with the actual payment patterns.

- Factor in annual and quarterly bills on the payables side of your projections.

- Consider potential changes in tax rates if your business is expected to reach a new tax level.

- Account for seasonal fluctuations and cyclical trends specific to your industry.

- Analyze historical data to identify patterns and adjust projections accordingly to reflect these variations.

- Incorporate contingencies in your projections to prepare for unforeseen circumstances such as economic downturns, natural disasters, or changes in market conditions.

- Build buffers to mitigate the impact of unexpected events on your cash flow.

- Failing to create multiple scenarios can leave you unprepared for different business outcomes.

- Develop projections for best-case, worst-case, and moderate scenarios to assess the impact of various circumstances on cash flow.

By addressing these pitfalls and adopting these best practices shared by finance executives, you can create more reliable and effective cash flow projections for your business. Stay proactive and keep your projections aligned with the realities of your industry and market conditions.

How Automation Helps in Projecting Cash Flow?

Building a cash flow projection chart is just the first step; the real power lies in the insights it can provide. Cash flow projection is crucial, but let’s face it – the traditional process is resource-consuming and hampers productivity.

However, there’s a solution: a cash flow projection chart automation tool.

Professionals in treasury understand this need for automation, but it requires an investment of time and money. Building a compelling business case is straightforward, especially for companies prioritizing cash reporting, forecasting, and leveraging the output for day-to-day cash management and investment planning.

Consider the following 3 business use cases shared by finance executives, highlighting the benefits of automated cash flow projections that far outweigh the initial investment:

Scalability and adaptability:

Forecasting cash flow in spreadsheets is manageable in the early stages, but as your business grows, it becomes challenging and resource-intensive. Manual cash flow management struggles to keep up with the increasing transactions and customer portfolios.

Many businesses rely on one-off solutions that only temporarily patch up cash flow processes without considering the implications for the future. Your business needs an automation tool that can effortlessly scale with your business, accommodating evolving needs.

Moreover, by opting for customization options, you can tailor the cash flow projections to your specific business requirements and adapt to changing market dynamics.

Time savings:

Consider a simple example of the time and effort involved in compiling a 13-week cash flow projection for stakeholders every week. The process typically includes:

- Capture cash flow data from banking and accounting platforms and classify transactions.

- Create short-term forecasts using payables and receivables data.

- Model budgets and other business plans for medium-term forecasts.

- Collect data from various business units, subsidiaries, and inventory levels.

- Consolidate the data into a single cash flow projection.

- Perform variance and sensitivity analysis.

- Compile reporting with commentary.

This process alone can consume many hours each week. Let’s assume it takes six hours for a single resource and another six hours for other contributors, totalling 12 hours per week or 624 hours per year.

By implementing a cash flow projection automation tool, you can say goodbye to tedious manual tasks such as logging in, downloading data, updating spreadsheets, and compiling reports. Automating these processes saves your team countless hours, allowing them to focus on strategic initiatives and high-value activities.

Imagine the added time spent on data conversations, information requests, and follow-ups. Cash reporting can quickly become an ongoing, never-ending process.

By implementing a cash flow projection automation tool, you can say goodbye to tedious manual tasks such as logging in, downloading data, manipulating spreadsheets, and compiling reports. Automating these processes saves your team countless hours, allowing them to focus on strategic initiatives and high-value activities.

Accuracy and efficiency:

When it comes to cash flow monitoring and projection, accuracy is paramount for effective risk management. However, manual data handling introduces the risk of human error, which can have significant financial implications for businesses. These challenges are:

- Inaccurate financial decision-making

- Cash flow uncertainty

- Increased financial risks

- Impaired stakeholder confidence

- Wasted resources and time

- Compliance and reporting challenges

- Inconsistent data processing

Automating cash flow projections mitigates these risks by ensuring accurate and reliable results. An automation tool’s consistent data processing, real-time integration, error detection, and data validation capabilities instill greater accuracy, reliability, and confidence in the projected cash flow figures.

For example, Harris, a leading national mechanical contractor, transformed their cash flow management by adopting an automation tool. They achieved up to 85% accuracy across forecasts for 900+ projects and gained multiple 360-view projection horizons, from 1 day to 6 months, updated daily. This improvement in accuracy allowed the team to focus on higher-value tasks, driving better outcomes.

Cash Flow Projections with HighRadius

Managing cash flow projections today requires a host of tools to track data, usage, and historic revenue trends as seen above. Teams rely on spreadsheets, data warehouses, business intelligence tools, and analysts to compile and report the data.

Discover the power of HighRadius cash flow forecasting software , designed to precisely capture and analyze diverse scenarios, seamlessly integrating them into your cash forecasts. By visualizing the impact of these scenarios on your cash flows in real time, you gain a comprehensive understanding of potential outcomes and can proactively respond to changing circumstances.

Here’s how AI takes variance analysis to the next level and helps you generate accurate cash flow forecasts with low variance. It automates the collection of data on past cash flows, including bank statements, accounts receivable, accounts payable, and other financial transactions, and integrates with most financial systems. This data is analyzed to detect patterns and trends that can be used to anticipate future cash flows. Based on this historical analysis and regression analysis of complex cash flow categories such as A/R and A/P, AI selects an algorithm that can provide an accurate cash forecast.

When your forecast is off, you can miss opportunities to invest in growth or undermine your credibility and investor confidence. An accurate forecast means predictable growth and increased shareholder confidence.

1. How do you prepare a projected cash flow statement?

Steps to prepare a projected cash flow statement:

- Analyze historical cash flows.

- Estimate future sales and collections from customers.

- Forecast expected payments to suppliers and vendors.

- Consider changes in operating, investing, and financing activities.

- Compile all these estimates into a projected cash flow statement for the desired period.

2. What is a projected cash flow budget?

A projected cash flow budget is a financial statement that estimates the amount of cash your business is expected to receive and pay out over a specific time period. This information can help your business have enough cash flow to maintain its regular operations during the given period.

3. What is a 3-year projected cash flow statement?

A 3-year projected cash flow statement forecasts cash inflows and outflows for the next three years. It helps businesses assess their expected cash position and plan for future financial needs and opportunities.

4. What are projected cash flow and fund flow statements?

A projected cash flow statement forecasts cash inflows and outflows over a period, aiding in budgeting and planning. The fund flow statement tracks the movement of funds between sources and uses, analyzing the financial position. Both provide insights into a company’s liquidity and financial health.

5. What are the four key uses of a cash flow forecast?

- Evaluate cash availability for operational expenses and investments.

- Identify potential cash flow gaps or surpluses.

- Support financial planning, budgeting, and decision-making.

- Assist in securing financing or negotiating favorable terms with stakeholders.

6. What is the cash flow projection ratio?

The term cash flow projection ratio is not a commonly used financial ratio. However, various ratios like operating cash flow ratio, cash flow margin, and cash flow coverage ratio are used to assess a company’s cash flow generation and management capabilities.

7. What is the formula for projected cash flow?

The projected cash flow formula is Projected Cash Flow = Projected Cash Inflows – Projected Cash Outflows . It calculates the anticipated net cash flow by subtracting projected expenses from projected revenues, considering all sources of inflows and outflows.

8. What are the advantages of cash flow projection?

Cash flow projection helps businesses:

- Anticipate future financial needs

- Manage cash shortages effectively

- Make informed decisions

- Ensure stability and growth

- Provide a roadmap for financial planning

- Stay proactive in managing finances

Related Resources

What is Variance Analysis: Types, Examples and Formula

How Does Online Cash Flow Forecasting Work?

Working Capital Optimization: Everything You Need to Know

Streamline your order-to-cash operations with highradius.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

The HighRadius™ Treasury Management Applications consist of AI-powered Cash Forecasting Cloud and Cash Management Cloud designed to support treasury teams from companies of all sizes and industries. Delivered as SaaS, our solutions seamlessly integrate with multiple systems including ERPs, TMS, accounting systems, and banks using sFTP or API. They help treasuries around the world achieve end-to-end automation in their forecasting and cash management processes to deliver accurate and insightful results with lesser manual effort.

Please fill in the details below

Get the hottest Accounts Receivable stories

Delivered straight to your inbox.

- Order To Cash

- Collections Management

- Cash Application Management

- Deductions Management

- Credit Management

- Electronic Invoicing

- B2B Payments

- Payment Gateway

- Surcharge Management

- Interchange Fee Optimizer

- Payment Gateway For SAP

- Record To Report

- Financial Close Management

- Account Reconciliation

- Anomaly Management

- Accounts Payable Automation

- Treasury & Risk

- Cash Management

- Cash Forecasting

- Treasury Payments

- Learn & Transform

- Whitepapers

- Courses & Certifications

- Why Choose Us

- Data Sheets

- Case Studies

- Analyst Reports

- Integration Capabilities

- Partner Ecosystem

- Speed to Value

- Company Overview

- Leadership Team

- Upcoming Events

- Schedule a Demo

- Privacy Policy

HighRadius Corporation 2107 CityWest Blvd, Suite 1100, Houston, TX 77042

We have seen financial services costs decline by $2.5M while the volume, quality, and productivity increase.

Colleen Zdrojewski

Trusted By 800+ Global Businesses

Internal Rate of Return (IRR): See How Your Investment Performs

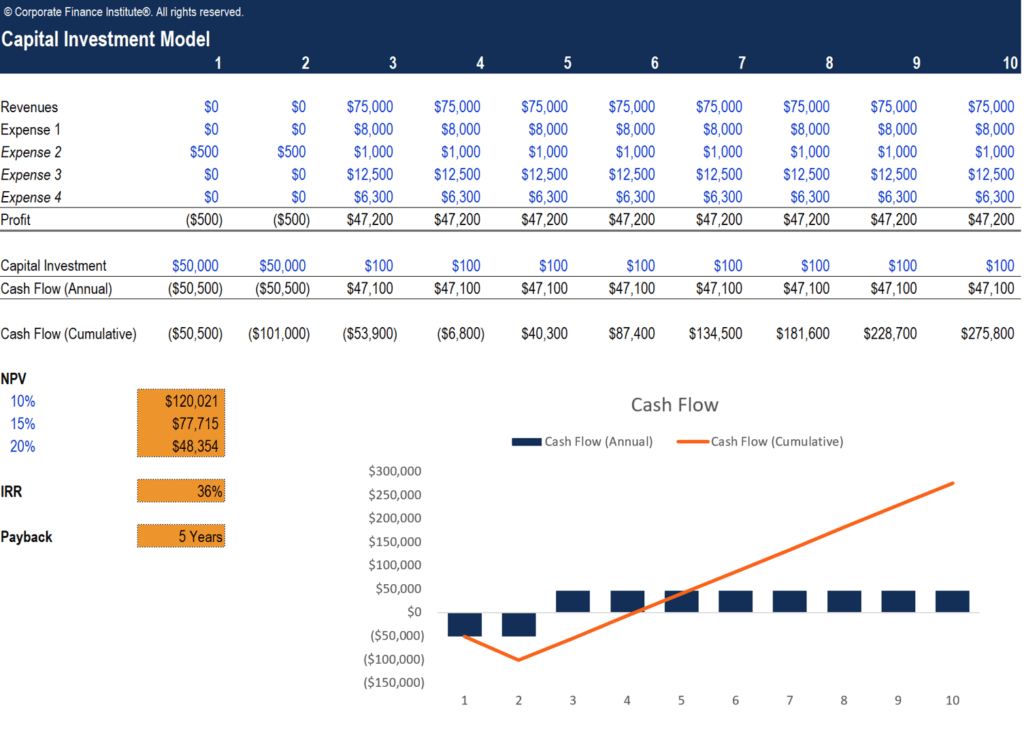

For evaluating and ranking potential investment opportunities and business projects, the internal rate of return is one important metric that businesses and individuals use for financial analysis.

This article covers the meaning of internal rate of return, the IRR formula, how to calculate internal rate of return, when it’s used, and FAQs.

What is the Internal Rate of Return (IRR)?

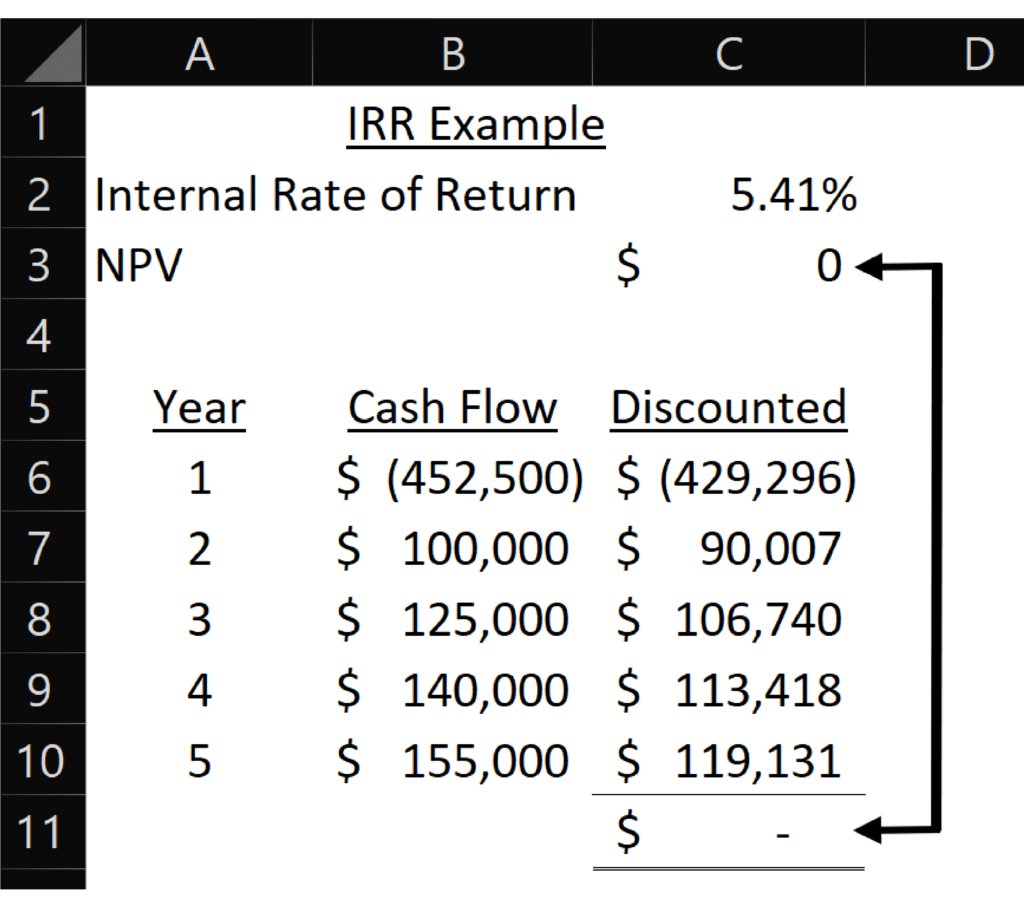

Internal rate of return is a capital budgeting calculation for deciding which projects or investments under consideration are investment-worthy and ranking them. IRR is the discount rate for which the net present value (NPV) equals zero (when time-adjusted future cash flows equal the initial investment). IRR is an annual rate of return metric also used to evaluate actual investment performance.

Understanding IRR

IRR is computed using a different type of discounted cash flow analysis to determine the rate that produces the initial investment breakeven. The initial investment is the company’s cost to launch the investment project.

Businesses compare the internal rate of return (IRR) for potential projects. When evaluating potential investment options, they often choose the highest IRR expected return that meets or exceeds the minimum percentage hurdle rate required for company investments.

If the budget amount is large enough for investment in more than one project, then available funds are allocated to other higher IRR projects within the company’s budget and risk tolerance.

Basic cash flow analysis is analyzing the cash inflows and outflows that are presented in a cash flow statement .

The corporate hurdle rate equals their weighted-average cost of capital (WACC), including a risk premium. A company’s WACC is the weighted average of its costs of equity, debt, and preferred stock, according to Strategic CFO.

A Harvard Business Review article about Internal Rate of Return (IRR) recommends that IRR be used in combination with net present value (NPV) to make better investment decisions. In a net present value financial analysis, a positive NPV means investment profitability.

In corporate finance, venture capital firms and private equity investment companies use cash-on-cash return or internal rate of return as methods to analyze which startups and growth companies they should fund as portfolio investments. Commercial real estate investors use IRR to evaluate potential or actual returns on investment properties.

Individuals may also use IRR to make personal investments and major purchasing decisions that can generate returns, such as an annuity .

Internal Rate of Return Formula

The internal rate of return (IRR) formula is based on the net present value (NPV) formula when it’s used to solve for zero NPV.

The internal rate of return formula is:

How to Calculate IRR

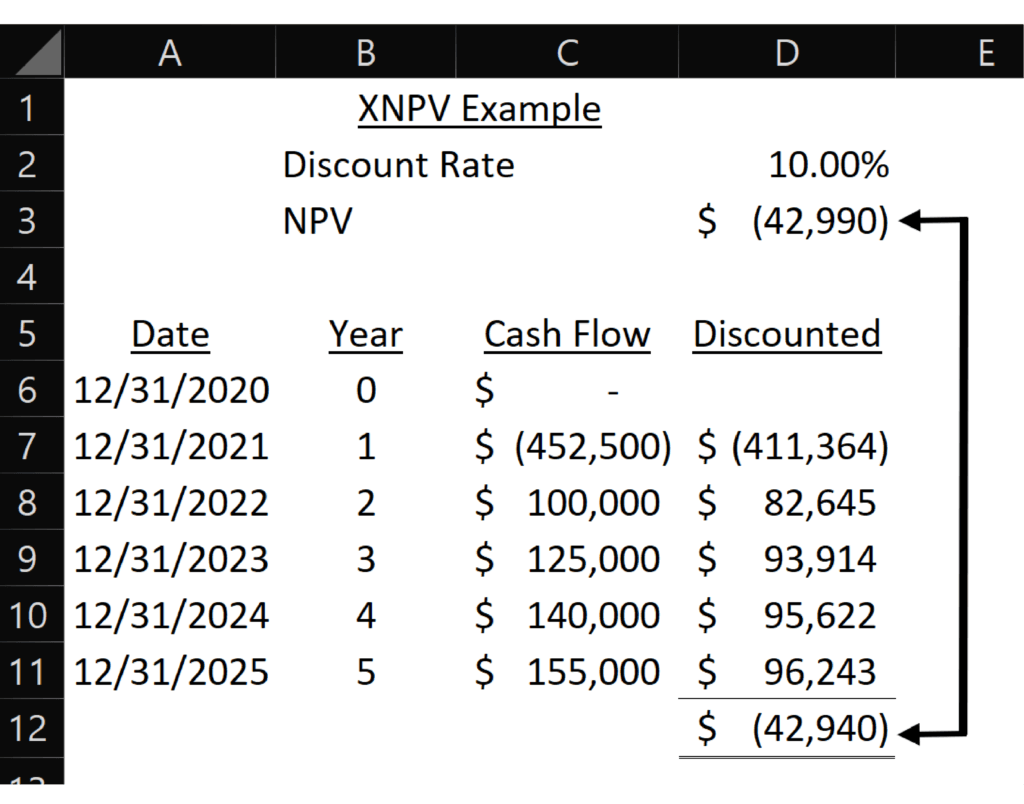

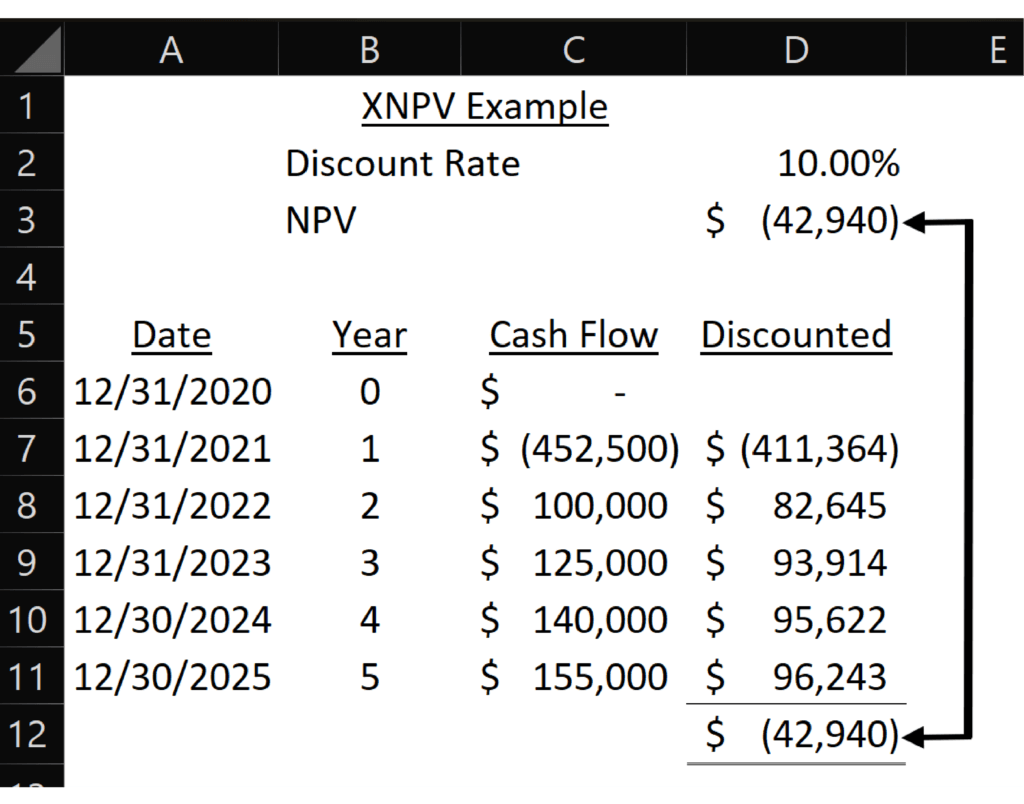

Financial analysts may use mathematical formulas to calculate IRR on a trial-and-error basis by calculating the net present value (NPV) of each cash flow amount, using an estimate of the internal rate of return. A more efficient process is to use three Excel spreadsheet functions for IRR , including IRR, XIRR, and MIRR, according to the Journal of Accountancy.

Instead, you can use a financial calculator for IRR. A financial calculator may either be a physical device with an IRR button (like a specialized Texas Instruments financial calculator ) or an online financial calculator for internal rate of return. If you decide to use an online calculator, initially compare the results to Excel to prove its accuracy.

Each Microsoft Excel function formula has certain built-in assumptions and variables to insert. For Excel to work in calculating the three IRR functions, the series of cash flows must include at least one negative cash flow amount for net cash outflows and one positive cash flow amount for net cash inflows.

IRR Function in Excel

The IRR function in Excel assumes periodic cash flows. IRR assumes an equal number of days in monthly cash flow periods. This doesn’t reflect the monthly fluctuations in calendar days for a month, resulting in a small amount of IRR calculation inaccuracy. In Excel, for the IRR function , you can compute IRR using either monthly or annual amounts and choose whether to use a guess.

Calculate IRR as of a certain number of years (or months). In the IRR function, enter the row and column identifiers as a sum for the years being considered in your IRR calculation. If you’re making a guess, that’s an extra entry in the function formula.

Steps for using Excel’s IRR function:

- Click the f x function in Excel.

- Select Financial function.

- In the function search box, type in IRR for the IRR function (and select IRR if given a choice of which IRR function to use).

- Using the Formula Arguments screen, insert the Excel data range as Values for the IRR period being analyzed, and optionally, your guess of the IRR rate.

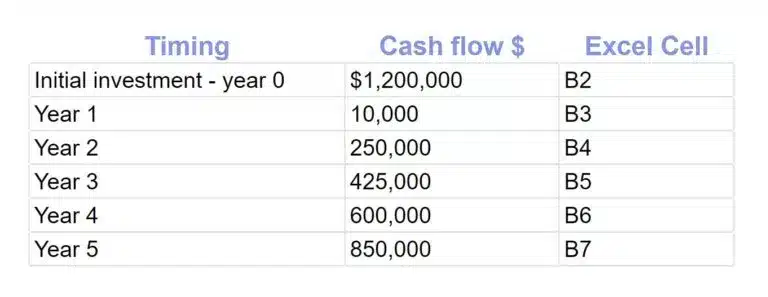

In the Example of IRR section below, which includes cash flow assumptions, Excel calculates IRR as 16% over a five-year time horizon.

XIRR Function in Excel

The XIRR function in Excel doesn’t need periodic cash flows and uses cash flow dates (using the Excel DATE function or dates in Excel cells formatted as DATE) instead. However, you can use periodic dates. Like IRR, XIRR lets the Excel user optionally insert a guess into the Function Arguments screen box.

Steps for using Excel’s XIRR function:

- In the function search box, type in XIRR for this type of IRR function (or select XIRR if given a choice of which IRR function to use).

- Using the Formula Arguments screen, insert the Excel data range as Values for the IRR period being analyzed, enter the range of the date cells that have been formatted as DATE, and optionally, your guess of the IRR rate.

Using the same assumptions in the Example of IRR section below, except replacing Years with actual cash flow dates that are in a new column C, the XIRR solves XIRR as 14%.

Excel column C includes the following dates and cell addresses to use in connection with the Example of IRR assumptions data instead of Year number. Cash flows are assumed to remain the same.

| 2-Jan-17 | C2 |

| 15-Jan-18 | C3 |

| 25-Mar-19 | C4 |

| 16-Feb-20 | C5 |

| 22-May-21 | C6 |

| 28-Dec-22 | C7 |

The XIRR function calculation shows in Excel as XIRR(B2:B7,C2:C7) or XIRR(B2:B7,C2:C7,.11) with an 11% guess. The calculated XIRR appears as 14% and these formulas appear in the cell content bar near the top of the Excel spreadsheet if you click on the 14% result.

MIRR Function in Excel

MIRR is a modified internal rate of return. The MIRR function in Excel uses periodic cash flows (like the IRR function ) and also assumes the reinvestment of cash in the calculation. The MIRR Excel function includes Function Arguments for Values, Finance_rate and Reinvest_rate, but no expected IRR rate guess. The Finance_rate is the interest rate paid on amounts borrowed to finance cash flows. The Reinvest_rate is the interest rate for interest received when money is reinvested from cash flows produced from the investment project.

Steps for using Excel’s MIRR function:

- In the function search box, type in MIRR for this type of IRR function (or select MIRR if given a choice of which IRR function to use).

- Using the Formula Arguments screen, insert the Excel data range as Values of cash flows for the IRR period being analyzed, and enter the Finance_rate and Reinvest_rate.

Assume the Finance_rate is 8% and the Reinvest_rate is 12%. Using the same cash flow and timing assumptions in the Example of IRR section below, the Excel function solves MIRR as 15%.

When you click on the 15% for MIRR function results, you’ll see MIRR(B2:B7,.08,.12) in the Excel cell content bar.

When to (and Why) Use IRR?

Use IRR (internal rate of return) to evaluate and compare the returns of business investment projects to select the best investment from these competing projects. Businesses often select investment projects with the highest return within their risk appetite that meets their minimum hurdle rate for investing. Individuals can also use IRR for investing.

You can also use IRR to determine the return rate on actual investments when NPV is zero, using discounted cash flow analysis.

Frequently Asked Questions

The answers to frequently asked questions about internal rate of return (IRR) follow.

What’s Considered a Good IRR?

A good IRR depends on the industry and the riskiness of the project. Higher-risk projects require greater IRR returns. Businesses select projects with an internal rate of return exceeding their minimum hurdle rate return, which is equal to or exceeding its weighted-average cost of capital (WACC). In real estate, a good IRR may vary from 12% to 20%, depending on the risk level.

What’s an IRR of 30% Mean?

An IRR of 30% means that the rate of return on an investment using projected discounted cash flows will equal the initial investment amount when the net present value (NPV) is zero. In this case, when the time value of money factors are applied to the cash flows, the resulting IRR is 30%. The investment is at breakeven with a 30% IRR.

What’s an Example of IRR?

An example of using the IRR function in Excel includes the following assumptions:

Hurdle rate as an optional guess: 11% WACC: 8%

For a timeframe of five years, Excel shows the IRR function as: IRR(B2:B7) with no IRR guess or IRR (B2:B7,.11) with a guess of 11% for IRR.

Result: For the above example, IRR = 16%