Manage Cookies

For more information about how we and our partners use cookies on our site, see our Cookie Policy

Strictly necessary

These cookies are necessary for the Savills website to function. Examples of this include: setting your privacy preferences, logging in to your Savills account, or filling in forms. Though these cookies cannot be switched off, you can set your browser to block or alert you about these cookies, but please be aware that this will stop some parts of the Savills website from functioning as intended.

Find out more about strictly necessary cookies here .

Functional cookies

These cookies are used to enhance the performance of the Savills website, as without them certain functions of the website may not be available. While they are not vital for the website to run, they allow us to remember important information and your preferences such as previous location searches.

Find out more about functional cookies here .

Targeting & tracking

These cookies record your activity on the Savills website and our partners may use that information to show you adverts that they think you will be most interested in when you visit other websites. We may also use information recorded by these cookies to see how well these adverts are performing.

Find out more about targeting and tracking cookies here .

- The Bahamas

- Czech Republic

- Hong Kong SAR

- The Netherlands

- New Zealand

- The Philippines

- Saudi Arabia

- The Seychelles

- South Africa

- St Kitts & Nevis

- Switzerland

- Taiwan, China

- United Kingdom

- United States

- Book a valuation

Site Search:

- Insight & Opinion

Publication

Spotlight: european serviced apartments 2024, contacts & related research.

Investor interest surges as the lines between hospitality and residential blur

- Operational outlook

The customer base expands

Emergence of digital nomads, where are the development hotspots and opportunities for further expansion, the big players continue to drive expansion, but some new names are accelerating, investment market outlook.

Why serviced apartments?

- Serviced Apartments (also known as 'extended stay'; we use both terms interchangeably in this report) have shown robust performance, with KPIs typically above those seen for equivalent hotels.

- The evolving maturity of the sector means that institutional grade stock is largely apart-hotel in nature, albeit typical unit sizes and on-site facilities vary depending on the operator/ brand.

- Average annual RevPAR rates between 2021 and 2023 for the UK extended stay sector were 27.5% higher than the hotel average.

- The sector typically enjoys higher profit margins. Central London properties can achieve net operating profit margins between 45–55%, compared to 30–40% for hotels.

Sector growth and attraction

- The sector recorded nearly €700 million in transactions in 2023, representing 4.7% of total hospitality volumes.

- Increased consumer awareness, the rise of digital nomads, and the curb on Airbnb in some markets will support demand and operational performance.

- Extended stay currently represents a small portion of the total European hospitality market, averaging 6.1% of the total accommodation supply in major cities: there are significant opportunities for development and expansion.

- Investment activity to pick up pace in 2025, supported by an increase in stock and continued investor interest.

- Global hotel groups, such as Hilton and Marriott, are looking to accelerate the rollout of their extended stay concepts, further helping to legitimise the sector.

- Blurring with co-living and student to become more common, albeit expansion will continue to be dominated by specialist extended stay operators/brands.

Operational Outlook

Enhanced profit potential aided by strong KPIs

Like other parts of the hospitality market, operational performance for the extended stay/Serviced Apartment sector has started to normalise.

Year-on-year (YoY) KPI growth for UK Serviced Apartments started to slow through the course of 2022 and into 2023, with most months in Q4 2023 and Q1 2024 seeing RevPAR growth drift into negative territory, largely driven by London.

This is a trend that we have seen in the wider hotel market, albeit to a slightly lesser degree.

Despite this normalisation in YoY comparisons, RevPAR remains significantly above 2019 levels, with the differential for UK Serviced Apartments averaging 19% over the first six months of 2024.

Serviced Apartments marginally outperformed hotels during the pandemic. They were the first to recover, benefiting from increased customer appeal due to the relative ‘isolation’ they offer. This is evidenced by RevPAR growth between 2021 and 2023, where the three-year CAGR for UK extended stay was 40% per annum against the 29% recorded for hotels.

This outperformance has since subsided, particularly against London hotels, as international tourism has resumed. As a result, the ten-year CAGR for Serviced Apartments in the UK is 1.2% per annum, a third of that reported for hotels.

But, it's not solely about growth, particularly as outperformance can be influenced by growth from a lower base. In terms of actual performance metrics such as occupancy, ADR (average daily rate) and RevPAR (revenue per available room), extended stay averages outperform average hotels.

For example, the average annual RevPAR rate between 2021 and 2023 (inclusive) for the UK extended stay sector was 27.5% higher than the hotel average.

Enhanced RevPAR rates are aided by the fact that ADRs in the sector tend to be higher, as unit sizes are larger than the average hotel. Likewise, higher average occupancy has also played a part (see Figure 2).

This, coupled with the fact that extended stay operations tend to have lower staffing levels with fewer services, means that operations usually have higher profit margin levels. For example, we would expect a typical block in Central London to have a net operating profit margin in the region of 45–55%, against a 30–40% margin for an equivalent hotel.

An expanding customer base and increased concept awareness will continue to support demand.

Growing customer awareness of the sector, helped by Airbnb, has been well documented and is reflected in the anecdotal evidence from operators who have reported an increasing leisure guest share. With a number of European cities introducing legislation to curb the use of traditional residential units for short-term use, such as Airbnb (Barcelona being the latest to announce a ban), we are likely to see much of that historical Airbnb demand migrate to professional extended stay product such as apart-hotels.

This, coupled with the growth in longer-length trips (those in excess of 4+ nights), has been critical to driving demand.

Fraser Suites Hamburg

On average, it would appear that length of stay has been contracting since the early 2000s, helped by growth in budget airlines and the rise in the short city break. However, looking at the top-line average only tells part of the story. Examining the number of trips across different trip lengths suggests that there is a growing customer segment who are likely to prefer a Serviced Apartment/ apart-hotel over a hotel stay due to the home-away-from-home feel and greater level of space.

For example, in London, international visitor trips lasting between four to seven nights and eight to 14 nights reported the strongest growth in the ten years to 2019, at 4.3% and 5.0% per annum respectively (see Figure 3).

These trips also account for a sizeable part of the market; nearly half (48%) of all international trips to London in 2019 were for between 4–14 nights, an increase on its 43% share in 2002.

This part of the market has also been one of the fastest to bounce back following the pandemic. 2023 international arrivals staying for four to seven nights reporting trip numbers just 0.3% below 2019 levels, with trips over 15 nights up 2.3%. This is against a backdrop where total international arrivals to London in 2023 were 6.6% below 2019 levels.

The emergence of new customer segments is also positively feeding into extended stay demand. Post-pandemic, we have seen the emergence of Digital Nomads in response to the growth of agile working.

A recent survey suggests that 28% of employees worldwide work from home either all or most of the time, which is more than double the 10% reported in 2019. An increasing number of these, particularly younger employees, are choosing to travel and work, basing themselves in new countries and cities for long periods.

The majority of these trips (55%) last between one to four months (Digital Nomad Report 2023). The top city for Digital Nomads to date in 2024 is London, with 2.3% of all those surveyed globally citing it as a city they visited on their most recent/current trip. European cities represent just over half of the top 10 most visited cities worldwide (see Figure 4).

The nature of these trips would make extended stay/Serviced Apartments particularly attractive, and anecdotally we have heard from operators that there has been an increase in levels of demand from these types of customers. This guest segment also has a bearing on the design and facilities offered by operators, with the provision of co-working space now becoming a major feature.

Paris and London are the lead markets in Europe in terms of current supply, with more than 11,000 units each, reflecting the size of their visitor markets. Based on the committed pipeline (schemes under construction and in final planning and expected to complete by the end of 2028), London is expected to overtake Paris as the largest Serviced Apartment market in Europe, with a projected 21% increase in supply.

Other development hotspots include Dublin, with close to 700 units in the development pipeline, reflecting a 34% increase in supply, albeit off a low base. Likewise, Lisbon will see a doubling in supply, also off a low base, with over 500 units in the pipeline. In percentage terms, the increase in supply is sizeable, but the reality is that extended stay continues to constitute a relatively small, albeit growing, part of overall European hospitality supply

Across Europe’s largest city markets, extended stay accommodation accounts for an average of 6.1% of total accommodation supply. Paris and Frankfurt lead with a share of 11.6% and 12.1%, respectively. In London – currently the second biggest extended stay market in supply terms – it makes up a 7.0% share of total accommodation supply. Even in Lisbon, where supply is expected to double, its market share is only 2%.

Bob W Østerbro Copenhagen

The sector’s relatively low hospitality market share means that most markets in Europe continue to offer attractive scope for expansion.

This expansion potential is further highlighted when examining current extended stay stock levels relative to the number of international arrival nights where trips are in excess of four nights, as it highlights several markets that remain relatively undersupplied by Serviced Apartments. On this basis, Lisbon and Stockholm stand out as being the most relatively undersupplied. For these markets, extended stay stock nights (stock/units multiplied by 365 nights) account for only 1.6% and 2.8% of total nights where trips are longer than four days. Frankfurt, Munich and Dublin are at the other end of the spectrum, albeit these markets still offer room for further expansion, considering the profile of demand and the sector’s low market share.

Even in Paris and London, where stock is over 11,000 units, there is a relative undersupply and an opportunity to capture a greater share of the longer-stay market. The size of the potential opportunity that exists across European markets is likely to be exacerbated by the emergence of co-living as there is the opportunity for operators to pivot into both demand segments where suitable.

Staycity, one of the biggest operators of extended stay in Europe, is projected to be a leader in terms of stock expansion, with over 2,700 new units already committed. Adagio Aparthotel continues to accelerate its expansion, with over 1,500 new units across eleven locations committed to be delivered. Edyn, with its stable of extended stay brands, a former leader when it came to development pipeline in previous years, still has a sizeable pipeline, although this has started to slow as its focus shifts to existing operations ahead of a potential sale.

There are, however, some relatively new names featuring in the top 15 when it comes to pipeline. Numa, the digitised hospitality platform, has seen rapid expansion over the last five years, with a known committed pipeline close to 500 units.

However, much of Numa’s recent growth has come from M&A activity rather than development. For example, it acquired YAYS in 2023 and, in July of this year, Native Places. The latter will add 800 units to its portfolio, all of which are in the UK, bringing Numa’s European portfolio to over 7,300 units. Bob W is also in expansion mode, with the potential to increase current stock by over 4,000 units.

Less familiar names featuring in the top 15 in regard to committed pipeline include Stayery, limehome and Líbere (box below provides some additional background). Stayery, like Numa, is a German-based design-and-technology-focused concept, and while it is much smaller (current stock is about a tenth of that of Numa), it has significant growth aspirations, with a committed pipeline similar in size to its German counterpart.

It’s not just dedicated serviced apartment brands that are in expansion mode: global hotel group Hilton is making its western European debut with its extended stay brand Home2 Suites in Dublin, following in the footsteps of Marriott’s rollout of its Residence Inn brand.

What is clear when looking at recent and future expansion is the growing shift towards digitised lifestyle concepts, many of which are trying to find the sweet spot between a digital customer journey that helps to maximise profits while still delivering a brand experience that engages customers and drives demand.

The growth of the co-living sector, and the blurring of that with extended stay, is offering operators new ways to grow their customer base and underpin investments. Likewise, extended stay is offering co-living operators a potential avenue to enhance returns, as daily rates tend to be higher.

Investor interest in the extended stay sector has increased, but the lack of investable stock remains a significant challenge

European extended stay transaction volumes totalled close to €700 million in 2023, only 4.7% of total volumes in the wider hospitality space.

Although activity was dwarfed by hotel investment, it did fare better when it came to annual comparisons, considering the wider slowing in the investment market. Volumes in 2023 were 1.3% down YoY and 17.2% below 2019 levels. In contrast, transaction volumes for the wider hospitality market were down 18% and 44%, respectively, over the same periods.

While investment activity has been relatively challenged, as has been the case for the wider market, its appeal to investors has improved. In Savills latest European Living Investor Sentiment Survey , 30% of respondents cited that they were targeting European extended stay/Serviced Apartments over the next three years, ranking it sixth out of 15 living sectors covered, and ranking higher as a target than some more traditional parts of the hospitality sector. This may, however, reflect the fact that investors already have a greater exposure to hotels than extended stay.

The sector’s rising appeal to investors may be in response to its typically higher profit margins – all the more attractive considering the rise in debt costs and greater lender scrutiny on debt serviceability. For example, depending on the market, profit levels can be 10–20% higher than comparable hotels. Likewise, greater consumer awareness, strong future demand fundamentals and the blurring with co-living in some cases have all combined to move the sector up the ‘wish list’ for investors. Its KPIs relative to more ‘established’ bed asset classes, such as Hotels and PBSA (purpose-built student accommodation), are also helping to underpin investor interest (see Table 1). Improved investor interest is only half the story.

Without high-quality investable stock available, these aspirations cannot be realised, and this remains a major barrier as the sector is still in growth mode. As a result, we have seen investors and owner-operators look to op-co/ prop-co platform acquisitions as this provides a much faster route to stock expansion as opposed to single asset acquisitions and development.

Numa has been particularly active in this regard, purchasing the YAYS portfolio in Q4 2023 and, in July of this year, Native Places. The latter acquisition will provide Numa with 800 units in the UK, and as with the YAYS purchase, gives them immediate exposure to new markets.

Looking forward, we expect there to be further consolidation in the sector over the next twelve months. In regard to real estate transactions, these are likely to remain relatively muted over the remainder of 2024 as debt costs and lack of product weigh on activity. We expect this will improve in 2025, helped in part by a number of portfolios coming to the market and a further softening in debt costs.

Atelier House, London by City Apartments Limited

For further information, please contact Savills Hotels experts , here.

Follow us on LinkedIn for our latest research, events, deals, people updates and more.

Back to top of page

- News Releases

The European Research Area: Evolving concept, implementation challenges

The 'European Research Area' (ERA) is the policy concept at the heart of the common European policy for research. The framing and adoption of ERA in 2000 was the result of a lengthy process started in 1972. Proposed by the European Commission, the concept has been reshaped by the Council of the European Union in 2008 and influenced by the involvement of stakeholders since 2012. The commitment of the Member States is now at the heart of the process of developing ERA. More than 40 years after the first steps to establish a common research policy, and 16 years after the formulation of the concept, ERA remains a work in progress, as both a complex concept to define and a challenging one to implement.

- In-Depth Analysis

- Choose your language DE (PDF - 1 MB) EN (PDF - 888 KB) FR (PDF - 1 MB)

- EN (EPUB - 2 MB)

About this document

Publication type.

- REILLON Vincent

Policy area

- Research Policy

European Research Area (ERA)

The European Research Area (ERA) is a single, borderless market for research and innovation fostering the free movement of researchers, scientific knowledge and innovation, and encouraging a more competitive European industry.

The ERA helps countries to be more effective by acting together, by closely aligning their research policies and programmes. The free circulation of researchers and knowledge enables better cross-border cooperation, the building up of critical mass and continent-wide competition.

Spreading excellent research and innovation (R&I) plays a key role in upgrading Europe’s research and innovation system in order for it to drive the digital and climate transitions and to contribute to recovery from the COVID-19 pandemic.

The ERA was launched in 2000, in the context of the Lisbon strategy. In 2009, the ERA got explicit recognition in Article 179 (1) of the Treaty on the Functioning of the European Union, which raised the achievement of the ERA to the level of a European Union objective.

Objectives and actions:

As part of the process to revitalise the ERA, the European Commission published its communication ‘A new ERA for Research and Innovation’ on 30 September 2020. The communication announced four objectives:

prioritise investments and reforms in research and innovation, to support the digital and green transition and Europe’s recovery;

improve access to excellent research and innovation for researchers across the EU;

translate results into the economy to ensure market uptake of research output and Europe’s competitive leadership in technology;

make progress on the free circulation of knowledge, researchers and technology through stronger cooperation with EU countries.

To achieve these objectives the EU and the EU countries will shape the new European Research Area through 14 actions.

- European Commission

- Horizon Europe

- Research and development

- European Research Area (ERA) ( European Commission )

- A new ERA for Research and Innovation ( website ).

- Work & Careers

- Life & Arts

European Research Area should emerge post-Brexit, scientists say

To read this article for free, register now.

Once registered, you can: • Read free articles • Get our Editor's Digest and other newsletters • Follow topics and set up personalised events • Access Alphaville: our popular markets and finance blog

Explore more offers.

Then $75 per month. Complete digital access to quality FT journalism. Cancel anytime during your trial.

FT Digital Edition

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- Global news & analysis

- Expert opinion

Standard Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- FT App on Android & iOS

- FT Edit app

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

Terms & Conditions apply

Publication detail

The new European Research Area

Publication metadata, available languages and formats, bulgarian (bg), spanish (es), danish (da), german (de), estonian (et), english (en), french (fr), croatian (hr), italian (it), latvian (lv), lithuanian (lt), hungarian (hu), maltese (mt), polish (pl), portuguese (pt), romanian (ro), slovak (sk), slovenian (sl), finnish (fi), swedish (sv).

- Publication details

- Related publications

- Published: 2021

- Corporate author(s): Directorate-General for Research and Innovation ( European Commission )

- Themes: Scientific and technical research

- Subject: EU research policy , gender equality , innovation , investment , knowledge management , open science , research staff , single market , technology

| ISSN | ISBN 978-92-76-37293-6 | DOI 10.2777/2736 | Catalogue number KI-08-21-114-EN-N |

- Released on EU Publications: 2021-10-12

Document viewer

Did you know that you can annotate your document and share your annotations?

Skip to content. | Skip to navigation

Personal tools

- Log in/Register Register

https://www.vitae.ac.uk/policy/european-research-area/european-research-area

This page has been reproduced from the Vitae website (www.vitae.ac.uk). Vitae is dedicated to realising the potential of researchers through transforming their professional and career development.

- Vitae members' area

European Research Area

The aim of the European Research Area (ERA) is to create an open labour market for researchers where researchers can move and interact freely, benefit from world-class infrastructures and work with excellent networks of research institutions.

It was created in 2000, is composed of all research and development activities, programmes and policies in the European Union that involve an international perspective, ie cross national boundaries. Together, they enable researchers, research institutions and businesses to circulate, compete and co-operate freely across borders. Its key aims are to:

- enable researchers to move and interact seamlessly, benefit from world-class infrastructures and work with excellent networks of research institutions

- share, teach, value and use knowledge effectively for social, business and policy purposes

- optimise and open European, national and regional research programmes in order to support the best research throughout Europe and coordinate these programmes to address major challenges together

- develop strong links with partners around the world so that Europe benefits from the worldwide progress of knowledge, contributes to global development and takes a leading role in international initiatives to solve global issues.

The key initiatives within the ERA focused on researchers are:

- The European Charter for Researchers and a Code of Conduct for the recruitment of researchers

- HR Excellence in Research and the human resources strategy for researchers (HRS4R)

- Marie Sklodowska-Curie Actions

- Innovation Union

- European Research Council.

The European Commission publishes updates on progress in creating the European Research Area. The latest report was published in 2013.

European partnership for researchers

The aim of the European partnership for researchers (EP4R) set up in 2008 is to create a framework within the European Research Area for joint priority actions for different Member States concerning:

- the systematic opening up of recruitment of researchers, including advertising vacancies on the EURXESS job portal and portability of grants

- pensions and social security for mobile researchers, including the establishment of a pan-European pension scheme for researchers

- attractive employment and working conditions

- improving training and skills, including creating national skills agendas and strengthening links between universities and businesses.

ERA Steering Group on Human Resources and Mobility

The ERA Steering Group on Human Resources and Mobility (ERA SGHRM) supports the implementation and the monitoring of progress of the Innovation Union , as well as the implementation of the ERA Communication “A Reinforced European Research Area Partnership for Excellence and Growth” (July 2012) with regard to researchers’ careers and mobility at EU and at national level, including the European Charter and Code , Innovative Doctoral Training and EURAXESS activities, as well as to the attractiveness of Europe to researchers in general. The ERA SGHRM is composed of Member State representatives. The representatives will provide information on the overall plans devised at national level for the implementation of the European partnership for researchers. They also regularly form working groups on topics relating to researcher careers, including ‘ Human Resources issues, including the HRS4R ’ and the ’ Professional Development of Researchers ’. A list of SGHRM Working Group reports are published on the EURAXESS website.

Bookmark & Share

EPSRC list of research areas

An A-Z list of all Engineering and Physical Sciences Research Council (EPSRC) research areas.

EPSRC research areas (PDF)

PDF , 163 KB

If you cannot open or read this document, you can ask for a different format.

Email [email protected] , telling us:

- the name of the document

- what format you need

- any assistive technology you use (such as type of screen reader).

Find out about our approach to the accessibility of our website .

This document includes a short description of each research area and links to further information.

- 15 February 2023 Updated document accessibility

This is the website for UKRI: our seven research councils, Research England and Innovate UK. Let us know if you have feedback or would like to help improve our online products and services .

European Research Area

The European Research Area (ERA) is a vision for a single, borderless market for research, innovation, and technology across the EU. It enhances the coordination of EU research efforts, boosting the circulation of researchers and knowledge, building critical mass, and promoting excellence. Although the ERA has been in development since 2000, the European Commission injected the ambition with a new lease of life in 2020. This initiative led to a new ERA governance framework shaped by the Pact for Research and Innovation (R&I) in Europe and the ERA Policy Agenda .

ERA Forum for Transition

The ERA Policy Agenda and its effective implementation are coordinated in the ERA Forum for Transition , composed of Member States representatives as well as one representative from each EEA/EFTA Country, and representatives of European R&I stakeholder groups. As one of the stakeholder groups, ALLEA officially represents all European academies and supports the European Commission and the Member States in delivering the ERA Policy Agenda Actions , which cover a wide range of ALLEA’s activities and priorities including Open Science, research assessment, academic freedom, research integrity, international cooperation, trust in science, citizen engagement, diversity and equality, climate sustainability, and many more.

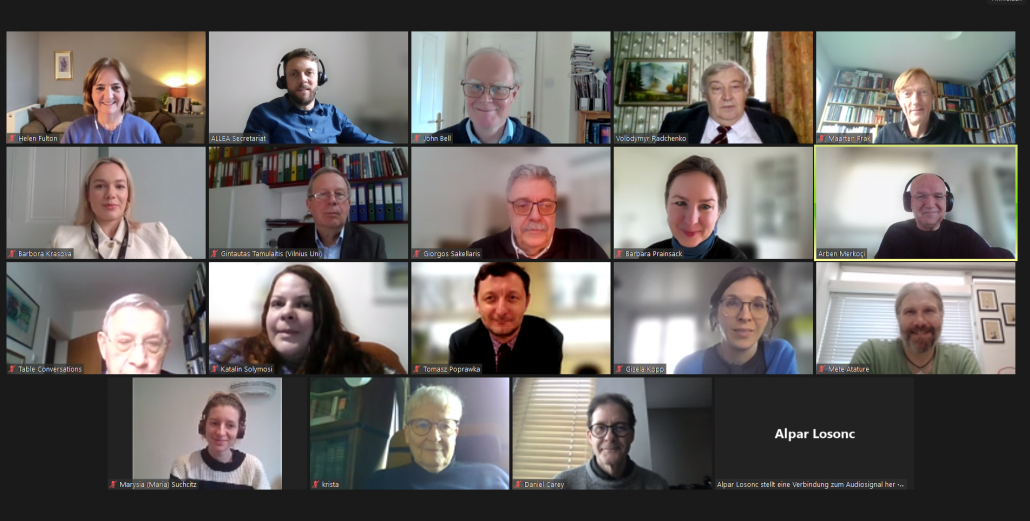

ALLEA Working Group on the European Research Area

The ALLEA Working Group on the ERA (WG ERA) aims to contribute to the further development of the ERA, its political framework, implementation and monitoring. The breadth of expertise and geographical representation of the group’s membership aptly reflects the heterogeneity of the ERA itself. Under the chairpersonship of Professor Arben Merkoçi of the Academy of Sciences of Albania , the working group engages with European institutions, particularly the European Commission, and collaborates with like-minded umbrella organisations from the European research and innovation landscape. As part of this mission, the WG ERA contributes to the design and evaluation of the European Framework Programmes for R&I, and advocates for the best framework conditions for excellent research in Europe and the world.

Members of the Working Group

- Professor Arben Merkoçi, Academy of Sciences of Albania (Chair)

- Professor Mete Atature, Bilim Akademisi (Turkey)

- Professor Daniel Carey, Royal Irish Academy

- Professor Helen Fulton, Learned Society of Wales

- Professor Hans Petter Graver, Norwegian Academy of Science and Letters

- Dr Arthur Ishkhanyan, National Academy of Sciences, Republic of Armenia

- Dr Gisela Kopp, Die Junge Akademie (Germany)

- Professor Alpár Losonc, Serbian Academy of Sciences

- Professor Marie Louise Bech Nosch, Royal Danish Academy of Sciences and Letters

- Professor Simona Pekarek Doehler, Swiss Academies of Arts and Sciences

- Dr Tomasz Poprawka, Polish Academy of Sciences

- Professor Maarten Prak, KNAW (Netherlands)

- Professor Barbara Prainsack, Austrian Academy of Sciences

- Professor Volodymyr Radchenko, National Academy of Sciences of Ukraine

- Dr George Sakellaris, Czech Academy of Sciences

- Professor Roberto Scazzieri, Accademia Nationale dei Lincei (Italy)

- Dr Katalin Solymosi, Hungarian Academy of Sciences

- Professor Emilija Stojmenova Duh, Global Young Academy

- Professor Birgitta Svensson, Royal Swedish Academy of Letters, History and Antiquities

- Professor Gintautas Tamulaitis, Lithuanian Academy of Sciences

- Professor Miloš Trifković, Academy of Sciences and Arts of Bosnia and Herzegovina

- Professor Krista Varantola, Council of Finnish Academies

ALLEA Contact Person

Daniel Kaiser Scientific Policy Officer [email protected]

Related Publications

ALLEA Statement on the Guiding Principles for Framework Programme 10

ALLEA Statement for an ERA of Freedom and Excellence

ALLEA’s Response to Council Conclusions on Research Assessment and Open Science

Delivering Horizon Europe

Living Together: Missions for Shaping the Future

Developing a Vision for Framework Programme 9

Embedding the Social Sciences and Humanities in Horizon 2020

Comments on the European Commission’s Communication on ERA

Related news.

Event report: European Research Collaboration in a Shifting Geopolitical Landscape – How Open Can We Be?

#ResearchMatters: Joint Letter to Strengthen Research and Innovation in Europe

ALLEA Provides Feedback to European Commission Consultation on Funding for Dual-use Projects

ALLEA Working Group on the ERA Meets to Discuss International Research Collaboration

ALLEA Welcomes Launch of European Research Area Policy Platform

ALLEA Outlines Its Vision for the Future of European Research and Innovation

ALLEA Working Group Gathers in Tirana to Shape Future of European Research Area and FP10

Framework Programme 10: ALLEA Advocates for Widening Scientific Cooperation and Freedom of Research

New Chair Appointed for the Working Group on the ERA

ALLEA Working Group on the ERA Meeting

Building an ERA that Fosters Freedom and Excellence

European Science Organisations Reach Agreement on Reforming Research Assessment

International Year of Basic Sciences for Sustainable Development (IYBSSD) Opening Ceremony

Allea welcomes council conclusions on research assessment and open science.

ALLEA Working Group European Research Area meets in Stockholm

Working Group European Research Area Meeting

The Race against Time for Smarter Development – A European Perspective

ALLEA Joins the European Commission Coalition on Research Assessment Reform

ALLEA Signs Open Letter Calling for Finalising UK Association to Horizon Europe

Towards a New European Research Area — Interview with Kerstin Sahlin

Allea participates in workshop on the future of era governance, related events.

The role of the EU in funding UK research

Excellent research and innovation help us to live healthier, fuller and better lives. Europe is home to world-class research, and researchers come from all over the world to collaborate with researchers that are based here and to use European scientific infrastructure.

The UK has created a world-leading research base that partners with the best and most ambitious in the rest of the world, keeping UK research at the cutting edge.

The European research landscape is complex. Both the European Union (EU) and individual European countries fund research. Researchers collaborate with each other within Europe and internationally.

A referendum on the United Kingdom’s membership of the European Union (EU) took place on 23 June 2016.

The Society is conducting a phased project gathering evidence about the influence of the UK’s relationship with the EU on research. It is intended to inform debate.

The first phase examines the role of the EU in funding UK research. Phase 2 considers the role of the EU in international research collaboration and researcher mobility , and phase 3 looks at the role of EU regulation and policy in governing UK research .

- EU data tables

Email updates

We promote excellence in science so that, together, we can benefit humanity and tackle the biggest challenges of our time.

Subscribe to our newsletters to be updated with the latest news on innovation, events, articles and reports.

What subscription are you interested in receiving? (Choose at least one subject)

Research system, culture and funding

The UK has a world-class research system, producing high quality science that contributes to the country’s economic growth while also tackling society’s biggest challenges. The funding of research, along with the culture it supports, needs to continually evolve if science is to be the best it can be.

IMAGES

VIDEO

COMMENTS

European extended stay transaction volumes totalled close to €700 million in 2023, only 4.7% of total volumes in the wider hospitality space. Although activity was dwarfed by hotel investment, it did fare better when it came to annual comparisons, considering the wider slowing in the investment market.

Modern lifestyles mean many people are sleep deprived on work or school days, and try to ‘catch-up’ with compensatory sleep on weekends The UK Biobank study of more than 90,000 ...

The European Research Area (ERA) is the ambition to create a single, borderless market for research, innovation and technology across the EU. By strongly aligning their research policies and programmes, European countries become more effective on the research sector. The ERA is based on excellence and. The ERA policy framework is based on.

The European Research Area ( ERA) is a system of scientific research programs integrating the scientific resources of the European Union (EU). Since its inception in 2000, the structure has been concentrated on European cooperation in the fields of medical, environmental, industrial, and socioeconomic research.

CREATING A SINGLE, BORDERLESS MARKET FOR RESEARCH, INNOVATION AND TECHNOLOGY ACROSS THE EUROPEAN UNION . The European Research Area platform provides space for researchers, innovators, citizens, and policymakers to connect, collaborate, and access the latest information, data and resources related to the European Research Area.. EXPLORE ERA'S PRIORITIES...

European research area (ERA) | European Commission (europa.eu) https://europa.eu/!YmgHHX • Describes concrete actions, based on the priority areas of the Pact. These are implemented jointly with the Member States Horizon Europe associated countries and stakeholders • The ERA Policy Agenda 2022-2024 encompasses 20 actions,

E EUROPEAN RESEARCH AREA The European Research Area (ERA) aims to create a unified research area open to the world and ba. ed on the internal market. It is intended to enable the free circulation of researchers, scientifi. knowledge and technology.The current implementation of the ERA is based on the ERA Roadmap (2015-2020) together with ERA ...

The launch of a new research and innovation era in 2000. The European Research Area (ERA) was launched in 2000 with the aim of creating a single market for research and innovation fostering free movement of researchers, scientific knowledge and innovation, and fostering a more competitive European industry. To reach these objectives the European research landscape needed to be oriented towards ...

The European Research Area (ERA) Forum is about to enter its implementation phase, after mapping out priorities across twenty R&I policy actions proposed by the European Commission.. Since February, member states, associated countries and invited stakeholders from the Brussels' R&I community have been assessing their capacities and have now come up with a final list of policy actions they ...

The European Research Area and Innovation Committee (ERAC) is the EU's strategic policy advisory committee on R&I topics within the ERA. The committee is a preparatory body to the Council, and its main mission is to advise the Council (in particular the Competitiveness Council), the European Commission and EU member states on ERA priority areas ...

The European Research Area Page 4 of 37 1. Historical roots The European Research Area (E RA) concept proposed in January 2000 had matured for almost 30 years. Indeed, the idea can be traced back to the first formulation of a European research policy at the beginning of the 1970s. 1.1. A Community policy in research and development

The 'European Research Area' (ERA) is the policy concept at the heart of the common European policy for research. The framing and adoption of ERA in 2000 was the result of a lengthy process started in 1972. Proposed by the European Commission, the concept has been reshaped by the Council of the European Union in 2008 and influenced by the ...

Executive Summary. This EU-level report is the first 18-months review of the progress towards the priority areas for joint action in the European Research Area (ERA), as laid down in the Pact for Research and Innovation in Europe, and of the implementation of the ERA Policy Agenda (for the period Jan. 2022 to mid-2023) at Union level.

The European Research Area (ERA) is a single, borderless market for research and innovation fostering the free movement of researchers, scientific knowledge and innovation, and encouraging a more competitive European industry. The ERA helps countries to be more effective by acting together, by closely aligning their research policies and ...

2021. 26 Nov. New governance structure for the European Research Area. The Council adopted conclusions on the governance of the European Research Area (ERA) and the 'Pact for research and innovation (R&I) in Europe', thereby completing the deep reform of the ERA. The conclusions set out priorities and establish a governance framework for ...

A powerful European Research Area should emerge after Brexit, with increased scientific collaboration across the EU and associated countries — including the UK, Switzerland and Norway — the ...

New factsheet on the European Research Area. Mon, 02/12/2024 - 15:43. Read more about The Commission (DGR&I) has just published a new factsheet on the European Research Area; Factsheet on the European Research Area.

On 16 July 2021, the European Commission adopted a proposal for a Council Recommendation on a Pact. The Pact proposal defines shared priority areas for joint action in support of the ERA, sets out the ambition for investments and reforms, and constitutes the basis for a simplified policy coordination and monitoring process at EU and Member States' level through an ERA platform where Member ...

The Council today adopted conclusions on the governance of the European Research Area (ERA) and a Pact for research and innovation (R&I) in Europe, setting out priorities and a streamlined governance framework for the ERA, including an ERA policy agenda for 2022-2024. Research and innovation is one of the top priorities of our presidency.

What are the objectives of the new European Research Area? More investments in research and innovation for a green and digital future. Uptake of research and innovation results on the markets. Better access to infrastructure and facilities for researchers. Promotion of researchers' mobility, skills and career development opportunities.

The aim of the European Research Area (ERA) is to create an open labour market for researchers where researchers can move and interact freely, benefit from world-class infrastructures and work with excellent networks of research institutions. It was created in 2000, is composed of all research and development activities, programmes and policies ...

Updates. 15 February 2023. Updated document accessibility. This is the website for UKRI: our seven research councils, Research England and Innovate UK. Let us know if you have feedback or would like to help improve our online products and services. An A-Z list of all Engineering and Physical Sciences Research Council (EPSRC) research areas.

Posted on: 11 June 2024. Launch of the new ERA Talent Platform. Posted on: 10 June 2024. Opinion papers on "FAIR data productivity" and "Advanced digitalisation of research". Posted on: 24 May 2024. Ad hoc workshop on ERA Action 4 - Promoting attractive researcher careers, talent circulation and mobility.

The European Research Area (ERA) is a vision for a single, borderless market for research, innovation, and technology across the EU. It enhances the coordination of EU research efforts, boosting the circulation of researchers and knowledge, building critical mass, and promoting excellence. Although the ERA has been in development since 2000 ...

The UK has created a world-leading research base that partners with the best and most ambitious in the rest of the world, keeping UK research at the cutting edge. The European research landscape is complex. Both the European Union (EU) and individual European countries fund research. Researchers collaborate with each other within Europe and ...